Abdullah719

T20I Captain

- Joined

- Apr 16, 2013

- Runs

- 44,825

ISLAMABAD: Amid a policy decision on Friday to allow rupee depreciation, Pakistan and an International Mone*tary Fund (IMF) delegation concluded the first round of discussions on the country’s economy. Now members of the IMF delegation and Pakistan team are taking a two-day break to prepare for the policy-level wrap-up by Dec 13-14.

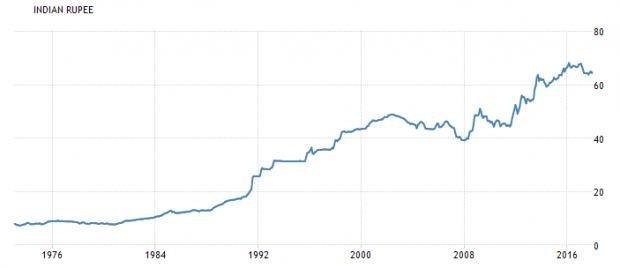

A senior official told Dawn that the State Bank of Pakistan (SBP) would now let the currency exchange rate to adjust to market conditions after many months, rather years, of resisting expectations. The timing of the move was planned for Friday to ensure materialisation of $2.5 billion worth of receipts from two international bonds launched last month.

This calculated move allowed the currency rate to touch Rs110 to a dollar on Friday before settling down at around Rs107 and did not go beyond official estimates. The two weekend holidays would give a breathing space instead of over-steaming the exchange rate.

The sources said that the IMF had concerns over the health of Pakistan’s external sector, but the government authorities had different opinions. As the two sides concluded technical talks, the IMF team will prepare a report of its assessment over the weekend and share with Pakistan officials on Monday for the feedback and discussions.

While the government team, led by secretary of finance Shahid Mehmood will review the assessment, the IMF mission to Pakistan, led by Harald Finger, will visit Lahore next week for talks with provincial authorities including Chief Minister Shahbaz Sharif and independent observers and researchers from the business community and representatives of a private-sector university.

The authorities believed the currency adjustment would help shift foreign currency holdings from commercial banks currently standing at a higher level of around $6 billion back to official reserves and help divert remittances to official channels with declining gap among the official, banking and open market rates.

For the first time after many months, the central bank is reported to have noticed exporters to offload their positions. In the long run, the recent imposition or increase in the import duties and regulatory duties would make unnecessary imports expensive.

An official said that projections for CPEC-related repayments were within the range already discussed by the two sides in connection with debt sustainability analysis as $23 billion worth of projects were currently under various stages of implementation, including $17 billion in the energy sector by the private sector. About $6 billion worth of projects are in the road sector.

While a clean certificate of economic health from the IMF is useful for international financial institutions and investment sentiment, the two sides are reported to have noted that recent bond results were very positive for the fact that this was the first fund raising from international capital market without the IMF programme after many years and attracted favourable response and rates despite high twin deficits, showing confidence of international investors and good reflection of fundamentals.

The IMF director of Middle East and Central Asian Department (MCD), Jihad Azour, the former finance minister from Lebanon, will also join the final round of talks next week. While the Pakistani side will continue to be led by Mr Mehmood, a meeting of the IMF mission could also be arranged with Prime Minister Shahid Khaqan Abbasi who holds the portfolio of the finance minister, depending on the gaps in policy positions, a source said.

Pakistan would continue to remain under the IMF’s post-programme monitoring (PPM) until about 2023 for borrowing significantly higher than its quota. The threshold for Pakistan to move out of the PPM is estimated at 1.4 billion special drawing rights (SDRs) of the IMF that now stand around 4.3 SDRs.

Secretary Finance Shahid Mahmood, when contacted, said that the two sides held various rounds of technical discussions over the last week and covered a host of areas including macroeconomic situation, developments in energy, financial, monetary and social sectors. He said that he shared with the IMF delegation an overview of the economy which was on track and key economic indicators were moving in the positive direction. He said that significant growth had been achieved in revenue generation in the current fiscal year.

