jaspa888

Local Club Star

- Joined

- Aug 1, 2007

- Runs

- 2,010

In the NW there are 2-3 bed houses available for <£100k, for these do you still tend to get a mortgage out or look to save for a while & buy cash; what is the better option, I guess for less experienced folk maybe cash is better to avoid the curve balls during the day to day running stuff.

Also, a big chunk of these houses are on very long leases, does that bother you, being in the city I found it odd but it seems to be the norm up there, you know the average asian terraced street close to town

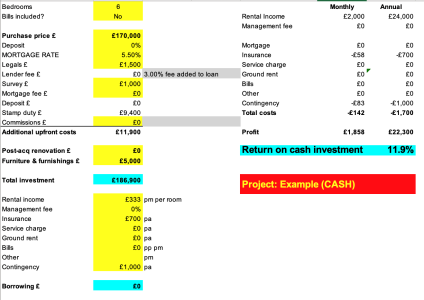

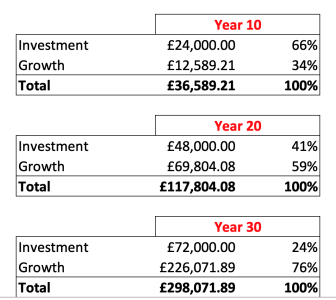

The only time I buy for 100% cash is when getting something in an auction, where the purchase price is substantially below open market value. These properties are usually unmortgageable anyway. And putting down only 20% deposit also allows you to buy multiple properties with your cash via mortgages. The % return on cash investment is also better when buying via a mortgage - my main metric.

90% of the properties in the NW are leasehold, with peppercorn (i.e. negligible) ground rent and long, long leases. This is not an issue at all with lenders. The only problem you get is with new build flats with doubling ground rent and lease length < 85 years. I avoid these at all costs.