- Joined

- Oct 2, 2004

- Runs

- 218,142

ISLAMABAD: A tax directory of Pakistan's elected representatives for the year 2018 has been published by the Federal Board of Revenue (FBR).

Prime Minister Imran Khan paid Rs282,449 in taxes during 2018, whereas the tax payments of his government for the same year are as follows:

Information and Broadcasting Minister Shibli Faraz paid Rs367,460

Human Rights Minister Dr Shireen Mazari paid Rs2,435,650

Foreign Minister Shah Mahmood Qureshi paid Rs183,900

Interior Minister Ijaz Ahmad Shah paid Rs58,120

Defence Minister Pervez Khattak paid Rs1,826,899

Law Minister Farogh Naseem paid Rs35,135,459

Planning Minister Asad Umer paid Rs5,346,342

Aviation Minister Ghulam Sarwar Khan paid Rs1,046,669

Railways Minister Sheikh Rashid Ahmed paid Rs579,011

Narcotics Control Minister Azam Khan Swati paid Rs590,916

Power Minister Omar Ayub Khan paid Rs26,055,517

States and Frontier Regions (SAFRON) Minister Shehryar Afridi paid Rs183,900

Kashmir and Gilgit-Baltistan Affairs Minister Ali Amin Gandapur paid Rs378,763

Religious Affairs Minister Noor-ul-Haq Qadri paid Rs3,506,009 as association of persons (AOP)

Communications and Postal Services Minister Murad Saeed paid Rs374,728

National Food Security and Research Minister Fakhar Imam paid Rs5,212,137

Industries and Production Minister Hammad Azhar paid Rs22,445 and Rs59,421,700 as AOP

Education Minister Shafqat Mahmood paid Rs231,730

Economic Affairs Minister Khusro Bukhtiar paid Rs624,292

Maritime Affairs Minister Ali Haider Zaidi paid Rs896,191

Water Resources Minister Faisal Vawda paid nothing

IT and Telecommunication Minister Aminul Haque paid Rs66,749

National Assembly Speaker Asad Qaiser paid Rs537,730 and Rs5,790,500 as AOP

Senate Chairperson Sadiq Sanjrani paid Rs1,363,414

Senate Deputy Chairperson Saleem Mandviwalla paid Rs1,591,722

State Minister for Parliamentary Affairs Ali Muhammad Khan paid Rs430,695

According to the FBR, in 2018, former prime minister and PML-N leader Shahid Khaqan Abbasi paid the highest tax of Rs241,329,362, whereas PPP Chairperson Bilawal Bhutto-Zardari paid Rs294,117 in taxes.

The FBR said the highest tax among the four provincial chief ministers was paid by Balochistan's Jam Kamal at Rs4,808,948, while Sindh's Murad Ali Shah paid Rs1,022,184 and Khyber Pakhtunkhwa's Mahmood Khan paid Rs235,982.

However, Punjab Chief Minister Usman Bazdar did not pay any tax during this period.

Former president and PPP Co-Chairperson Asif Ali Zardari paid Rs2,891,455, whereas former Punjab chief minister and PML-N President Shehbaz Sharif paid Rs9,730,545.

Shehbaz's son, Hamza, paid Rs8,705,368 in taxes.

Earlier, PM Imran's finance adviser, Dr Abdul Hafeez Shaikh, shared details about the tax paid by the parliamentarians, saying the elected provincial representatives paid Rs340 million in taxes in the same year.

Some 90 senators and 311 MNAs paid a total of Rs800 million in taxes, he added.

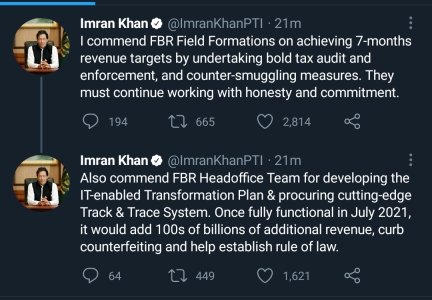

Shaikh said the FBR is "striving for transparency in the tax system", adding that the tax and audit systems were being automated and computerised.

"We wish to make the FBR's tax system transparent," he said, announcing that the institution had made two major decisions. "We are not bringing the tax audit under the control of any officer; it should not be so that a single officer selects the people of their choice in the audit.

"We are trying to have fewer people audited; we do not wish to audit a lot of people. This year, more than 10,000 cases have been selected for auditing," Shaikh noted, adding that less than 1% of the people would be audited for income tax.

The adviser stressed, however, that the salaried class as well as the beneficiaries of the tax amnesty scheme were not included in the audit. A 1.7% audit of sales tax would also be carried out, he said.

The adviser said people wished to be informed about taxpayers and, therefore, the details of those from 2018 "will be published today".

"The tax details of Pakistan's elected representatives will be published today [and] a tax directory of parliamentarians is being issued," he added.

"The government's basic philosophy is to collect taxes," he underlined, adding that the PTI regime wished for taxes to be collected in such a way that there were no undue hardships for the business community and no harassment of taxpayers.

Speaking of the industries, budget, as well as the coronavirus pandemic and its impact on the economy, Shaikh said the taxes on raw materials were reduced to zero and the government maintained subsidies for industries despite challenging circumstances.

"The government is giving subsidies on electricity and gas to industries, as well as subsidies on loans," he said. "We took immediate steps to improve the economy but still did not choose to impose any new taxes when the Budget 2020 was announced.

