Bhaijaan

Hall of Famer

- Joined

- Jan 10, 2011

- Runs

- 71,987

- Post of the Week

- 1

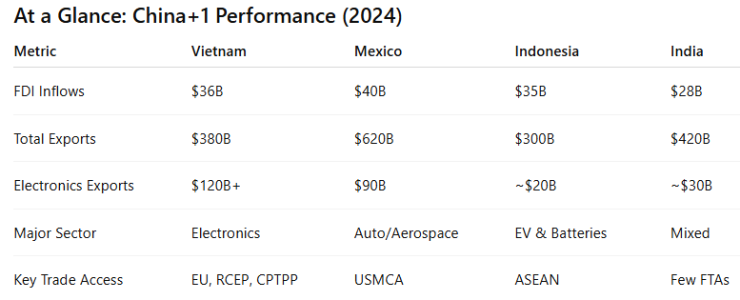

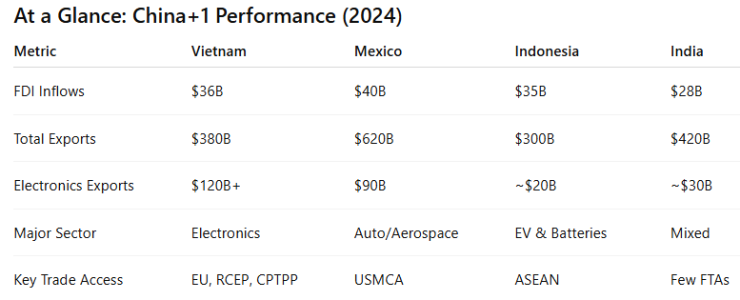

As global companies continue to diversify their supply chains away from China, the much-discussed “China+1” strategy has become a defining factor in reshaping international manufacturing and trade patterns. While India is often seen as a natural alternative, recent trends show that Vietnam, Mexico, and Indonesia have surged ahead in securing a larger share of foreign direct investment (FDI), particularly in high-growth sectors like electronics, automobiles, and green technologies.

Vietnam has emerged as a clear front-runner in the China+1 race, thanks to its agile policy-making, deep integration into global trade frameworks, and a highly efficient industrial infrastructure.

With over $36 billion in FDI in 2024 and exports exceeding $380 billion, the Southeast Asian nation has positioned itself as a global manufacturing hub. Electronics exports, driven by firms like Samsung, Intel, Foxconn, and LG, constitute a significant portion of this success. In fact, Samsung alone accounts for nearly 20% of the country’s total exports.

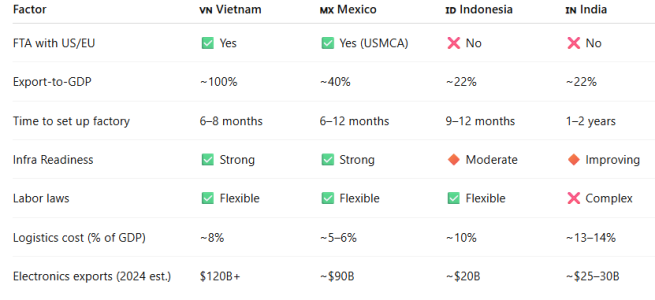

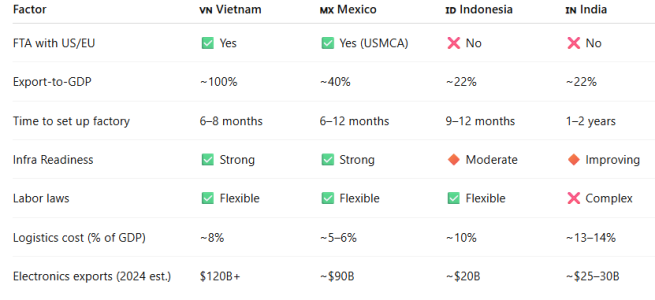

Vietnam’s strategic advantage lies in its expansive Free Trade Agreement (FTA) network. Agreements with the European Union (EVFTA), the Regional Comprehensive Economic Partnership (RCEP), and the CPTPP (Trans-Pacific Partnership) allow Vietnamese goods to flow freely across global markets, providing a clear edge over competitors like India, which is yet to secure similar agreements with major economies.

Furthermore, Vietnam’s plug-and-play industrial parks and streamlined regulatory approvals have made it a preferred choice for companies seeking rapid scale-up with minimal bureaucratic friction.

In North America, Mexico has capitalised on its geographic proximity to the United States, positioning itself as a linchpin in regional supply chains. With trade covered under the United States–Mexico–Canada Agreement (USMCA), Mexico enjoys duty-free access to two of the world’s largest markets.

Multinational giants such as Tesla, Ford, General Motors, and Boeing have expanded their manufacturing footprints in Mexico, leading to a surge in both auto and aerospace exports. The country's FDI inflows crossed $40 billion in 2024, while its total exports soared to $620 billion, with over 80% heading to the US.

