-

Contact the PP Team

Connect with us

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying shares?

- Thread starter DeadlyVenom

- Start date

http://www.bbc.co.uk/news/business-43285885

Fancy charging up your electric car in 10 minutes?

By Matthew Wall

Technology of Business editor

Fancy charging up your electric car in 10 minutes?

By Matthew Wall

Technology of Business editor

CPX Interim Results out

As we've come to expect still 'jam tomorrow'. I think the good sign is the royalty income growth and eventually would expect this to be rated very highly so I think stock underpinned at around 10p with little account for the potential upside optionality

https://www.investegate.co.uk/cap-xx-limited--cpx-/rns/interim-results/201803060700057661G/

Looks like, a bit longer to wait...

Personally will see it out, it has to come good at some point...

SALV chart

Up on serious volume. Maybe delayed reaction to last week's news update

Mr.Q

Tape Ball Star

- Joined

- Dec 2, 2017

- Runs

- 948

- Post of the Week

- 1

DOW drops 724 points. What is their president doing

Looks like we’re going to see a trade war.

Looks like we’re going to see a trade war.

PYC

There are two outstanding pieces of news due

1) Result of next round funding application from Government / Innovate UK (deadline was circa Feb 8th and typically preliminary indications have been received 2 months later with definitive award 4 months later)

2) In the October 2nd 2017 RNS they said they were in talks with 6 larger service providers and expected to do a deal with one within 6 months so they are due to update on that

They will also be attending two major conferences this April. AACR in the US where the 'great and good' meet and Biotrinity a UK investment partnering event.

Chart suggests a conclusion to this wedge formation imminent

There are two outstanding pieces of news due

1) Result of next round funding application from Government / Innovate UK (deadline was circa Feb 8th and typically preliminary indications have been received 2 months later with definitive award 4 months later)

2) In the October 2nd 2017 RNS they said they were in talks with 6 larger service providers and expected to do a deal with one within 6 months so they are due to update on that

They will also be attending two major conferences this April. AACR in the US where the 'great and good' meet and Biotrinity a UK investment partnering event.

Chart suggests a conclusion to this wedge formation imminent

CPX

https://www.investegate.co.uk/cap-x...rismatic-supercapacitors/201804110700054788K/

CAP-XX (LSE:CPX), a leader in supercapacitors that deliver peak power to support or replace batteries, today announces that it has developed the industry's first 3 Volt (3V) thin, prismatic supercapacitor.

Anthony Kongats, CAP-XX's Chief Executive Officer, will cover the new 3V developments in a paper that he is presenting titled "Using thin prismatic supercapacitors to support 3V coin cell batteries", on 12th April 2018 at the IDTechEx conference in Berlin. It is anticipated that CAP-XX's 3V supercapacitors will complete production trials shortly, with samples expected to be available to customers in August 2018, and commercial production potentially commencing in Q2 2019.

https://www.investegate.co.uk/cap-x...rismatic-supercapacitors/201804110700054788K/

CAP-XX (LSE:CPX), a leader in supercapacitors that deliver peak power to support or replace batteries, today announces that it has developed the industry's first 3 Volt (3V) thin, prismatic supercapacitor.

Anthony Kongats, CAP-XX's Chief Executive Officer, will cover the new 3V developments in a paper that he is presenting titled "Using thin prismatic supercapacitors to support 3V coin cell batteries", on 12th April 2018 at the IDTechEx conference in Berlin. It is anticipated that CAP-XX's 3V supercapacitors will complete production trials shortly, with samples expected to be available to customers in August 2018, and commercial production potentially commencing in Q2 2019.

AXM

https://www.investegate.co.uk/alexa...-at-the-uk-investor-show/201804110700054981K/

Presentation at the UK Investor Show on 21 April

https://www.investegate.co.uk/alexa...-at-the-uk-investor-show/201804110700054981K/

Presentation at the UK Investor Show on 21 April

CPX

https://www.investegate.co.uk/cap-x...rismatic-supercapacitors/201804110700054788K/

CAP-XX (LSE:CPX), a leader in supercapacitors that deliver peak power to support or replace batteries, today announces that it has developed the industry's first 3 Volt (3V) thin, prismatic supercapacitor.

Anthony Kongats, CAP-XX's Chief Executive Officer, will cover the new 3V developments in a paper that he is presenting titled "Using thin prismatic supercapacitors to support 3V coin cell batteries", on 12th April 2018 at the IDTechEx conference in Berlin. It is anticipated that CAP-XX's 3V supercapacitors will complete production trials shortly, with samples expected to be available to customers in August 2018, and commercial production potentially commencing in Q2 2019.