He said that Pakistan had achieved fiscal consolidation without compromising on expenditures on development and social protection and the government had set its eyes on achieving 6pc GDP growth which was inclusive, pro-poor and sustainable. Mr Mahmood said that the recent successful launch of Sukuk and Euro Bond were also discussed briefly.

https://www.dawn.com/news/1375449/in-talks-with-imf-pakistan-agrees-to-depreciate-rupee

A senior official told Dawn that the State Bank of Pakistan (SBP) would now let the currency exchange rate to adjust to market conditions after many months, rather years, of resisting expectations. The timing of the move was planned for Friday to ensure materialisation of $2.5 billion worth of receipts from two international bonds launched last month.

This calculated move allowed the currency rate to touch Rs110 to a dollar on Friday before settling down at around Rs107 and did not go beyond official estimates. The two weekend holidays would give a breathing space instead of over-steaming the exchange rate.

The sources said that the IMF had concerns over the health of Pakistan’s external sector, but the government authorities had different opinions. As the two sides concluded technical talks, the IMF team will prepare a report of its assessment over the weekend and share with Pakistan officials on Monday for the feedback and discussions.

While the government team, led by secretary of finance Shahid Mehmood will review the assessment, the IMF mission to Pakistan, led by Harald Finger, will visit Lahore next week for talks with provincial authorities including Chief Minister Shahbaz Sharif and independent observers and researchers from the business community and representatives of a private-sector university.

The authorities believed the currency adjustment would help shift foreign currency holdings from commercial banks currently standing at a higher level of around $6 billion back to official reserves and help divert remittances to official channels with declining gap among the official, banking and open market rates.

For the first time after many months, the central bank is reported to have noticed exporters to offload their positions. In the long run, the recent imposition or increase in the import duties and regulatory duties would make unnecessary imports expensive.

An official said that projections for CPEC-related repayments were within the range already discussed by the two sides in connection with debt sustainability analysis as $23 billion worth of projects were currently under various stages of implementation, including $17 billion in the energy sector by the private sector. About $6 billion worth of projects are in the road sector.

While a clean certificate of economic health from the IMF is useful for international financial institutions and investment sentiment, the two sides are reported to have noted that recent bond results were very positive for the fact that this was the first fund raising from international capital market without the IMF programme after many years and attracted favourable response and rates despite high twin deficits, showing confidence of international investors and good reflection of fundamentals.

The IMF director of Middle East and Central Asian Department (MCD), Jihad Azour, the former finance minister from Lebanon, will also join the final round of talks next week. While the Pakistani side will continue to be led by Mr Mehmood, a meeting of the IMF mission could also be arranged with Prime Minister Shahid Khaqan Abbasi who holds the portfolio of the finance minister, depending on the gaps in policy positions, a source said.

Pakistan would continue to remain under the IMF’s post-programme monitoring (PPM) until about 2023 for borrowing significantly higher than its quota. The threshold for Pakistan to move out of the PPM is estimated at 1.4 billion special drawing rights (SDRs) of the IMF that now stand around 4.3 SDRs.

Secretary Finance Shahid Mahmood, when contacted, said that the two sides held various rounds of technical discussions over the last week and covered a host of areas including macroeconomic situation, developments in energy, financial, monetary and social sectors. He said that he shared with the IMF delegation an overview of the economy which was on track and key economic indicators were moving in the positive direction. He said that significant growth had been achieved in revenue generation in the current fiscal year.

He said that Pakistan had achieved fiscal consolidation without compromising on expenditures on development and social protection and the government had set its eyes on achieving 6pc GDP growth which was inclusive, pro-poor and sustainable. Mr Mahmood said that the recent successful launch of Sukuk and Euro Bond were also discussed briefly.

https://www.dawn.com/news/1375449/in-talks-with-imf-pakistan-agrees-to-depreciate-rupee