Runner Up

T20I Debutant

- Joined

- Mar 15, 2011

- Runs

- 7,708

ISLAMABAD:

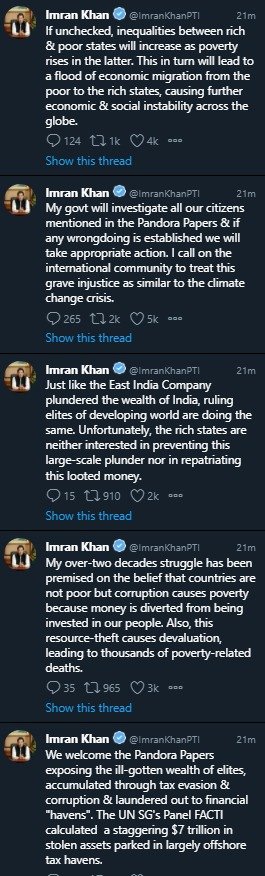

The world is all set to dive into the Pandora's box of offshore finances as a new investigation by the International Consortium of Investigative Journalists (ICIJ) into international finance and tax havens will be released to the public at 9:30pm on Sunday.

The ICIJ’s major investigation titled: “The Pandora Papers”, is said to be the result of 600 journalists in 117 countries studying for months roughly 11.9 million documents that leaked from the offshore environment. The countdown has begun as the names of several Pakistanis are said to be on the Pandora Papers.

Late on Saturday, the ICIJ announced that it was going to release the “most expansive exposé of financial secrecy yet”. In 2016, ICIJ had released the Panama Papers, which took the world by storm and eventually led to the downfall of governments, including that of Nawaz Sharif.

Journalist Umar Cheema, who was part of the ICIJ’s team investigating the Pandora Papers, told a private news channel that the names of several Pakistanis were on the Pandora Papers, adding that people should wait for just another day as the report will officially be released on October 3 (today).

“The number of people named in [the Pandora Papers] is more than those named in the Panama Papers,” Cheema said, adding “the names are kind of interesting, but you will have to wait for another 24 hours”. He said that the ICIJ teams worked on the project for two years.

Cheema tweeted that the major international financial investigation has now been concluded, saying it is the biggest investigation conducted so far. Political commentators were quick to add that it would be interesting to see how the government, judiciary and media react this time around.

The mega research into the financial world’s hidden secrets is expected to explain what some of the rich in the world did to hide their wealth and evade taxes from the states. The Panama Papers was a giant leak of more than 11.5 million financial and legal records exposing a system that enables crime, corruption and wrongdoing, hidden by secretive offshore companies.

The project named the Pandora Papers is in reference to the Greek mythology’s character in whose box would be all the ills of humanity. It is expected that Pandora Papers would open another Pandora’s box that might led to the downfall of several capitals of the world and big names.

Reportedly, the Pandora Papers is a result of the new massive leak of financial files that exposes how the global elite transfer money to tax havens by secret companies. It is said that the investigation will show the tax evasion of hundreds of former and current world leaders, businessmen, celebrities, fugitives and judges.

https://tribune.com.pk/story/2323085/pandora-papers-to-open-pandoras-box

The world is all set to dive into the Pandora's box of offshore finances as a new investigation by the International Consortium of Investigative Journalists (ICIJ) into international finance and tax havens will be released to the public at 9:30pm on Sunday.

The ICIJ’s major investigation titled: “The Pandora Papers”, is said to be the result of 600 journalists in 117 countries studying for months roughly 11.9 million documents that leaked from the offshore environment. The countdown has begun as the names of several Pakistanis are said to be on the Pandora Papers.

Late on Saturday, the ICIJ announced that it was going to release the “most expansive exposé of financial secrecy yet”. In 2016, ICIJ had released the Panama Papers, which took the world by storm and eventually led to the downfall of governments, including that of Nawaz Sharif.

Journalist Umar Cheema, who was part of the ICIJ’s team investigating the Pandora Papers, told a private news channel that the names of several Pakistanis were on the Pandora Papers, adding that people should wait for just another day as the report will officially be released on October 3 (today).

“The number of people named in [the Pandora Papers] is more than those named in the Panama Papers,” Cheema said, adding “the names are kind of interesting, but you will have to wait for another 24 hours”. He said that the ICIJ teams worked on the project for two years.

Cheema tweeted that the major international financial investigation has now been concluded, saying it is the biggest investigation conducted so far. Political commentators were quick to add that it would be interesting to see how the government, judiciary and media react this time around.

The mega research into the financial world’s hidden secrets is expected to explain what some of the rich in the world did to hide their wealth and evade taxes from the states. The Panama Papers was a giant leak of more than 11.5 million financial and legal records exposing a system that enables crime, corruption and wrongdoing, hidden by secretive offshore companies.

The project named the Pandora Papers is in reference to the Greek mythology’s character in whose box would be all the ills of humanity. It is expected that Pandora Papers would open another Pandora’s box that might led to the downfall of several capitals of the world and big names.

Reportedly, the Pandora Papers is a result of the new massive leak of financial files that exposes how the global elite transfer money to tax havens by secret companies. It is said that the investigation will show the tax evasion of hundreds of former and current world leaders, businessmen, celebrities, fugitives and judges.

https://tribune.com.pk/story/2323085/pandora-papers-to-open-pandoras-box

)

)