Good rise today.

But potential is huge

Yes CPX always have these moves in the locker.

Big ones still to come though will be big name partners.

Potential huge but timescales are long when you are trying to be a 99.999% reliable supplier to Tier 1 Auto OEMs who have massive reputations to protect

Big ones still to come though will be big name partners.

Potential huge but timescales are long when you are trying to be a 99.999% reliable supplier to Tier 1 Auto OEMs who have massive reputations to protect

PYC

Bollinger Bands really tightening right now

News has been promised on a number of fronts which could be useful catalysts

this chart has looked ready to break out for a while

they presented a very interesting abstract at AACR (came off embargo over the weekend)

PYC to present at Biotrinity Launchpad 24th April 2018

http://www.physiomics-plc.com/physiomics-to-present-at-biotrinity-2018/

http://www.physiomics-plc.com/physiomics-to-present-at-biotrinity-2018/

PYC to present at Biotrinity Launchpad 24th April 2018

http://www.physiomics-plc.com/physiomics-to-present-at-biotrinity-2018/

Nice rise today, before the tomorrows presentation.

Syed1

ODI Captain

- Joined

- Jan 22, 2015

- Runs

- 46,152

- Post of the Week

- 3

PYC

<iframe width="560" height="315" src="https://www.youtube.com/embed/R-V0cD7-4JY" frameborder="0" allow="autoplay; encrypted-media" allowfullscreen></iframe>

For someone who has finally paid off student loans and car loan and built up a little bit of saving, where would you recommend they invest? Its not a huge sum of money, around 30-40k, which I want to grow at a moderate but consistent rate with lesser chance of losing it all. I intend to keep it in my investment for 3-5 years at which point I'll take it out for a down-payment for a house.

Folks tell me go into mutual funds but all of those offered really small growth. I also work fulltime and do not have the time or capacity to follow individual companies, their earnings and performance etc.

#AOR chart looking well poised with catalysts due

Not the news expected

ARCM - Director Buy at £3.10 per share

Confident shown there

https://www.investegate.co.uk/arc-m...-/rns/directors--dealing/201805230700119440O/

Confident shown there

https://www.investegate.co.uk/arc-m...-/rns/directors--dealing/201805230700119440O/

ARCM - Director Buy at £3.10 per share

Confident shown there

https://www.investegate.co.uk/arc-m...-/rns/directors--dealing/201805230700119440O/

Nice rise today, finished with massive buy at COP

For someone who has finally paid off student loans and car loan and built up a little bit of saving, where would you recommend they invest? Its not a huge sum of money, around 30-40k, which I want to grow at a moderate but consistent rate with lesser chance of losing it all. I intend to keep it in my investment for 3-5 years at which point I'll take it out for a down-payment for a house.

Folks tell me go into mutual funds but all of those offered really small growth. I also work fulltime and do not have the time or capacity to follow individual companies, their earnings and performance etc.

Not sure where exactly you are located, I'm assuming in the NA region? but I would suggest going with 80% index fund and 20% risk stock (bitcoin, small/mid cap tech/biotech stock). Here's an example of one index fund I am vested in, last year's returns was something like 30%.

Problem with this thread is that it is mainly focused on the UK market.... someone needs to start a separate thread for NA market, would love to see some ideas for trading in the US market.

Last edited:

AOR similar, albeit not had the same volume to clear placing overhang. However expect AOR placees to be more sticky and long term supporters of what is a great story.

AOR GM today to approve the Placing and Open Offer

The Stigologist 7 Jun '18 - 11:30 - 4585 of 4597

I think as stated above the settlement for placing stock was today so any selling to fund uptake will have dissipated. Normal technical pressure from the mechanics of an offer such as this. Should go stronger especially if people who wanted more get scaled back.

With £60m historic investment and £2.5m in the bank you'd think this should be worth £62.5m minimum. add in the superstars/rock stars/legends who've joined the Board this becomes a real option on success in multibillion potential markets.

Using £62.5m as a starting point with 14.7m shares in issue I really think this should be valued at c. 425p right now

30-40p is plain wrong by a/several multiples

I would hope to see some research from Stockdale help the secondary market cotton on this fact in coming weeks

landy90 7 Jun '18 - 11:42 - 4586 of 4597

Good post Stig, take up of open offer should also be interesting, if oversubscribed there will be unmet demand.

