When India’s government last month asked refiners to speed up diversification and reduce dependence on the Middle East - days after OPEC+ said it would maintain production cuts - it sent a message about its clout and foreshadowed changes to the world’s energy maps. It was a move that had been in the works for years, fuelled by repeated comments from Indian Oil Minister Dharmendra Pradhan, who in 2015 called oil purchases a “weapon” for his country.

When the Organisation of Oil Exporting Countries and Major Producers (OPEC+) extended the production cuts into April, India unsheathed that weapon. Indian refiners plan to cut imports from the Kingdom by about a quarter in May, sources told Reuters, dropping them to 10.8 million barrels from monthly average of 14.7-14.8 million barrels.

Oil secretary Tarun Kapoor, the top bureaucrat in the ministry, told Reuters that India is asking state refiners to jointly negotiate with oil producers to get better deals, but declined to comment on plans to cut Saudi imports.

“India is a big market so sellers have to be mindful of our country’s demand as well to keep the long-term relationship intact,” he said.

The Saudi state oil company Saudi Aramco and the Saudi energy ministry declined to comment.

Pradhan, who sees high oil prices as a threat to India’s recovering economy, said he was saddened by the OPEC+ decision. India’s fuel import bill has rocketed, and fuel prices – inflated by government taxes imposed last year - have hit records.

The International Energy Agency forecasts India’s consumption to double and its oil import bill to nearly triple from 2019 levels to more than $250 billion by 2040.

An oil ministry official, who declined to be named because of the sensitivity of the matter, said the OPEC+ cuts have created uncertainty and made it difficult for refiners to plan for procurement and price risk.

It also creates opportunities for companies in the Americas, Africa, Russia and elsewhere to fill the gap. It was a move that had been in the works for years, fuelled by repeated comments from Indian Oil Minister Dharmendra Pradhan, who in 2015 called oil purchases a “weapon” for his country.

When the Organisation of Oil Exporting Countries and Major Producers (OPEC+) extended the production cuts into April, India unsheathed that weapon. Indian refiners plan to cut imports from the Kingdom by about a quarter in May, sources told Reuters, dropping them to 10.8 million barrels from monthly average of 14.7-14.8 million barrels.

Oil secretary Tarun Kapoor, the top bureaucrat in the ministry, told Reuters that India is asking state refiners to jointly negotiate with oil producers to get better deals, but declined to comment on plans to cut Saudi imports.

“India is a big market so sellers have to be mindful of our country’s demand as well to keep the long-term relationship intact,” he said.

The Saudi state oil company Saudi Aramco and the Saudi energy ministry declined to comment.

Pradhan, who sees high oil prices as a threat to India’s recovering economy, said he was saddened by the OPEC+ decision. India’s fuel import bill has rocketed, and fuel prices – inflated by government taxes imposed last year - have hit records.

The International Energy Agency forecasts India’s consumption to double and its oil import bill to nearly triple from 2019 levels to more than $250 billion by 2040.

An oil ministry official, who declined to be named because of the sensitivity of the matter, said the OPEC+ cuts have created uncertainty and made it difficult for refiners to plan for procurement and price risk.

It also creates opportunities for companies in the Americas, Africa, Russia and elsewhere to fill the gap.It was a move that had been in the works for years, fuelled by repeated comments from Indian Oil Minister Dharmendra Pradhan, who in 2015 called oil purchases a “weapon” for his country.

When the Organisation of Oil Exporting Countries and Major Producers (OPEC+) extended the production cuts into April, India unsheathed that weapon. Indian refiners plan to cut imports from the Kingdom by about a quarter in May, sources told Reuters, dropping them to 10.8 million barrels from monthly average of 14.7-14.8 million barrels.

Oil secretary Tarun Kapoor, the top bureaucrat in the ministry, told Reuters that India is asking state refiners to jointly negotiate with oil producers to get better deals, but declined to comment on plans to cut Saudi imports.

“India is a big market so sellers have to be mindful of our country’s demand as well to keep the long-term relationship intact,” he said.

The Saudi state oil company Saudi Aramco and the Saudi energy ministry declined to comment.

Pradhan, who sees high oil prices as a threat to India’s recovering economy, said he was saddened by the OPEC+ decision. India’s fuel import bill has rocketed, and fuel prices – inflated by government taxes imposed last year - have hit records.

The International Energy Agency forecasts India’s consumption to double and its oil import bill to nearly triple from 2019 levels to more than $250 billion by 2040.

An oil ministry official, who declined to be named because of the sensitivity of the matter, said the OPEC+ cuts have created uncertainty and made it difficult for refiners to plan for procurement and price risk.

It also creates opportunities for companies in the Americas, Africa, Russia and elsewhere to fill the gap.If India is successful, it will set an example for other countries. As buyers see more affordable choices and renewable energy becomes increasingly common, the influence of big producers like Saudi Arabia could wane, altering geopolitics and trade routes.

