The Pakistan Tehreek-e-Insaf (PTI) led government is projected to add over Rs10 trillion in public debt during its first almost three years, due to rigidity in expenditures, increase in interest rates and currency devaluation. This debt will be equal to the total debt added by the last Pakistan Muslim League-Nawaz (PML-N) in its five years term.

The foreign commercial borrowings from Chinese, European and Gulf banks and through floatation of sovereign bonds will also be the preferred tools for the PTI government to raise loans for meeting the budgetary and balance of payments requirements, sources in the Finance Ministry said.

Pakistan has shared these public debt projections with the International Monetary Fund (IMF), suggesting that the public debt could be Rs36 trillion by June 2021. These projections are exclusive of publicly guaranteed debt and private debt.

In terms of size of the economy, the debt to the GDP ratio would remain closer to 70% by June 2021, which will be lower than the level left by the PML-N but far higher than the path set in the Fiscal Responsibility and Debt Limitation Act of 2005.

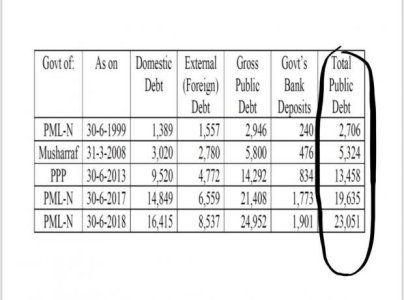

When the PML-N government completed its 2013-18 term, the public debt was Rs24.95 trillion, according to the State Bank of Pakistan (SBP).

Prime Minister Imran Khan has been very critical of the economic policies followed by the Pakistan Peoples Party (PPP) and the PML-N governments. During the PPP’s 2008-2013 tenure, the public debt surged from Rs6 trillion to Rs14 trillion. During the next five years, it hit the Rs25 trillion mark.

There was an increase of roughly Rs1 trillion from July through September of this fiscal year. Even after first quarter discount, there will be an addition of Rs10 trillion in a span of 33 months in the public debt that would swell to Rs36 trillion, the sources said.

The debt projections have been made for the period of 2019 to 2021, for the period when Pakistan may be under the IMF programme if both sides mend their differences on the pace of fiscal, monetary and exchange rate adjustments.

The sources said by June 2019, the public debt could hit Rs29.4 trillion, equal to 75% of GDP. It was 72.5% at the end of the PML-N term, far above the statutory limit of 60% of GDP.

The key reason for likely increase in public debt by June 2019 will be a minimum of Rs2.2 trillion budget deficit caused by growing debt and defence expenditures and low tax revenues.

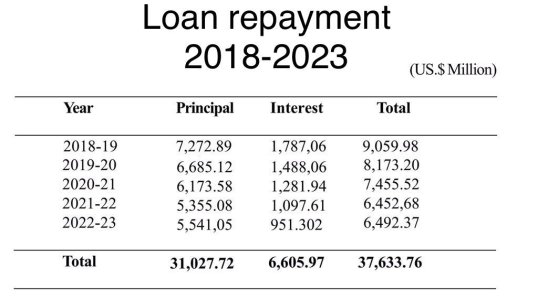

The interest payments that were Rs1.5 trillion in June 2018 could increase to Rs2 trillion by June next year due to increase in discount rate by the SBP and currency devaluation of over 20% in full fiscal year.

The sources said during the second year of the PTI government, the public debt would further jump to Rs32.6 trillion. There is projected addition of Rs3.2 trillion in public debt from July 2019 to June 2020. The assessment is based on Rs2.4 trillion budget deficit and nearly 6% further devaluation of the rupee.

In the fiscal year 2019-20, the interest payments have been projected to increase to Rs2.7 trillion and the defence budget is estimated at Rs1.27 trillion. Similarly in the third year, the public debt could increase by another Rs3.3 trillion to Rs36 trillion. In that year, the budget deficit is estimated at Rs2.5 trillion. The interest payments would shoot to Rs3.2 trillion and defence budget to Rs1.5 trillion.

In a span of three years, the debt servicing cost would double, thanks to interest rate hikes and currency devaluation. The gloomy debt scenario indicates the grave problems that Pakistan’s economy faces due to its low tax revenues and low exports.

In a meeting of the Senate Standing Committee on Finance on Wednesday, the Finance Minister Asad Umar said increasing exports is ‘economic jihad’ in Pakistan and his government is committed to do that.

The worrisome trends also expose the vulnerabilities in shape of growing refinancing risks. The Average time-to-maturity of the public debt has already come down to three years and six months.