Mr.Q

Tape Ball Star

- Joined

- Dec 2, 2017

- Runs

- 948

- Post of the Week

- 1

This thread should be more active. Nobody is sharing their strategy or anything interesting. TA charts with MA and Volume bars alone wont attract many.

Monsoon has arrived in India. The forecast seems to be good. Foreign investors have been pumping in 1000s of crores into the Indian market due to this and the falling oil prices. ₹ falling could be another reason.

Fertiliser companies and other agriculture related companies are likely to run. Tyre companies are likely to run as sales volume increase is expected during rainy season. Companies manufacturing trucks and tractors should be watched too. Pharma stocks will be in demand as well because rainy season means more potential to sell medicines. You can use similar strategies to find seasonal stocks in most economies.

Monsoon has arrived in India. The forecast seems to be good. Foreign investors have been pumping in 1000s of crores into the Indian market due to this and the falling oil prices. ₹ falling could be another reason.

Fertiliser companies and other agriculture related companies are likely to run. Tyre companies are likely to run as sales volume increase is expected during rainy season. Companies manufacturing trucks and tractors should be watched too. Pharma stocks will be in demand as well because rainy season means more potential to sell medicines. You can use similar strategies to find seasonal stocks in most economies.

Mr.Q

Tape Ball Star

- Joined

- Dec 2, 2017

- Runs

- 948

- Post of the Week

- 1

I would not expect thread to be active right now.

Old adage : Sell in May and Go Away, Come again Saint Legers Day

One should be able to ride the trend in both directions man

This thread should be more active. Nobody is sharing their strategy or anything interesting. TA charts with MA and Volume bars alone wont attract many.

Monsoon has arrived in India. The forecast seems to be good. Foreign investors have been pumping in 1000s of crores into the Indian market due to this and the falling oil prices. ₹ falling could be another reason.

Fertiliser companies and other agriculture related companies are likely to run. Tyre companies are likely to run as sales volume increase is expected during rainy season. Companies manufacturing trucks and tractors should be watched too. Pharma stocks will be in demand as well because rainy season means more potential to sell medicines. You can use similar strategies to find seasonal stocks in most economies.

Just to address a few things here.

Seasonality is a Known Known. It is predictable and can be discounted ahead of time by the market.

Markets/stocks tend to move on UNdiscounted information i.e. known unknowns or unknown unknowns

Likely to have more impact on a market is the (known unknown) Economic or Business cycle. Even this is a predictable to some extent so can be partially discounted, although cycles tend to be more variable (amplitude/length etc) than seasonality.

What is far more dramatic is shocks such as exogenous events and policy mis-steps. With someone like Trump in charge of the US and Brexit occurring in EU there is huge capacity right now for unknown unknown shocks to hit the system. That is why I'm trying to steer clear of economically sensitive sectors like Industrial/Basic commodities e.g. copper, iron ore, oil etc

I'd prefer right now to focus on Special Situations, Secular Small Cap Growth stories and some insurance in form of highly (operationally) geared gold plays

Mr.Q

Tape Ball Star

- Joined

- Dec 2, 2017

- Runs

- 948

- Post of the Week

- 1

Just to address a few things here.

Seasonality is a Known Known. It is predictable and can be discounted ahead of time by the market.

Markets/stocks tend to move on UNdiscounted information i.e. known unknowns or unknown unknowns

Likely to have more impact on a market is the (known unknown) Economic or Business cycle. Even this is a predictable to some extent so can be partially discounted, although cycles tend to be more variable (amplitude/length etc) than seasonality.

What is far more dramatic is shocks such as exogenous events and policy mis-steps. With someone like Trump in charge of the US and Brexit occurring in EU there is huge capacity right now for unknown unknown shocks to hit the system. That is why I'm trying to steer clear of economically sensitive sectors like Industrial/Basic commodities e.g. copper, iron ore, oil etc

I'd prefer right now to focus on Special Situations, Secular Small Cap Growth stories and some insurance in form of highly (operationally) geared gold plays

In fully developed economies where the output is very consistent, it might not be a huge factor. But in developing economies it’s still very dependent on the forecast. In India, a lot of stocks run based on the monsoon/rain forecast as the agricultural output is very much dependent on it. This also has an impact on the purchasing power of the poor farmers who depend on it.