Mexico’s logistics efficiency, flexible labor laws, and customs integration with the US have made it a beacon for “nearshoring” strategies, where companies aim to bring production closer to their end markets.

Indonesia has taken a more resource-driven approach to climb the manufacturing value chain. With the world’s largest nickel reserves, it has attracted billions in investment from electric vehicle (EV) and battery manufacturers.

The government’s ban on raw nickel exports—designed to force companies to process and manufacture within the country—has proved effective. Companies like LG Chem, CATL, BYD, and Hyundai are setting up integrated battery production plants, turning Indonesia into a vital node in the global EV supply chain.

Indonesia also offers generous tax incentives and is developing modern industrial zones in areas like Batang and Morowali, specifically tailored for green technology and electronics sectors. With FDI touching $35 billion in 2024, and exports exceeding $300 billion, Indonesia is positioning itself not only as a resource exporter, but increasingly as a tech manufacturer.

Despite its demographic advantage and robust talent base, India remains in the middle row of the China+1 bus, observers say. While the Production-Linked Incentive (PLI) schemes have brought some success—most notably with Apple expanding its iPhone assembly footprint—the overall pace of reform remains slower than its competitors.

India’s logistics cost remains high (13–14% of GDP), land acquisition processes are cumbersome, and the absence of FTAs with key markets like the EU or UK continues to hinder export competitiveness.

Experts note that while India has made progress in infrastructure development through the Gati Shakti initiative and Dedicated Freight Corridors (DFCs), ease of doing business remains a major sticking point for global investors, particularly when compared to Vietnam’s rapid setup timelines or Mexico’s seamless trade integration.

Vietnam: Asia’s New Manufacturing Dynamo

Vietnam has emerged as a clear front-runner in the China+1 race, thanks to its agile policy-making, deep integration into global trade frameworks, and a highly efficient industrial infrastructure.

With over $36 billion in FDI in 2024 and exports exceeding $380 billion, the Southeast Asian nation has positioned itself as a global manufacturing hub. Electronics exports, driven by firms like Samsung, Intel, Foxconn, and LG, constitute a significant portion of this success. In fact, Samsung alone accounts for nearly 20% of the country’s total exports.

Vietnam’s strategic advantage lies in its expansive Free Trade Agreement (FTA) network. Agreements with the European Union (EVFTA), the Regional Comprehensive Economic Partnership (RCEP), and the CPTPP (Trans-Pacific Partnership) allow Vietnamese goods to flow freely across global markets, providing a clear edge over competitors like India, which is yet to secure similar agreements with major economies.

Furthermore, Vietnam’s plug-and-play industrial parks and streamlined regulatory approvals have made it a preferred choice for companies seeking rapid scale-up with minimal bureaucratic friction.

Mexico: Riding the Nearshoring Wave

In North America, Mexico has capitalised on its geographic proximity to the United States, positioning itself as a linchpin in regional supply chains. With trade covered under the United States–Mexico–Canada Agreement (USMCA), Mexico enjoys duty-free access to two of the world’s largest markets.

Multinational giants such as Tesla, Ford, General Motors, and Boeing have expanded their manufacturing footprints in Mexico, leading to a surge in both auto and aerospace exports. The country's FDI inflows crossed $40 billion in 2024, while its total exports soared to $620 billion, with over 80% heading to the US.

Mexico’s logistics efficiency, flexible labor laws, and customs integration with the US have made it a beacon for “nearshoring” strategies, where companies aim to bring production closer to their end markets.

Indonesia: From Resource Giant to EV Powerhouse

Indonesia has taken a more resource-driven approach to climb the manufacturing value chain. With the world’s largest nickel reserves, it has attracted billions in investment from electric vehicle (EV) and battery manufacturers.

The government’s ban on raw nickel exports—designed to force companies to process and manufacture within the country—has proved effective. Companies like LG Chem, CATL, BYD, and Hyundai are setting up integrated battery production plants, turning Indonesia into a vital node in the global EV supply chain.

Indonesia also offers generous tax incentives and is developing modern industrial zones in areas like Batang and Morowali, specifically tailored for green technology and electronics sectors. With FDI touching $35 billion in 2024, and exports exceeding $300 billion, Indonesia is positioning itself not only as a resource exporter, but increasingly as a tech manufacturer.

India: High on Potential, Slow on Execution

Despite its demographic advantage and robust talent base, India remains in the middle row of the China+1 bus, observers say. While the Production-Linked Incentive (PLI) schemes have brought some success—most notably with Apple expanding its iPhone assembly footprint—the overall pace of reform remains slower than its competitors.

India’s logistics cost remains high (13–14% of GDP), land acquisition processes are cumbersome, and the absence of FTAs with key markets like the EU or UK continues to hinder export competitiveness.

Experts note that while India has made progress in infrastructure development through the Gati Shakti initiative and Dedicated Freight Corridors (DFCs), ease of doing business remains a major sticking point for global investors, particularly when compared to Vietnam’s rapid setup timelines or Mexico’s seamless trade integration.