During the past one year, the Finance Ministry’s contingent liabilities also increased significantly, which showed deterioration in public sector enterprises and more borrowings by the state-owned companies for various purposes. By June 2018, the last government’s contingent liabilities stood at Rs1.236 trillion.

The sources said Pakistan has assured the IMF that it will reduce reliance on the central bank borrowings. It has also committed to fully book the contingent liabilities aimed at reducing the debt related risks.

The Debt Policy Coordination Office that is currently working without full time director general is promised to be strengthened. But the sources said the government’s reliance on foreign commercial borrowings would continue until situation on the external front improves.

https://tribune.com.pk/story/1871496/2-debt-growth-pti-surpass-pml-n-three-years/

The foreign commercial borrowings from Chinese, European and Gulf banks and through floatation of sovereign bonds will also be the preferred tools for the PTI government to raise loans for meeting the budgetary and balance of payments requirements, sources in the Finance Ministry said.

Pakistan has shared these public debt projections with the International Monetary Fund (IMF), suggesting that the public debt could be Rs36 trillion by June 2021. These projections are exclusive of publicly guaranteed debt and private debt.

In terms of size of the economy, the debt to the GDP ratio would remain closer to 70% by June 2021, which will be lower than the level left by the PML-N but far higher than the path set in the Fiscal Responsibility and Debt Limitation Act of 2005.

When the PML-N government completed its 2013-18 term, the public debt was Rs24.95 trillion, according to the State Bank of Pakistan (SBP).

Prime Minister Imran Khan has been very critical of the economic policies followed by the Pakistan Peoples Party (PPP) and the PML-N governments. During the PPP’s 2008-2013 tenure, the public debt surged from Rs6 trillion to Rs14 trillion. During the next five years, it hit the Rs25 trillion mark.

There was an increase of roughly Rs1 trillion from July through September of this fiscal year. Even after first quarter discount, there will be an addition of Rs10 trillion in a span of 33 months in the public debt that would swell to Rs36 trillion, the sources said.

The debt projections have been made for the period of 2019 to 2021, for the period when Pakistan may be under the IMF programme if both sides mend their differences on the pace of fiscal, monetary and exchange rate adjustments.

The sources said by June 2019, the public debt could hit Rs29.4 trillion, equal to 75% of GDP. It was 72.5% at the end of the PML-N term, far above the statutory limit of 60% of GDP.

The key reason for likely increase in public debt by June 2019 will be a minimum of Rs2.2 trillion budget deficit caused by growing debt and defence expenditures and low tax revenues.

The interest payments that were Rs1.5 trillion in June 2018 could increase to Rs2 trillion by June next year due to increase in discount rate by the SBP and currency devaluation of over 20% in full fiscal year.

The sources said during the second year of the PTI government, the public debt would further jump to Rs32.6 trillion. There is projected addition of Rs3.2 trillion in public debt from July 2019 to June 2020. The assessment is based on Rs2.4 trillion budget deficit and nearly 6% further devaluation of the rupee.

In the fiscal year 2019-20, the interest payments have been projected to increase to Rs2.7 trillion and the defence budget is estimated at Rs1.27 trillion. Similarly in the third year, the public debt could increase by another Rs3.3 trillion to Rs36 trillion. In that year, the budget deficit is estimated at Rs2.5 trillion. The interest payments would shoot to Rs3.2 trillion and defence budget to Rs1.5 trillion.

In a span of three years, the debt servicing cost would double, thanks to interest rate hikes and currency devaluation. The gloomy debt scenario indicates the grave problems that Pakistan’s economy faces due to its low tax revenues and low exports.

In a meeting of the Senate Standing Committee on Finance on Wednesday, the Finance Minister Asad Umar said increasing exports is ‘economic jihad’ in Pakistan and his government is committed to do that.

The worrisome trends also expose the vulnerabilities in shape of growing refinancing risks. The Average time-to-maturity of the public debt has already come down to three years and six months.

During the past one year, the Finance Ministry’s contingent liabilities also increased significantly, which showed deterioration in public sector enterprises and more borrowings by the state-owned companies for various purposes. By June 2018, the last government’s contingent liabilities stood at Rs1.236 trillion.

The sources said Pakistan has assured the IMF that it will reduce reliance on the central bank borrowings. It has also committed to fully book the contingent liabilities aimed at reducing the debt related risks.

The Debt Policy Coordination Office that is currently working without full time director general is promised to be strengthened. But the sources said the government’s reliance on foreign commercial borrowings would continue until situation on the external front improves.

https://tribune.com.pk/story/1871496/2-debt-growth-pti-surpass-pml-n-three-years/

Last edited by a moderator: