Mamoon

ATG

- Joined

- Sep 3, 2012

- Runs

- 108,086

- Post of the Week

- 12

Mods - merge this thread if required, but I couldn't find a relevant one.

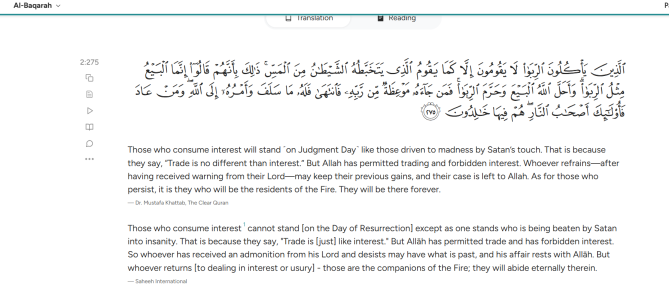

I've been pondering about this for quite some time. I have a savings account but I am considering moving my savings to a current (interest free) account because almost all Islamic scholars are unanimous in their belief that savings account interest is haraam.

Does any have an alternative opinion on this? If no, how do you manage your savings?

I don't have a strong opinion on this because I don't have enough evidence to counter this belief, but I do have the following reservations that are open to scrutiny:

Firstly, the modern banking model is completely different from the core reasons for why interest was banned in Islam at the time of the Prophet. Interest back then was banned because it was taking advantage of, or exploiting a person in need. Someone needy is asking you to lend them 50k and you do so with the promise that you will charge 70k a year later. That person will most likely accept the deal if he is in a desperate situation today.

However, this clearly doesn't translate to modern savings accounts in commercial banks. They are financial institutions that are using your savings to make money and giving you a share of the profit.

Secondly, how do you safeguard yourself from currency devaluation if you are depositing your savings in an interest-free account. The money suspending in your account is losing value rapidly, much more rapidly than money lost value 1,400 years ago.

However, my conviction in my counter-argument is not strong enough for me to continue using a Savings account, but if anyone has any strong thoughts on why modern banking system cannot be considered haraam in the Islamic essence of interest, I would love to hear more about it.

There is also a school of thought that argues that interested earned on Savings account can be utilized for zakaat/charity, although the counter to this is that since the interest money does not belong to you, any zakaat/charity made on that money will not be accepted.

I've been pondering about this for quite some time. I have a savings account but I am considering moving my savings to a current (interest free) account because almost all Islamic scholars are unanimous in their belief that savings account interest is haraam.

Does any have an alternative opinion on this? If no, how do you manage your savings?

I don't have a strong opinion on this because I don't have enough evidence to counter this belief, but I do have the following reservations that are open to scrutiny:

Firstly, the modern banking model is completely different from the core reasons for why interest was banned in Islam at the time of the Prophet. Interest back then was banned because it was taking advantage of, or exploiting a person in need. Someone needy is asking you to lend them 50k and you do so with the promise that you will charge 70k a year later. That person will most likely accept the deal if he is in a desperate situation today.

However, this clearly doesn't translate to modern savings accounts in commercial banks. They are financial institutions that are using your savings to make money and giving you a share of the profit.

Secondly, how do you safeguard yourself from currency devaluation if you are depositing your savings in an interest-free account. The money suspending in your account is losing value rapidly, much more rapidly than money lost value 1,400 years ago.

However, my conviction in my counter-argument is not strong enough for me to continue using a Savings account, but if anyone has any strong thoughts on why modern banking system cannot be considered haraam in the Islamic essence of interest, I would love to hear more about it.

There is also a school of thought that argues that interested earned on Savings account can be utilized for zakaat/charity, although the counter to this is that since the interest money does not belong to you, any zakaat/charity made on that money will not be accepted.