-

Contact the PP Team

Connect with us

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying shares?

- Thread starter DeadlyVenom

- Start date

IAJ

ODI Star

- Joined

- Dec 14, 2008

- Runs

- 33,859

- Post of the Week

- 1

Last week was brutal on European stock exchanges, and today has been one of the worst days. Sweden and Finland down over 5%, France and Denmark over 4% and Norway close to 3,50%.

The interest rate and the tension in Ukraine some of the reasons I believe.

The interest rate and the tension in Ukraine some of the reasons I believe.

JaDed

T20I Captain

- Joined

- May 5, 2014

- Runs

- 42,478

It’s official bear market , let’s see how long it lasts.

Biden will not get another term for sure.

Biden will not get another term for sure.

IAJ

ODI Star

- Joined

- Dec 14, 2008

- Runs

- 33,859

- Post of the Week

- 1

Nasdaq down 5,40% currently and Dow Jones down 3,60%. Not looking good for European stock markets tomorrow. This after Fed raises rates by half a percentage point — the biggest hike in two decades.

- Joined

- Oct 2, 2004

- Runs

- 218,154

Shares in Silicon Valley Bank (SVB), a key lender to technology start-ups, plummeted on Thursday as investors moved to withdraw their deposits.

The slide came after the bank announced a $1.75bn (£1.5bn) share sale to help shore up its finances.

Shares in banks have fallen around the world - with the four largest US banks, including JP Morgan and Wells Fargo, losing more than $50bn in market value.

One venture capitalist told the BBC the day's events were "wild" and "brutal".

In Friday morning trade, shares in Asian banks were also lower.

Shares in SVB saw their biggest one-day drop on record as they plunged by more than 60% and lost another 20% in after-hours trade.

The firm launched the share sale after losing around $1.8bn when it offloaded a portfolio of assets, mainly US Treasuries.

But more concerningly for the bank, some start-ups who have money deposited have been advised to withdraw funds.

Hannah Chelkowski, founder of Blank Ventures, a fund that invests in financial technology, told the BBC the situation was "wild". She is advising companies in her portfolio to withdraw funds.

"It's crazy how it's just unravelled like this... The interesting thing is that it's the most start-up friendly bank and supported start-ups so much through Covid. Now VCs are telling their portfolio companies to pull their funds," she said.

"It's brutal," she added.

A crucial lender for early-stage businesses, SVB is the banking partner for nearly half of US venture-backed technology and healthcare companies that listed on stock markets last year.

SVB did not immediately respond to a BBC request for further comment.

In the wider market, there were concerns about the value of bonds held by banks as rising interest rates made those bonds less valuable.

Central banks around the world - including the US Federal Reserve and the Bank of England - have sharply increased interest rates as they try to curb inflation.

Banks tend to hold large portfolios of bonds and as a result are sitting on significant potential losses. The falls in the value of bonds held by banks is not necessarily a problem unless they are forced to sell them.

But, if like Silicon Valley Bank, lenders have to sell the bonds they hold at a loss it could have an impact on their profits.

"The banks are casualties of the hike in interest rates," Ray Wang, founder and chief executive of Silicon Valley-based consultancy Constellation Research told the BBC.

"Nobody at Silicon Valley Bank and in a lot of places thought that these interest rate hikes would have lasted this long. And I think that's really what happened. They bet wrong," he added.

BBC

The slide came after the bank announced a $1.75bn (£1.5bn) share sale to help shore up its finances.

Shares in banks have fallen around the world - with the four largest US banks, including JP Morgan and Wells Fargo, losing more than $50bn in market value.

One venture capitalist told the BBC the day's events were "wild" and "brutal".

In Friday morning trade, shares in Asian banks were also lower.

Shares in SVB saw their biggest one-day drop on record as they plunged by more than 60% and lost another 20% in after-hours trade.

The firm launched the share sale after losing around $1.8bn when it offloaded a portfolio of assets, mainly US Treasuries.

But more concerningly for the bank, some start-ups who have money deposited have been advised to withdraw funds.

Hannah Chelkowski, founder of Blank Ventures, a fund that invests in financial technology, told the BBC the situation was "wild". She is advising companies in her portfolio to withdraw funds.

"It's crazy how it's just unravelled like this... The interesting thing is that it's the most start-up friendly bank and supported start-ups so much through Covid. Now VCs are telling their portfolio companies to pull their funds," she said.

"It's brutal," she added.

A crucial lender for early-stage businesses, SVB is the banking partner for nearly half of US venture-backed technology and healthcare companies that listed on stock markets last year.

SVB did not immediately respond to a BBC request for further comment.

In the wider market, there were concerns about the value of bonds held by banks as rising interest rates made those bonds less valuable.

Central banks around the world - including the US Federal Reserve and the Bank of England - have sharply increased interest rates as they try to curb inflation.

Banks tend to hold large portfolios of bonds and as a result are sitting on significant potential losses. The falls in the value of bonds held by banks is not necessarily a problem unless they are forced to sell them.

But, if like Silicon Valley Bank, lenders have to sell the bonds they hold at a loss it could have an impact on their profits.

"The banks are casualties of the hike in interest rates," Ray Wang, founder and chief executive of Silicon Valley-based consultancy Constellation Research told the BBC.

"Nobody at Silicon Valley Bank and in a lot of places thought that these interest rate hikes would have lasted this long. And I think that's really what happened. They bet wrong," he added.

BBC

daytrader

ODI Debutant

- Joined

- Jul 11, 2015

- Runs

- 11,175

- Post of the Week

- 1

Silicon Valley Bank: Regulators take over as failure raises fears

US regulators have shut down Silicon Valley Bank (SVB) and taken control of its customer deposits in the largest failure of a US bank since 2008.

The moves came as the firm, a key tech lender, was scrambling to raise money to plug a loss from the sale of assets affected by higher interest rates.

Its troubles prompted a rush of customer withdrawals and sparked fears about the state of the banking sector.

Officials said they acted to "protect insured depositors".

Silicon Valley Bank faced "inadequate liquidity and insolvency", banking regulators in California, where the firm has its headquarters, said as they announced the takeover.

The Federal Deposit Insurance Corporation (FDIC), which typically protects deposits up to $250,000, said it had taken charge of the roughly $175bn (£145bn) in deposits held at the bank, the 16th largest in the US.

Bank offices would reopen and clients with insured deposits would have access to funds "no later than Monday morning", it said, adding that money raised from selling the bank's assets would go to uninsured depositors.

...

https://www.bbc.com/news/business-64915616

US regulators have shut down Silicon Valley Bank (SVB) and taken control of its customer deposits in the largest failure of a US bank since 2008.

The moves came as the firm, a key tech lender, was scrambling to raise money to plug a loss from the sale of assets affected by higher interest rates.

Its troubles prompted a rush of customer withdrawals and sparked fears about the state of the banking sector.

Officials said they acted to "protect insured depositors".

Silicon Valley Bank faced "inadequate liquidity and insolvency", banking regulators in California, where the firm has its headquarters, said as they announced the takeover.

The Federal Deposit Insurance Corporation (FDIC), which typically protects deposits up to $250,000, said it had taken charge of the roughly $175bn (£145bn) in deposits held at the bank, the 16th largest in the US.

Bank offices would reopen and clients with insured deposits would have access to funds "no later than Monday morning", it said, adding that money raised from selling the bank's assets would go to uninsured depositors.

...

https://www.bbc.com/news/business-64915616

Asif khan

First Class Player

- Joined

- Aug 7, 2005

- Runs

- 3,000

Spilled over to crypto with USDC losing it's peg.

Asif khan

First Class Player

- Joined

- Aug 7, 2005

- Runs

- 3,000

It’s official bear market , let’s see how long it lasts.

Biden will not get another term for sure.

All decade for SPX.

shaz619

Test Star

- Joined

- Mar 31, 2010

- Runs

- 39,800

- Post of the Week

- 7

Damn, no monies to DCA in over a year or so

Looks like the SALE is on in tech anyway

Looks like the SALE is on in tech anyway

Bewal Express

T20I Captain

- Joined

- Nov 6, 2005

- Runs

- 41,495

Last month, i sold my glencore shares and normally as soon as I sell them, they go up. Not this time.

daytrader

ODI Debutant

- Joined

- Jul 11, 2015

- Runs

- 11,175

- Post of the Week

- 1

Silicon Valley Bank: Money in failed US bank is safe - US government

People and businesses who have money deposited with failed US bank Silicon Valley Bank (SVB) will be able to access all their cash from Monday, the US government has said.

A statement from the US Treasury, the Federal Reserve and Federal Deposit Insurance Corporation (FDIC) said depositors would be fully protected.

The taxpayer will not bear any losses from the move, the statement said.

SVB was shut down by regulators who seized its assets on Friday.

It was the largest failure of a US bank since the financial crisis in 2008.

The move came as the firm, a key tech lender, was scrambling to raise money to plug a loss from the sale of assets affected by higher interest rates.

"The US banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry," the authorities' joint statement said.

"Those reforms combined with today's actions demonstrate our commitment to take the necessary steps to ensure that depositors' savings remain safe."

Those actions also apply to Signature Bank of New York, seen as the most vulnerable institution after SVB, which came under regulatory control on Sunday.

As part of their moves to restore confidence, regulators also unveiled a new way to give banks access to emergency funds.

...

https://www.bbc.com/news/world-us-canada-64935170

People and businesses who have money deposited with failed US bank Silicon Valley Bank (SVB) will be able to access all their cash from Monday, the US government has said.

A statement from the US Treasury, the Federal Reserve and Federal Deposit Insurance Corporation (FDIC) said depositors would be fully protected.

The taxpayer will not bear any losses from the move, the statement said.

SVB was shut down by regulators who seized its assets on Friday.

It was the largest failure of a US bank since the financial crisis in 2008.

The move came as the firm, a key tech lender, was scrambling to raise money to plug a loss from the sale of assets affected by higher interest rates.

"The US banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis that ensured better safeguards for the banking industry," the authorities' joint statement said.

"Those reforms combined with today's actions demonstrate our commitment to take the necessary steps to ensure that depositors' savings remain safe."

Those actions also apply to Signature Bank of New York, seen as the most vulnerable institution after SVB, which came under regulatory control on Sunday.

As part of their moves to restore confidence, regulators also unveiled a new way to give banks access to emergency funds.

...

https://www.bbc.com/news/world-us-canada-64935170

daytrader

ODI Debutant

- Joined

- Jul 11, 2015

- Runs

- 11,175

- Post of the Week

- 1

HSBC buys Silicon Valley Bank UK

The bank used by tech companies and start ups has a balance sheet worth £8.8bn yet was bought by Europe's largest bank for £1.

HSBC has bought the embattled UK arm of Silicon Valley Bank (SVBUK), securing the deposits of more than 3,000 customers worth £6.7bn.

Confirming a story broken on Monday by Sky's City editor Mark Kleinman, the Bank of England, which had been preparing to bring the bank into an insolvency process, said all depositors' money with SVBUK was safe and secure as a result of the purchase.

All SVBUK services will continue to operate as normal and customers should not notice any changes, the statement said.

HSBC said it bought SVBUK - which has a balance sheet of £8.8bn - for £1.

A statement from the Treasury highlighted that no taxpayer money is involved in the sale.

Chancellor Jeremy Hunt said: "Making use of post-crisis banking reforms, which introduced powers to safely manage the failure of banks, this sale has protected both the customers of SVB UK and taxpayers."

"The UK's tech sector is genuinely world-leading and of huge importance to the British economy, supporting hundreds of thousands of jobs. I said yesterday that we would look after our tech sector, and we have worked urgently to deliver on that promise and find a solution that will provide SVB UK's customers with confidence," Mr Hunt said.

"HSBC is Europe's largest bank, and SVB UK customers should feel reassured by the strength, safety and security that brings them."

Sky News

The bank used by tech companies and start ups has a balance sheet worth £8.8bn yet was bought by Europe's largest bank for £1.

HSBC has bought the embattled UK arm of Silicon Valley Bank (SVBUK), securing the deposits of more than 3,000 customers worth £6.7bn.

Confirming a story broken on Monday by Sky's City editor Mark Kleinman, the Bank of England, which had been preparing to bring the bank into an insolvency process, said all depositors' money with SVBUK was safe and secure as a result of the purchase.

All SVBUK services will continue to operate as normal and customers should not notice any changes, the statement said.

HSBC said it bought SVBUK - which has a balance sheet of £8.8bn - for £1.

A statement from the Treasury highlighted that no taxpayer money is involved in the sale.

Chancellor Jeremy Hunt said: "Making use of post-crisis banking reforms, which introduced powers to safely manage the failure of banks, this sale has protected both the customers of SVB UK and taxpayers."

"The UK's tech sector is genuinely world-leading and of huge importance to the British economy, supporting hundreds of thousands of jobs. I said yesterday that we would look after our tech sector, and we have worked urgently to deliver on that promise and find a solution that will provide SVB UK's customers with confidence," Mr Hunt said.

"HSBC is Europe's largest bank, and SVB UK customers should feel reassured by the strength, safety and security that brings them."

Sky News

shaz619

Test Star

- Joined

- Mar 31, 2010

- Runs

- 39,800

- Post of the Week

- 7

Am looking to sell out my positions in the stock market and look to invest in BTC/ETH, not a lot, but my returns in the stock market have been 0%

Been a very long bear market in the UK small caps

But maybe there are signs of hope ? Interest rate cycle appears to have peaked (often it is rate of change of rises and falls and anticipation of these which leads through to market sentiment rather than the actual changes)

Also repeat the old adage 'Sell in May and go away ; Come again St.Leger's Day' (i.e. September)

But maybe there are signs of hope ? Interest rate cycle appears to have peaked (often it is rate of change of rises and falls and anticipation of these which leads through to market sentiment rather than the actual changes)

Also repeat the old adage 'Sell in May and go away ; Come again St.Leger's Day' (i.e. September)

Bewal Express

T20I Captain

- Joined

- Nov 6, 2005

- Runs

- 41,495

My British airways are still not back to break even, Centrica is going great but ITV making big losses at the moment.

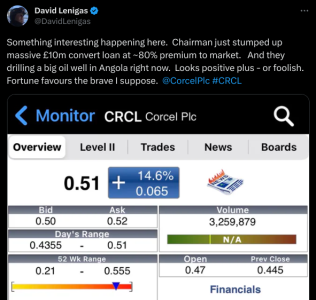

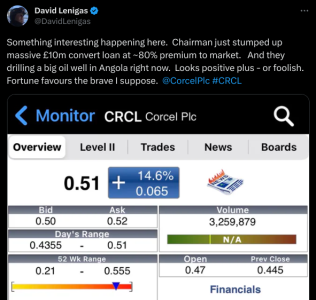

CRCL Corcel - starting a drilling campaign in Angola, chart on verge of breakout ?

David Lenigas on current CRCL drilling campaign

CRCL Corcel working nicely so far

Drilling started a couple of days ago. Should take around a week to get down to target depth and then the moment of truth whether they have 1) Oil 2) Recoverable Oil 3) Economically Recoverable Oil 4) How much and how fast is the oil recoverable 5 ) What do the learnings from this drill tell us about the other prospects on this acreage where CRCL hold further interests

Drilling started a couple of days ago. Should take around a week to get down to target depth and then the moment of truth whether they have 1) Oil 2) Recoverable Oil 3) Economically Recoverable Oil 4) How much and how fast is the oil recoverable 5 ) What do the learnings from this drill tell us about the other prospects on this acreage where CRCL hold further interests

Miners surged as hopes of a recovery in China’s economy following challenges in its property sector boosted metal prices.

Fresnillo gained 4.6 per cent, or 25.6p, to 580p, Glencore rose 2.2 per cent, or 9.35p, to 435.35p, Anglo American added 2.4 per cent, or 48.5p, to 2071.5p, Antofagasta ascended 2.9 per cent, or 43p, to 1509.5p and Rio Tinto lost 3.4 per cent, or 166.5p, to 5001p.

Fresnillo gained 4.6 per cent, or 25.6p, to 580p, Glencore rose 2.2 per cent, or 9.35p, to 435.35p, Anglo American added 2.4 per cent, or 48.5p, to 2071.5p, Antofagasta ascended 2.9 per cent, or 43p, to 1509.5p and Rio Tinto lost 3.4 per cent, or 166.5p, to 5001p.

CPX Cap-XX

Interesting chart set-up and news today

Graham Cooley who was long time CEO of ITM Power (which became a £1bn Company under his leadership) has appeared as a 3%+ shareholder in Cap-XX

Graham Cooley is on twitter where he tweets a lot about interesting new Green technology plays so his newly announced involvement in CPX is worth watching

CPX been around a long time but never delivered on its supercapacitor tech promise and recently been involved in patent disputes with other supercapacitor companies like Maxwell (now owned by Tesla). A result / settlement of that legal dispute could be a potential catalyst for the stock (assuming judgement goes the right way and / or they settle amicably and thus can spend money or R&D and focus Management time on business rather than legals/lawyers etc)

Interesting chart set-up and news today

Graham Cooley who was long time CEO of ITM Power (which became a £1bn Company under his leadership) has appeared as a 3%+ shareholder in Cap-XX

Graham Cooley is on twitter where he tweets a lot about interesting new Green technology plays so his newly announced involvement in CPX is worth watching

CPX been around a long time but never delivered on its supercapacitor tech promise and recently been involved in patent disputes with other supercapacitor companies like Maxwell (now owned by Tesla). A result / settlement of that legal dispute could be a potential catalyst for the stock (assuming judgement goes the right way and / or they settle amicably and thus can spend money or R&D and focus Management time on business rather than legals/lawyers etc)

- Joined

- Aug 1, 2023

- Runs

- 5,668

Anyone buy ARM Holdings on its IPO debut?

Surely it's valuation is too rich with a PE ratio of over 100 which is the same as NVDIA

"

Arm’s stock is expected to be priced at roughly 20 times its revenue, which positions it as a relatively high-priced option within its industry.

Comparatively, several competitors are achieving growth rates that surpass three times that of Arm, yet they are trading at more conservative multiples, typically ranging from 12 to 15 times their sales.

For instance, Nvidia shares a similar 20-times multiple with Arm, but industry experts anticipate Nvidia’s growth rate to reach approximately 100% this year. Furthermore, Nvidia boasts a more diverse range of business operations compared to Arm, further differentiating the two companies.

""

Or am I missing something

Surely it's valuation is too rich with a PE ratio of over 100 which is the same as NVDIA

"

Arm’s stock is expected to be priced at roughly 20 times its revenue, which positions it as a relatively high-priced option within its industry.

Comparatively, several competitors are achieving growth rates that surpass three times that of Arm, yet they are trading at more conservative multiples, typically ranging from 12 to 15 times their sales.

For instance, Nvidia shares a similar 20-times multiple with Arm, but industry experts anticipate Nvidia’s growth rate to reach approximately 100% this year. Furthermore, Nvidia boasts a more diverse range of business operations compared to Arm, further differentiating the two companies.

""

Or am I missing something

- Joined

- Aug 1, 2023

- Runs

- 5,668

Miners surged as hopes of a recovery in China’s economy following challenges in its property sector boosted metal prices.

Fresnillo gained 4.6 per cent, or 25.6p, to 580p, Glencore rose 2.2 per cent, or 9.35p, to 435.35p, Anglo American added 2.4 per cent, or 48.5p, to 2071.5p, Antofagasta ascended 2.9 per cent, or 43p, to 1509.5p and Rio Tinto lost 3.4 per cent, or 166.5p, to 5001p.

Yes, miners and energy stocks doing well. I like the product oil tanker space as well. With refining margins going wild, product tanker rates are mooning. Q4/Q1 is also their seasonaly strong period

Bewal Express

T20I Captain

- Joined

- Nov 6, 2005

- Runs

- 41,495

Although I have been reasonably successful in my share dealing , its interesting that if I held onto the shares I brought at the start of the pandemic I would be in a financially healthier place. I brought Glencore for a £1 and sold at £1.45, they reached £5.80 in April, I sold centrica at 53p, today its around 170p. If only.

I'm so old I remember when the only way to get exposure to ARM stock was via this funny little Cambridge based company called Acorn which made 'computers for schools'. Acorn were one of the early investors in ARM from its first Venture Capital rounds in the 1990s. ARM eventually floated on the stock market in the late 1990s and was valued at less than a billion pounds at that stage. Been an amazing growth story. The PE rating always looks high because the market is paying for the quality of the earnings which are seen as high quality because of the high royalty margins, plus diversity and growth.Anyone buy ARM Holdings on its IPO debut?