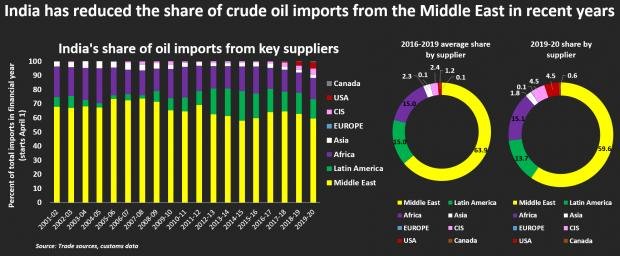

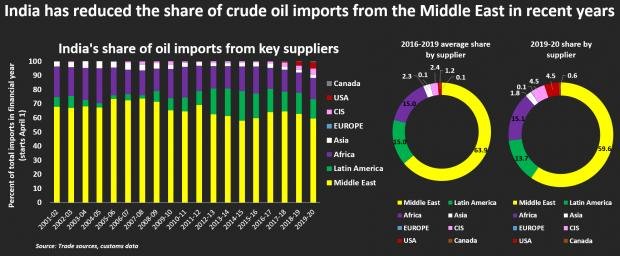

India has reduced the share of crude oil imports from the Middle East in recent years:

India’s oil demand has risen by 25% in the last seven years - more than any other major buyer - and the country has surpassed Japan as the world’s third-largest oil importer and consumer.

The country has already curbed its reliance on the Middle East from more than 64% of imports in 2016 to below 60% in 2019.

That trend reversed in 2020, however, when the pandemic pummelled fuel demand and forced Indian refiners to make committed oil purchases from the Middle East under term contracts, shunning spot purchases.

As India shifts gears again after Pradhan’s call for faster diversification, refineries are looking for new suppliers, the oil ministry official said.

Costly refinery upgrades that allow for the processing of cheaper, heavier oil grades have encouraged importers to seek out far-flung sources. HPCL-Mittal Energy Ltd bought the country’s first cargo from Guyana this month, and Mangalore Refinery and Petrochemicals Ltd just imported Brazilian Tupi crude for the first time.

In past years, refiners have jointly negotiated here oil deals with sanctions-hit Iran, which offered free shipping here and price discounts, and now plan to do the same with other producers.

Since the break with Saudi Arabia began, Pradhan has had meetings with United Arab Emirates’ minister of state and chief executive of Abu Dhabi National Oil Co (ADNOC), Sultan Ahmed Al Jaber, and U.S. energy secretary Jennifer Granholm to strengthen energy partnerships.

Pradhan recently said African nations could play a central role in India’s oil diversification. The country is looking at signing long-term oil supply deal with Guyana and exploring options to raise imports from Russia, the oil ministry source said.

A separate Indian government source said the government expects Iranian sanctions to ease in three to four months, potentially offering India a cheaper alternative to Saudi oil.

Two traders agreed that Iran stood a good chance to benefit from India’s shift, as did Venezuela, Kuwait and the United States. An Indian refinery source said the U.S., Africa, Kazakhstan’s CPC Blend and Russian oil would probably get a look too.

Although Indian importers will scoop up increasing volumes of attractively priced global grades, most analysts expect the Middle East to remain India’s primary oil supplier, mainly because of lower shipping costs.

India’s oil ministry is working with refiners on a framework to jointly negotiate terms with suppliers.

“Buyers have alternatives in today’s market and these alternatives are going to multiply going forward,” Kapoor said.

“There are so many companies in India that do buying at their own level, so these companies coming together also becomes quite a big bloc.”

On Thursday, Saudi Arabia and OPEC+ agreed after discussions with U.S. officials to ease oil curbs beginning in May.

Saudi energy minister Prince Abdulaziz bin Salman conceded that the production cuts had put state oil company Aramco “in some difficulty with some of its partners.”

Analysts say the oil spat does not need to spill over into broader strategic ties in other sectors, including defence.

“Until recently, the balance of power was skewed towards Saudi Arabia, but increasingly, India is using access to its market and the diversity of options to put pressure on Saudi Arabia,” consultancy Eurasia said in a note. “For Saudi Arabia, losing market share in a global environment in which most developed economies are already seeing their oil demand decline due to green policy implementation, would be a blow.”

Abdulaziz confirmed that Aramco had maintained normal April oil supplies to Indian refiners while cutting volumes for other buyers - a sign Saudi Arabia is concerned about India’s search for new sources.

Saudi Arabia is India’s fourth-biggest trade partner, importing a slew of items, including food. Saudi Armaco is looking at buying a 20% stake in Reliance Industries’ oil and chemicals business. It is also a part of a joint venture to build a 1.2 million barrels per day refinery in India.

But Amitendu Palit, senior research fellow at National University of Singapore, said it would be difficult for Saudi to find a stable alternative buyer if India continues with reduced purchases for too long.

“This bilateral relationship should not be impacted due to any decisions on one commodity. However in a global surplus, market buyers have a lot of negotiating power and sources,” Palit said.