Ertugrul_Bey

Debutant

- Joined

- Sep 21, 2018

- Runs

- 235

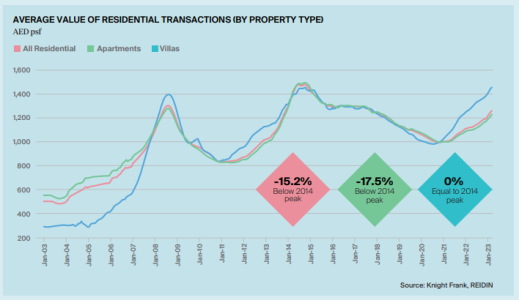

I have been planning on buying a property in dubai and recently met a real estate agent there. She was trying to have me invest in areas away from the main city but I was not too sure on it as I am not too familiar with the market there.

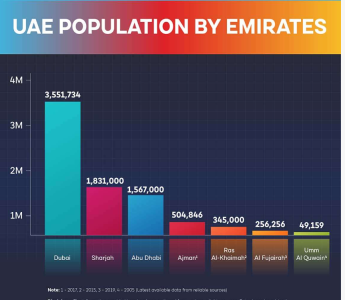

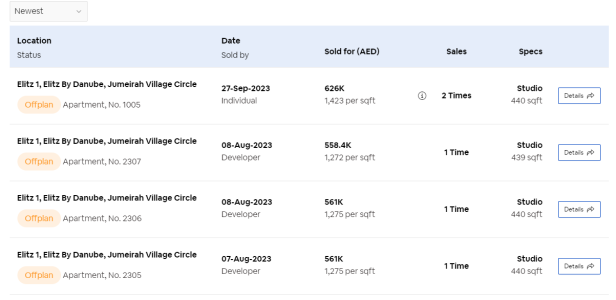

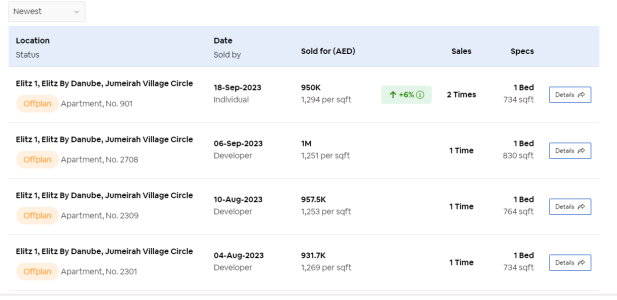

Has anyone purchased property there as in investment? If yes, what areas would you recommend and what should be the price range. My budget is around 1M dharam and I’m open to looking to Abu Dhabi as well. Thanks in advance!

Has anyone purchased property there as in investment? If yes, what areas would you recommend and what should be the price range. My budget is around 1M dharam and I’m open to looking to Abu Dhabi as well. Thanks in advance!