Surely it's valuation is too rich with a PE ratio of over 100 which is the same as NVDIA

"

Arm’s stock is expected to be priced at roughly 20 times its revenue, which positions it as a relatively high-priced option within its industry.

Comparatively, several competitors are achieving growth rates that surpass three times that of Arm, yet they are trading at more conservative multiples, typically ranging from 12 to 15 times their sales.

For instance, Nvidia shares a similar 20-times multiple with Arm, but industry experts anticipate Nvidia’s growth rate to reach approximately 100% this year. Furthermore, Nvidia boasts a more diverse range of business operations compared to Arm, further differentiating the two companies.

""

Or am I missing something

CRCL Corcel

In middle of a potentially high impact oil and gas drilling campaign in Angola alongside State Oil company Sonangol

Interesting news today with Chairman giving funding security at big premium to current share price

Also punter favourite David Lenigas commenting today elsewhere...

I think a fund raising at the right price is definitely on the cards. But I’m sure Karam wants the price to be a lot higher than it is now. He wants this CRCL at multi hundred million market cap. That’s what he told me last week. Let’s see.

In middle of a potentially high impact oil and gas drilling campaign in Angola alongside State Oil company Sonangol

Interesting news today with Chairman giving funding security at big premium to current share price

Also punter favourite David Lenigas commenting today elsewhere...

Lenigas

18 Sep '23 - 11:13 - 1296 of 1307 |

APTA Aptamer a AVCT Avacta type play (Aptamer using these protein binders called aptamers as opposed to Avacta using affimers) been a total disaster since IPO but had a news story a few months back which drove a huge rise to 30p (versus 1p now) on its aptamers potentially being used in a new Alzheimers test from a Company run by 'eminent neuroscientist' Prof Susan Greenfield

aptamergroup.com

aptamergroup.com

“We’re delighted to be working with Aptamer Group on this potentially game-changing technology to combat one of the biggest unmet medical needs of our time. It’s a further example of UK ingenuity and teamwork for highly innovative and disruptive science.”

Baronness Susan Greenfield, CEO of Neuro-Bio

Aptamer Group And Neuro-Bio Partner To Develop An Alzheimer’s Disease Diagnostic Test

14/06/2023

“We’re delighted to be working with Aptamer Group on this potentially game-changing technology to combat one of the biggest unmet medical needs of our time. It’s a further example of UK ingenuity and teamwork for highly innovative and disruptive science.”

Baronness Susan Greenfield, CEO of Neuro-Bio

CPX Cap-XX

Interesting chart set-up and news today

Graham Cooley who was long time CEO of ITM Power (which became a £1bn Company under his leadership) has appeared as a 3%+ shareholder in Cap-XX

Graham Cooley is on twitter where he tweets a lot about interesting new Green technology plays so his newly announced involvement in CPX is worth watching

CPX been around a long time but never delivered on its supercapacitor tech promise and recently been involved in patent disputes with other supercapacitor companies like Maxwell (now owned by Tesla). A result / settlement of that legal dispute could be a potential catalyst for the stock (assuming judgement goes the right way and / or they settle amicably and thus can spend money or R&D and focus Management time on business rather than legals/lawyers etc)

December seems to be date for CPX vs Maxwell / TESLA Court judgement

This is a previous judgement CPX won vs competitor Ioxus (won around $5m in that case)

APTA shaping nicely on the chart

APTA Aptamer a AVCT Avacta type play (Aptamer using these protein binders called aptamers as opposed to Avacta using affimers) been a total disaster since IPO but had a news story a few months back which drove a huge rise to 30p (versus 1p now) on its aptamers potentially being used in a new Alzheimers test from a Company run by 'eminent neuroscientist' Prof Susan Greenfield

Aptamer Group And Neuro-Bio Partner To Develop An Alzheimer’s Disease Diagnostic Test

14/06/2023aptamergroup.com

“We’re delighted to be working with Aptamer Group on this potentially game-changing technology to combat one of the biggest unmet medical needs of our time. It’s a further example of UK ingenuity and teamwork for highly innovative and disruptive science.”

Baronness Susan Greenfield, CEO of Neuro-Bio

APTA RNSAPTA shaping nicely on the chart

Aptamer Group Regulatory News. Live APTA RNS. Regulatory News Articles for Aptamer Group Plc Ord 0.1p

Aptamer Group Regulatory News. Live APTA RNS. Regulatory News Articles for Aptamer Group Plc Ord 0.1p

Hasn't gone to well with the market

- Joined

- Aug 1, 2023

- Runs

- 5,668

A crazy year for stocks this year. Coming into 2023, most possessed themselves for a ressession, but in the end, it was a boon year, with the S&P500 up about 23% and the Nasdaq up 54%.

The biggest flop of the year was utilities, which is expected in a bullish year.

Going into 2024 what sectors do you think will do well?

Personally, I like gold, industrials, materials, and emerging markets for 2024. With inflation taking a breather, the dollar should weaken more, and that benefits these sectors. Also, with a US election coming up, they will do what they can to avoid a recession in an election year. If this is the case, then economically sensitive areas should do well.

The biggest flop of the year was utilities, which is expected in a bullish year.

Going into 2024 what sectors do you think will do well?

Personally, I like gold, industrials, materials, and emerging markets for 2024. With inflation taking a breather, the dollar should weaken more, and that benefits these sectors. Also, with a US election coming up, they will do what they can to avoid a recession in an election year. If this is the case, then economically sensitive areas should do well.

Bewal Express

T20I Captain

- Joined

- Nov 6, 2005

- Runs

- 41,495

I am heavily invested into British airways. Break even price around 170p. Anything above and its profit and anything less is a loss.

- Joined

- Nov 25, 2023

- Runs

- 24,477

Traders work on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., December 13, 2023.

Global stock markets extended a New Year slide on Wednesday and the dollar edged higher as concerns about the chances of a soft landing mounted, while the latest hostilities in the Middle East added to downbeat market sentiment.

The yield on benchmark 10-year Treasury notes briefly climbed above 4% as market optimism about interest rate cuts ebbed despite bullish comments about the U.S. labor market by Richmond Federal Reserve President Thomas Barkin.

A soft landing is "increasingly conceivable" as the Fed makes "real progress" toward taming inflation without inflicting major damage on the jobs market, Barkin said.

MSCI's broad index of world equities (.MIWD0000PUS) slipped 1.0% to its lowest level in almost two weeks, with the major European bourses down more than 1% and Wall Street indices all lower too. Asia Pacific shares (.MIAPJ0000PUS) outside Japan shed 1.5%.

The market is trying to figure out if a soft landing is possible with the six rate cuts by year-end the futures market is currently pricing in or if that scenario will be painful, said Anthony Saglimbene, chief market strategist at Ameriprise Financial in Troy, Michigan.

Advertisement · Scroll to continue

"Usually when you get that type of aggressive interest rate cuts, it comes with more economic pain," Saglimbene said. "Our view is that the market is probably priced in too many rate cuts for this year."