"We are witnessing economic recovery after the coronavirus pandemic," he added.

"Pakistan's exports have increased" during the same period, the adviser emphasised, adding that the government had decided to increase the country's exports.

https://www.geo.tv/latest/308557-fbr-releases-2018-tax-details-of-parliamentarians-chief-ministers

Prime Minister Imran Khan paid Rs282,449 in taxes during 2018, whereas the tax payments of his government for the same year are as follows:

Information and Broadcasting Minister Shibli Faraz paid Rs367,460

Human Rights Minister Dr Shireen Mazari paid Rs2,435,650

Foreign Minister Shah Mahmood Qureshi paid Rs183,900

Interior Minister Ijaz Ahmad Shah paid Rs58,120

Defence Minister Pervez Khattak paid Rs1,826,899

Law Minister Farogh Naseem paid Rs35,135,459

Planning Minister Asad Umer paid Rs5,346,342

Aviation Minister Ghulam Sarwar Khan paid Rs1,046,669

Railways Minister Sheikh Rashid Ahmed paid Rs579,011

Narcotics Control Minister Azam Khan Swati paid Rs590,916

Power Minister Omar Ayub Khan paid Rs26,055,517

States and Frontier Regions (SAFRON) Minister Shehryar Afridi paid Rs183,900

Kashmir and Gilgit-Baltistan Affairs Minister Ali Amin Gandapur paid Rs378,763

Religious Affairs Minister Noor-ul-Haq Qadri paid Rs3,506,009 as association of persons (AOP)

Communications and Postal Services Minister Murad Saeed paid Rs374,728

National Food Security and Research Minister Fakhar Imam paid Rs5,212,137

Industries and Production Minister Hammad Azhar paid Rs22,445 and Rs59,421,700 as AOP

Education Minister Shafqat Mahmood paid Rs231,730

Economic Affairs Minister Khusro Bukhtiar paid Rs624,292

Maritime Affairs Minister Ali Haider Zaidi paid Rs896,191

Water Resources Minister Faisal Vawda paid nothing

IT and Telecommunication Minister Aminul Haque paid Rs66,749

National Assembly Speaker Asad Qaiser paid Rs537,730 and Rs5,790,500 as AOP

Senate Chairperson Sadiq Sanjrani paid Rs1,363,414

Senate Deputy Chairperson Saleem Mandviwalla paid Rs1,591,722

State Minister for Parliamentary Affairs Ali Muhammad Khan paid Rs430,695

According to the FBR, in 2018, former prime minister and PML-N leader Shahid Khaqan Abbasi paid the highest tax of Rs241,329,362, whereas PPP Chairperson Bilawal Bhutto-Zardari paid Rs294,117 in taxes.

The FBR said the highest tax among the four provincial chief ministers was paid by Balochistan's Jam Kamal at Rs4,808,948, while Sindh's Murad Ali Shah paid Rs1,022,184 and Khyber Pakhtunkhwa's Mahmood Khan paid Rs235,982.

However, Punjab Chief Minister Usman Bazdar did not pay any tax during this period.

Former president and PPP Co-Chairperson Asif Ali Zardari paid Rs2,891,455, whereas former Punjab chief minister and PML-N President Shehbaz Sharif paid Rs9,730,545.

Shehbaz's son, Hamza, paid Rs8,705,368 in taxes.

Earlier, PM Imran's finance adviser, Dr Abdul Hafeez Shaikh, shared details about the tax paid by the parliamentarians, saying the elected provincial representatives paid Rs340 million in taxes in the same year.

Some 90 senators and 311 MNAs paid a total of Rs800 million in taxes, he added.

Shaikh said the FBR is "striving for transparency in the tax system", adding that the tax and audit systems were being automated and computerised.

"We wish to make the FBR's tax system transparent," he said, announcing that the institution had made two major decisions. "We are not bringing the tax audit under the control of any officer; it should not be so that a single officer selects the people of their choice in the audit.

"We are trying to have fewer people audited; we do not wish to audit a lot of people. This year, more than 10,000 cases have been selected for auditing," Shaikh noted, adding that less than 1% of the people would be audited for income tax.

The adviser stressed, however, that the salaried class as well as the beneficiaries of the tax amnesty scheme were not included in the audit. A 1.7% audit of sales tax would also be carried out, he said.

The adviser said people wished to be informed about taxpayers and, therefore, the details of those from 2018 "will be published today".

"The tax details of Pakistan's elected representatives will be published today [and] a tax directory of parliamentarians is being issued," he added.

"The government's basic philosophy is to collect taxes," he underlined, adding that the PTI regime wished for taxes to be collected in such a way that there were no undue hardships for the business community and no harassment of taxpayers.

Speaking of the industries, budget, as well as the coronavirus pandemic and its impact on the economy, Shaikh said the taxes on raw materials were reduced to zero and the government maintained subsidies for industries despite challenging circumstances.

"The government is giving subsidies on electricity and gas to industries, as well as subsidies on loans," he said. "We took immediate steps to improve the economy but still did not choose to impose any new taxes when the Budget 2020 was announced.

"We are witnessing economic recovery after the coronavirus pandemic," he added.

"Pakistan's exports have increased" during the same period, the adviser emphasised, adding that the government had decided to increase the country's exports.

https://www.geo.tv/latest/308557-fbr-releases-2018-tax-details-of-parliamentarians-chief-ministers