Economy noob here. How important is this rating in terms of investment?

Massive especially in FDI terms especially for emerging economies.

The investment world runs on two major factors, confidence and cost of borrowing.

Agency ratings are used by lenders when deciding on rates. So say you want to borrow from a foreign institution to expand domestically or abroad, they gauge the risk based on these ratings (one of the criteria). If the borrower is from a high risk economy then the interest rate goes up. Again that's if they agree to lend you the money.

This then increases the cost of your business having to service these loans.

For foreign institutional investors they simply remove companies from one portfolio (say a safer emerging market one) to a higher risk portfolio that is unlikely to be very attractive. Fitch, Moodys, S&P are very influential when big money is involved.

Is this an immediate problem, I do not think so.

The biggest challenges to the economy is as follows (in my opinion):

- Ensuring remittances from abroad are steady,

- Increasing oil prices and a devalued rupee do not go hand in hand such things rapidly increase inflationary pressure,

- Somehow control imports that are climbing year on year leading to a widening trade deficit,

- Boost the struggling/declining textile industry the life blood of Pakistan's exports,

- Helping cotton farmers overcome electricity and water issues.

- Protect domestic industry from cheaper Chinese imports. Offering zero duty on almost 6,000 tariff lines out of the total 7,000 that might jeopardise many major industries in Pakistan as per the recent Pak-China Free Trade Agreement (FTA). This can cause irreversible damage to the local economy in the medium to long term. Hopefully the next government can nip this in the bud.

:

: ) Plz hit me baby one more time

) Plz hit me baby one more time

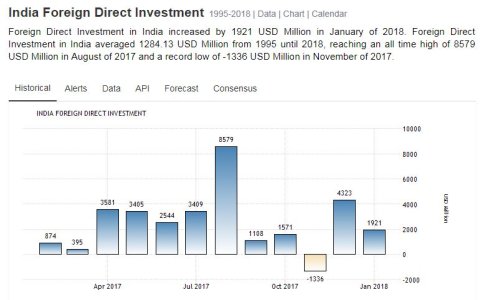

As per your graphs a monthly FDI in India is being compared to an yearly investment in Pakistan!!

As per your graphs a monthly FDI in India is being compared to an yearly investment in Pakistan!!