Caution ticked up ahead of the release of minutes from the Fed's last policy meeting in 2023, due at 2 p.m. ET (1900 GMT), as well as the U.S. unemployment report for December on Friday.

Fed officials in December predicted 75 basis points (bps) of rate cuts this year, driving money market bets for around double that amount and market optimism that prompted a year-end rally in stocks and bonds.

Advertisement · Scroll to continue

"We had that whacking great rally at the end of last year when markets convinced themselves there will be a soft (economic) landing, cooling inflation and a rapid pivot to rate cuts," AJ Bell investment director Russ Mould said.

"But if you get an unexpected hard landing or an inflationary boom, you might get a slightly different script, so I guess people are now pausing for reflection."

Resilience in the U.S. labor market has kept a recession at bay. The government is expected to report on Friday that non-farm payrolls increased by 168,000 jobs in December, according to a Reuters survey of economists, after rising 199,000 in November.

But labor market conditions are gradually easing. U.S. job openings dropped by 62,000 to 8.79 million for the third straight month in November, the Labor Department said on Wednesday.

Market sentiment, meanwhile, also was undermined by souring tensions in the Middle East.

Hamas deputy leader Saleh al-Arouri was killed on Tuesday in an Israeli drone strike in Lebanon's capital Beirut, Lebanese and Palestinian security sources said, raising the risk of war in Gaza spreading well beyond the Palestinian enclave. Israel has neither confirmed nor denied that it killed Arouri.

Source : Reuters

Global stock markets extended a New Year slide on Wednesday and the dollar edged higher as concerns about the chances of a soft landing mounted, while the latest hostilities in the Middle East added to downbeat market sentiment.

The yield on benchmark 10-year Treasury notes briefly climbed above 4% as market optimism about interest rate cuts ebbed despite bullish comments about the U.S. labor market by Richmond Federal Reserve President Thomas Barkin.

A soft landing is "increasingly conceivable" as the Fed makes "real progress" toward taming inflation without inflicting major damage on the jobs market, Barkin said.

MSCI's broad index of world equities (.MIWD0000PUS) slipped 1.0% to its lowest level in almost two weeks, with the major European bourses down more than 1% and Wall Street indices all lower too. Asia Pacific shares (.MIAPJ0000PUS) outside Japan shed 1.5%.

The market is trying to figure out if a soft landing is possible with the six rate cuts by year-end the futures market is currently pricing in or if that scenario will be painful, said Anthony Saglimbene, chief market strategist at Ameriprise Financial in Troy, Michigan.

Advertisement · Scroll to continue

"Usually when you get that type of aggressive interest rate cuts, it comes with more economic pain," Saglimbene said. "Our view is that the market is probably priced in too many rate cuts for this year."

Caution ticked up ahead of the release of minutes from the Fed's last policy meeting in 2023, due at 2 p.m. ET (1900 GMT), as well as the U.S. unemployment report for December on Friday.

Fed officials in December predicted 75 basis points (bps) of rate cuts this year, driving money market bets for around double that amount and market optimism that prompted a year-end rally in stocks and bonds.

Advertisement · Scroll to continue

"We had that whacking great rally at the end of last year when markets convinced themselves there will be a soft (economic) landing, cooling inflation and a rapid pivot to rate cuts," AJ Bell investment director Russ Mould said.

"But if you get an unexpected hard landing or an inflationary boom, you might get a slightly different script, so I guess people are now pausing for reflection."

Resilience in the U.S. labor market has kept a recession at bay. The government is expected to report on Friday that non-farm payrolls increased by 168,000 jobs in December, according to a Reuters survey of economists, after rising 199,000 in November.

But labor market conditions are gradually easing. U.S. job openings dropped by 62,000 to 8.79 million for the third straight month in November, the Labor Department said on Wednesday.

Market sentiment, meanwhile, also was undermined by souring tensions in the Middle East.

Hamas deputy leader Saleh al-Arouri was killed on Tuesday in an Israeli drone strike in Lebanon's capital Beirut, Lebanese and Palestinian security sources said, raising the risk of war in Gaza spreading well beyond the Palestinian enclave. Israel has neither confirmed nor denied that it killed Arouri.

Source : Reuters

- Joined

- Aug 1, 2023

- Runs

- 5,668

I've always found Aswath Damodaran's analysis to be very good. He thinks the US stock market is over valued sitiing that most good news is already priced in. He likes utilities as a sector though.

#AGL Angle PLC

Chart becoming interesting with Golden Cross likely within a month possibly ?

<iframe width="560" height="315" src="

" title="YouTube video player" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share" allowfullscreen></iframe>

Chart becoming interesting with Golden Cross likely within a month possibly ?

<iframe width="560" height="315" src="

good call (for a change heh heh)CRCL Corcel - starting a drilling campaign in Angola, chart on verge of breakout ?

APTA

www.europeanpharmaceuticalreview.com

www.europeanpharmaceuticalreview.com

Will therapeutic agent replace antibodies for bacterial detection?

Aptamers offer a “cutting-edge approach” for identifying gram-negative bacterial pathogens, a paper suggests.

Hello Hello experts on this forum...so which Shares are good to buy now? I must admit, I burnt my hand few times before investing in Equities and stayed away from Share market since. However, intending to try my luck (and patience) again!

I have below 5 Shares in mind:

1. Alphabet (GOOG) - Trading at 149$ now, I expect it to close 2024 with its shares trading around $210. I don't think google's demand will go down anytime in next decade - Youtube isn't going away, people will continue to use Google search, maps, weathers etc etc. However, anyone investing in Google must be for long term and who know by 2035 the stock price maybe around $800.

2. Zoom (ZM) - The world will go more and more virtual and people will continue to use this app for video calls. Currently trading at 64$, I think its a good deal with a huge uprise potential

3. Amazon (AMZN) - Yes, you heard it right...I am talking about Amazon shares in 2024. I think it will remain as biggest e-commerce platform and with cloud computing etc., its shares which are trading at 174$ are still cheap. Like Google, it is a long term share as well.

4. Starbucks (SBUX) - Everyone needs coffee and everyone will go to Starbucks. Its shares trading at 92$ now looks cheap to me. It also gives decent cash dividend if anyone wants to lap in.

Now my 5th and game changing stock. This AI stock has the potential to be next NVIDIA. 10 years ago back in 2014 when we were busy arguing in PP forum about cricket, had we invested 1000$ in NVIDIA stocks which were trading around 14$ then...we all would be rich men now. NVIDIA stocks are now closing 900$ with even more uprise potential.

I am looking for a similar stock which can be next game changer. So I think:

5. Palantir Tech (PLTR) - which is an AI stock has tremendous potential. Considering AI is the future, like internet was 20 years ago, its stock trading around 23$ which is a steal. Lots of investors are jumping into it and if it can be next NVIDIA, it will make many people rich.

I have below 5 Shares in mind:

1. Alphabet (GOOG) - Trading at 149$ now, I expect it to close 2024 with its shares trading around $210. I don't think google's demand will go down anytime in next decade - Youtube isn't going away, people will continue to use Google search, maps, weathers etc etc. However, anyone investing in Google must be for long term and who know by 2035 the stock price maybe around $800.

2. Zoom (ZM) - The world will go more and more virtual and people will continue to use this app for video calls. Currently trading at 64$, I think its a good deal with a huge uprise potential

3. Amazon (AMZN) - Yes, you heard it right...I am talking about Amazon shares in 2024. I think it will remain as biggest e-commerce platform and with cloud computing etc., its shares which are trading at 174$ are still cheap. Like Google, it is a long term share as well.

4. Starbucks (SBUX) - Everyone needs coffee and everyone will go to Starbucks. Its shares trading at 92$ now looks cheap to me. It also gives decent cash dividend if anyone wants to lap in.

Now my 5th and game changing stock. This AI stock has the potential to be next NVIDIA. 10 years ago back in 2014 when we were busy arguing in PP forum about cricket, had we invested 1000$ in NVIDIA stocks which were trading around 14$ then...we all would be rich men now. NVIDIA stocks are now closing 900$ with even more uprise potential.

I am looking for a similar stock which can be next game changer. So I think:

5. Palantir Tech (PLTR) - which is an AI stock has tremendous potential. Considering AI is the future, like internet was 20 years ago, its stock trading around 23$ which is a steal. Lots of investors are jumping into it and if it can be next NVIDIA, it will make many people rich.

Rua Life Sciences PLC - Total Market Solutions

The road to RUA looks ready to rock “…Now might be the time to consider taking a position in a company that may be on the cusp of confirming transformative contracts with major industry players….” Flush with cash after a £4.4m fundraise late last year, heart device specialist RUA Life...

total-market-solutions.com

total-market-solutions.com

shaz619

Test Star

- Joined

- Mar 31, 2010

- Runs

- 39,800

- Post of the Week

- 7

Hello Hello experts on this forum...so which Shares are good to buy now? I must admit, I burnt my hand few times before investing in Equities and stayed away from Share market since. However, intending to try my luck (and patience) again!

I have below 5 Shares in mind:

1. Alphabet (GOOG) - Trading at 149$ now, I expect it to close 2024 with its shares trading around $210. I don't think google's demand will go down anytime in next decade - Youtube isn't going away, people will continue to use Google search, maps, weathers etc etc. However, anyone investing in Google must be for long term and who know by 2035 the stock price maybe around $800.

2. Zoom (ZM) - The world will go more and more virtual and people will continue to use this app for video calls. Currently trading at 64$, I think its a good deal with a huge uprise potential

3. Amazon (AMZN) - Yes, you heard it right...I am talking about Amazon shares in 2024. I think it will remain as biggest e-commerce platform and with cloud computing etc., its shares which are trading at 174$ are still cheap. Like Google, it is a long term share as well.

4. Starbucks (SBUX) - Everyone needs coffee and everyone will go to Starbucks. Its shares trading at 92$ now looks cheap to me. It also gives decent cash dividend if anyone wants to lap in.

Now my 5th and game changing stock. This AI stock has the potential to be next NVIDIA. 10 years ago back in 2014 when we were busy arguing in PP forum about cricket, had we invested 1000$ in NVIDIA stocks which were trading around 14$ then...we all would be rich men now. NVIDIA stocks are now closing 900$ with even more uprise potential.

I am looking for a similar stock which can be next game changer. So I think:

5. Palantir Tech (PLTR) - which is an AI stock has tremendous potential. Considering AI is the future, like internet was 20 years ago, its stock trading around 23$ which is a steal. Lots of investors are jumping into it and if it can be next NVIDIA, it will make many people rich.

1. and 3. are a good buy due to their fundamentals, I always had my best returns with Alphabet and I don’t buy shares lately but I think even now Amazon is undervalued and about 15-20% below its fair value

shaz619

Test Star

- Joined

- Mar 31, 2010

- Runs

- 39,800

- Post of the Week

- 7

I would also look at whoever is making semi-conductor chips, I don’t think the gravy train has departed just yet on this

FearlessRoar

T20I Star

- Joined

- Sep 11, 2023

- Runs

- 30,521

Asia-Pacific stocks plunge as sell-off spreads; Japan down 10%

apan's benchmark Nikkei Stock Average opened lower on Monday and extended losses to 10% on fears of a possible U.S. recession and the yen's strength, marking a third straight day of decline.

The average at one point fell as much as 10%, or 3,595.30 points, from Friday's close to 32,314.40 -- its lowest intraday level since Dec. 8. The broader Tokyo Stock Price Index also shed 10%.

Stocks dropped elsewhere in the Asia-Pacific region. Taiwan's benchmark Taiex dove over 8%, falling past the 20,000 mark at one stage. South Korea's KOSPI was down by over 7%, and Singapore's Straits Times Index and Australia's All Ordinaries both skidded more than 3%.

Foreign investors are selling Japanese stocks due to concerns that the U.S. may be heading for a recession, said Naka Matsuzawa, chief strategist at Nomura Securities. "The fall is not really happening due to Japan-specific reasons," he said. "Markets are still trying to find the bottom."

He said he is taking a "wait-and-see approach until U.S. tech stocks show some kind of resilience." He does not foresee a global recession, and said markets will be volatile until the U.S. Federal Reserve lowers rates. Investors are pricing in a cut by September.

Japanese financial stocks were hammered on Monday, as it has become "almost impossible" for the Bank of Japan to raise rates under current circumstances, he said.

Japanese megabanks plummeted, with Mizuho Financial Group down by 15%, Mitsubishi UFJ Financial Group by 16%, Resona Holdings by 15% and Sumitomo Mitsui Financial Group by 14%. Mizuho Financial Group slid 14.15%.

Regional banks were no exception. Chiba Bank declined by 19% and Fukuoka Financial Group by 15%. Brokerage giant Nomura Holdings was off 16%, and Shizuoka Financial Group lost 12.54%

Exporters were hit by the stronger yen, with Toyota down 10%.

Trading of Nikkei 225 futures and Topix futures was halted temporarily at Osaka Securities Exchange, the Japanese bourse for derivatives trading, on Monday, as a circuit breaker was triggered. Circuit breakers are usually applied in order to allow investors to calm down when the market is overly volatile.

The yen strengthened to the 142 level to the dollar Monday morning, a seven-month high. It had appreciated to the mid-146 level from the higher end of the 148 level in New York trading Friday. That came after a weaker-than-expected July U.S. jobs report stoked recession worries and raised questions about whether the Federal Reserve should have cut rates at its July meeting.

The yen's appreciation is one reason behind the selloff, said Zuhair Khan, senior fund manager at UBP Investments. "Excessive yen weakness is going to unwind pretty quickly," he said.

He said Japanese stocks were trading at fair value before the fall but that they had risen "quite rapidly on a lot of hot money flowing in, including those from China."

The drop in stocks has created a buying opportunity for Japanese institutions and pension funds, he said.

Stocks have been on a downward spiral since Thursday, a day after the Bank of Japan aggressively raised rates to 0.25% from 0.1% and said it was open to more hikes this year.

The Nikkei average shed 3.5% on Thursday. The following day the index lost 5.8%, or 2,216.63 points, its worst daily sell-off since the Black Monday crash of October 1987.

Japan stocks dive 4,451 points, more than Black Monday in 1987

Yen surges to 142 per dollar as potential U.S. recession spooks investors

FearlessRoar

T20I Star

- Joined

- Sep 11, 2023

- Runs

- 30,521

TSMC Leads Taiwan Slump, as Index Suffers Worst Day in 57 Years

Taiwan’s benchmark stock index plunged by a record, as the tech-heavy gauge took the brunt of a selloff triggered by fear of a deeper US economic slowdown.

The Taiex gauge ended 8.4% lower in Taipei, marking its worst selloff since 1967. The decline was led by AI-chipmaker Taiwan Semiconductor Manufacturing Co., which plunged by 9.8%.

The price action underscores how quickly sentiment has pivoted from the potential of artificial intelligence to focusing on the risks of a US recession and disappointing earnings outlooks from companies including Intel Corp. TSMC accounts for more than than 30% of the Taiex gauge.

The Finance Ministry, which is responsible for the operation of financial stabilization funds, said it will closely monitor development in both domestic and overseas markets.

TSMC Drags Down Taiwan as Index Suffers Worst Day in 57 Years

(Bloomberg) -- Taiwan’s benchmark stock index plunged by a record, as tech-heavy gauges in Asia took the brunt of a selloff triggered by fear of a deeper US economic slowdown.Most Read from BloombergSinger Akon’s Multibillion-Dollar Futuristic City in Africa Gets Final NoticeWhat a Beautiful Bus...

I started investing in stocks a few weeks after the Middle East war broke out. Basically cherrypicked the SP500 and created a portfolio on T212 which includes:Hello Hello experts on this forum...so which Shares are good to buy now? I must admit, I burnt my hand few times before investing in Equities and stayed away from Share market since. However, intending to try my luck (and patience) again!

I have below 5 Shares in mind:

1. Alphabet (GOOG) - Trading at 149$ now, I expect it to close 2024 with its shares trading around $210. I don't think google's demand will go down anytime in next decade - Youtube isn't going away, people will continue to use Google search, maps, weathers etc etc. However, anyone investing in Google must be for long term and who know by 2035 the stock price maybe around $800.

2. Zoom (ZM) - The world will go more and more virtual and people will continue to use this app for video calls. Currently trading at 64$, I think its a good deal with a huge uprise potential

3. Amazon (AMZN) - Yes, you heard it right...I am talking about Amazon shares in 2024. I think it will remain as biggest e-commerce platform and with cloud computing etc., its shares which are trading at 174$ are still cheap. Like Google, it is a long term share as well.

4. Starbucks (SBUX) - Everyone needs coffee and everyone will go to Starbucks. Its shares trading at 92$ now looks cheap to me. It also gives decent cash dividend if anyone wants to lap in.

Now my 5th and game changing stock. This AI stock has the potential to be next NVIDIA. 10 years ago back in 2014 when we were busy arguing in PP forum about cricket, had we invested 1000$ in NVIDIA stocks which were trading around 14$ then...we all would be rich men now. NVIDIA stocks are now closing 900$ with even more uprise potential.

I am looking for a similar stock which can be next game changer. So I think:

5. Palantir Tech (PLTR) - which is an AI stock has tremendous potential. Considering AI is the future, like internet was 20 years ago, its stock trading around 23$ which is a steal. Lots of investors are jumping into it and if it can be next NVIDIA, it will make many people rich.

- An ETF which contains most of the Tech companies in the SP500. Doesn't include Google or Meta so added these separately.

- Consumer retailers like Amazon, Costco, Lowes, Home Depot, Walmart, TJX etc.

- Some healthcare/pharmaceuticals including Eli Lily, Novo Nordisk, McKesson etc.

Also started a few months ago in gold. Can't profess to be an expert at any of this but decent returns so far. Better than simply having money sitting idle in bank. Wish I started during COVID though.

Bewal Express

T20I Captain

- Joined

- Nov 6, 2005

- Runs

- 41,495

Bar my dalliance with Crypto and ICP i have generally done OK. My advice is stay away from Tesla-Highly over valued.I started investing in stocks a few weeks after the Middle East war broke out. Basically cherrypicked the SP500 and created a portfolio on T212 which includes:

- An ETF which contains most of the Tech companies in the SP500. Doesn't include Google or Meta so added these separately.

- Consumer retailers like Amazon, Costco, Lowes, Home Depot, Walmart, TJX etc.

- Some healthcare/pharmaceuticals including Eli Lily, Novo Nordisk, McKesson etc.

Also started a few months ago in gold. Can't profess to be an expert at any of this but decent returns so far. Better than simply having money sitting idle in bank. Wish I started during COVID though.

- Joined

- Aug 12, 2023

- Runs

- 24,294

Dow futures tumble 1,000 points on fear Trump’s tariffs will spark trade war

U.S. stock futures cratered as President Donald Trump unveiled sweeping tariffs of at least 10%, with even higher rates for some countries, increasing the risk of a global trade war that could further weaken the already sputtering U.S. economy.

Futures tied to the Dow Jones Industrial Average lost 1,007 points, or 2.3%, while S&P 500 futures dropped 3.4%. Nasdaq-100 futures fell 4.2%.

Shares of multinational companies tumbled in extended trading, with Nike and Apple each dropping about 7%. Companies heavily reliant on imported goods saw significant losses—Five Below plunged 15%, Dollar Tree tumbled 11%, and Gap dropped 8.5%. Tech stocks also declined in the overall risk-off environment, as Nvidia fell 4.5% and Tesla lost 6%.

The White House announced a baseline tariff rate of 10% on all countries, set to take effect on April 5. Additional, higher duties will be imposed on countries that levy higher rates on U.S. goods, with further details to follow in the coming days, according to the administration.

U.S. stock futures cratered as President Donald Trump unveiled sweeping tariffs of at least 10%, with even higher rates for some countries, increasing the risk of a global trade war that could further weaken the already sputtering U.S. economy.

Futures tied to the Dow Jones Industrial Average lost 1,007 points, or 2.3%, while S&P 500 futures dropped 3.4%. Nasdaq-100 futures fell 4.2%.

Shares of multinational companies tumbled in extended trading, with Nike and Apple each dropping about 7%. Companies heavily reliant on imported goods saw significant losses—Five Below plunged 15%, Dollar Tree tumbled 11%, and Gap dropped 8.5%. Tech stocks also declined in the overall risk-off environment, as Nvidia fell 4.5% and Tesla lost 6%.

The White House announced a baseline tariff rate of 10% on all countries, set to take effect on April 5. Additional, higher duties will be imposed on countries that levy higher rates on U.S. goods, with further details to follow in the coming days, according to the administration.

Bhaijaan

Hall of Famer

- Joined

- Jan 10, 2011

- Runs

- 72,183

- Post of the Week

- 1

Kianig89

ODI Star

- Joined

- Oct 30, 2012

- Runs

- 34,154

Long term wealth creation it is needs patience and preservance, however with growing inflation and other factors is the wait worthwhile and ain't real estate a better option ,

Long term wealth creation it is needs patience and preservance, however with growing inflation and other factors is the wait worthwhile and ain't real estate a better option ,

Long term is a myth...its all about timing. I am holding ITV shares for last 12 years when it used to be on FTSE 100. Still on loss

Bhaijaan

Hall of Famer

- Joined

- Jan 10, 2011

- Runs

- 72,183

- Post of the Week

- 1

Sensex down 3000 points today amid US tariffs and resulting global panic

Hitman

Senior T20I Player

- Joined

- Feb 25, 2013

- Runs

- 19,317

Equity has historically given better returns than real estate, at least in my country.Long term wealth creation it is needs patience and preservance, however with growing inflation and other factors is the wait worthwhile and ain't real estate a better option ,

Hitman

Senior T20I Player

- Joined

- Feb 25, 2013

- Runs

- 19,317

Long term is a myth...its all about timing. I am holding ITV shares for last 12 years when it used to be on FTSE 100. Still on loss

Not every stock is going to give satisfactory results even if you hold it for long term. That's why I'm more inclined into mutual funds.

Bhaag Viru Bhaag

T20I Star

- Joined

- Aug 20, 2013

- Runs

- 32,425

You are absolutely right here. The long-term game is over for now. It is all about booking profits and buying again at lower levels. Those who missed the chance to book gains during the election rally are already banging their heads against the wall. And those who don't start accumulating now will be doing the same later.Long term is a myth...its all about timing. I am holding ITV shares for last 12 years when it used to be on FTSE 100. Still on loss

Bhaag Viru Bhaag

T20I Star

- Joined

- Aug 20, 2013

- Runs

- 32,425

Lo ji recession aa gaya.....Nikkei and Sensex opened very low with more bloodbath to follow once Europe and later America opens.

My pension pot is screwed

Well done brother Trump

Bhaijaan

Hall of Famer

- Joined

- Jan 10, 2011

- Runs

- 72,183

- Post of the Week

- 1

Lo ji recession aa gaya.....Nikkei and Sensex opened very low with more bloodbath to follow once Europe and later America opens.

My pension pot is screwed

Well done brother Trump

We will consider it a learn

Bhaijaan

Hall of Famer

- Joined

- Jan 10, 2011

- Runs

- 72,183

- Post of the Week

- 1

You are absolutely right here. The long-term game is over for now. It is all about booking profits and buying again at lower levels. Those who missed the chance to book gains during the election rally are already banging their heads against the wall. And those who don't start accumulating now will be doing the same later.

In the long run we are all dead.

We will consider it a learn

Basically what you are saying, Ya win hai..Ya L(ear)un hai?

Bhaijaan

Hall of Famer

- Joined

- Jan 10, 2011

- Runs

- 72,183

- Post of the Week

- 1

Bhaijaan

Hall of Famer

- Joined

- Jan 10, 2011

- Runs

- 72,183

- Post of the Week

- 1

sweep_shot

Hall of Famer

- Joined

- Mar 30, 2016

- Runs

- 59,728

Anyone into penny stocks?

I have recently been interested in penny stocks. Trying to learn more before I jump in.

I have recently been interested in penny stocks. Trying to learn more before I jump in.

- Joined

- Sep 4, 2015

- Runs

- 3,123

- Post of the Week

- 2

Yes, AAPL because it will reboundAll Share market experts here, it is good time to buy AAPL and NVIDIA?

Its at $177.79 and will drop further on Wednesday (April 09, 2025)

Bhaijaan

Hall of Famer

- Joined

- Jan 10, 2011

- Runs

- 72,183

- Post of the Week

- 1

One by one they will all fold

Bhaag Viru Bhaag

T20I Star

- Joined

- Aug 20, 2013

- Runs

- 32,425

Indian markets have recovered from yesterday's low.

- Joined

- Sep 4, 2015

- Runs

- 3,123

- Post of the Week

- 2

Apple is at $205 right now so whoever saw this post would have made a whopping $28 per shareYes, AAPL because it will rebound

Its at $177.79 and will drop further on Wednesday (April 09, 2025)

Bewal Express

T20I Captain

- Joined

- Nov 6, 2005

- Runs

- 41,495

Some serious manipulation going on with Tesla. Up 10% one day and down 10% the next day and still heavily over valuedApple is at $205 right now so whoever saw this post would have made a whopping $28 per share

shaz619

Test Star

- Joined

- Mar 31, 2010

- Runs

- 39,800

- Post of the Week

- 7

All Share market experts here, it is good time to buy AAPL and NVIDIA?

I bought both, had small positions in them. NVIDIA has been undervalued for a long time and was the best purchase pre-tariffs imo Out of all the shares I bought, it is doing the best.

However, I also bought the ETF EQQ which is tech heavy and that has outperformed everything.

I didn’t have the money at the time and might have invested more, but at the same time I am glad that I am mostly holding cash at the minute.

Not sure we’ve seen the full impact off the tariffs yet, and perhaps it’s not the best strategy but I am more of a lump sum investor opposed to DCA’ing, I am back in this sphere now after a while, didn’t have the opportunity since the COVID period.

I also have positions in JNJ & BMY, the latter especially is not doing so well and need to do research into whether it’s still a good bet, I liked these for health exposure and kept them as an insurance policy.

- Joined

- Nov 25, 2023

- Runs

- 24,477

Gold these days is much more profitable than any shares

shaz619

Test Star

- Joined

- Mar 31, 2010

- Runs

- 39,800

- Post of the Week

- 7

Gold these days is much more profitable than any shares

In uncertain times it’s good to keep a part of any portfolio, although it depends on your age and level of risk you’re comfortable with.

Bhaijaan

Hall of Famer

- Joined

- Jan 10, 2011

- Runs

- 72,183

- Post of the Week

- 1

Gold these days is much more profitable than any shares

I love my mom.

90% for being my mom, 10% for holding our meagre household gold reserves lol.

Bhaijaan

Hall of Famer

- Joined

- Jan 10, 2011

- Runs

- 72,183

- Post of the Week

- 1

Sensed makes a 3.74% rally in a single day. After long time such an upward trend seen.

Kianig89

ODI Star

- Joined

- Oct 30, 2012

- Runs

- 34,154

Sensed makes a 3.74% rally in a single day. After long time such an upward trend seen.

Similar threads

- Replies

- 23

- Views

- 1K

- Replies

- 98

- Views

- 3K

- Replies

- 1

- Views

- 185

- Replies

- 2

- Views

- 180

- Replies

- 33

- Views

- 458