But like you said, certain things can be predicted like clothing companies doing well in winter, clothing, auto, sugar & liquor stocks doing well during festive season etc But even then there’s increased market participation during that period which gives the early movers an advantage.

I’ve stopped keeping overnight positions in derivatives because of Trump

. But I have to admit he’s a good president if you look at it from the American perspective. His policies will have long term positive effects on their economy.

. But I have to admit he’s a good president if you look at it from the American perspective. His policies will have long term positive effects on their economy.AOR AorTech

Stockdale have issued a big 20 page note on AorTech with a Price Target (12 month) of 400p

Versus current price of 40p !

Well worth signing up to the free trial available here to read the report :-

https://www.research-tree.com/

Stockdale have issued a big 20 page note on AorTech with a Price Target (12 month) of 400p

Versus current price of 40p !

Well worth signing up to the free trial available here to read the report :-

https://www.research-tree.com/

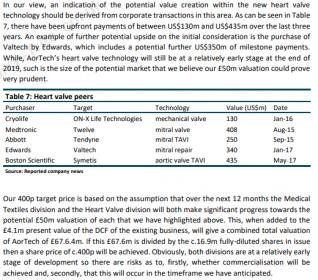

The Research Note on AorTech is very comprehensive and I would suggest very conservative.

For example it only focuses on the two major new potential growth platforms (grafts and heart valves), it does not include anything in its forecasts for the extension of current business with Biomerics and current IP into Breast Implant market.

e.g.

On Biomerics :-

"Biomerics is motivated to grow its polymer business and AorTech will benefit

from this growth, although we have not factored any upside in our projections"

On Breast Implants :-

"A leading device manufacturer is investigating using AorTech’s technology for its next generation products.

Development plan

AorTech is in the early stages of an investigatory programme with a breast implant business that has identified the opportunity to develop new technology to drive its business in the future.

Opportunities for Aortech

This project requires little investment by AorTech but, if successful, would result in either a very attractive licence and royalty income or a JV opportunity to disrupt current technologies and supply chains. Not assumed in our projections, but as an indication of the potential value is that a 5% royalty on a 5% global market share would generate an income stream of £2.5m per annum to AorTech."

For example it only focuses on the two major new potential growth platforms (grafts and heart valves), it does not include anything in its forecasts for the extension of current business with Biomerics and current IP into Breast Implant market.

e.g.

On Biomerics :-

"Biomerics is motivated to grow its polymer business and AorTech will benefit

from this growth, although we have not factored any upside in our projections"

On Breast Implants :-

"A leading device manufacturer is investigating using AorTech’s technology for its next generation products.

Development plan

AorTech is in the early stages of an investigatory programme with a breast implant business that has identified the opportunity to develop new technology to drive its business in the future.

Opportunities for Aortech

This project requires little investment by AorTech but, if successful, would result in either a very attractive licence and royalty income or a JV opportunity to disrupt current technologies and supply chains. Not assumed in our projections, but as an indication of the potential value is that a 5% royalty on a 5% global market share would generate an income stream of £2.5m per annum to AorTech."

AssassinatedDevil

Local Club Star

- Joined

- Nov 6, 2017

- Runs

- 2,035

- Post of the Week

- 1

Recently bought VKTX and sold it for a very good profit. Currently own CNAT and CLPS. Hoping they shoot up soon.

Nice update from CPX

Further news to follow as stated in the RNS

“The Company expects to announce further progress in these respects shortly.”

On first read I thought oh dear sounds like a profit warning coming... but looks like people focusing on the bullish and promotional top line growth rather than the poor bottom line... so far

AssassinatedDevil

Local Club Star

- Joined

- Nov 6, 2017

- Runs

- 2,035

- Post of the Week

- 1

Pharmaceutical stocks is where it's at these days imo. Move over tech stocks, you had your turn.

Syed1

ODI Captain

- Joined

- Jan 22, 2015

- Runs

- 46,152

- Post of the Week

- 3

Invested a good chunk of change in Netflix and had a cool 30% growth in just 2 months

AssassinatedDevil

Local Club Star

- Joined

- Nov 6, 2017

- Runs

- 2,035

- Post of the Week

- 1

Invested a good chunk of change in Netflix and had a cool 30% growth in just 2 months

I'm a bit envious of people who invested in it when the stock price was still around 200. Crazy exponential growth over the past 6 months.

AOR similar, albeit not had the same volume to clear placing overhang. However expect AOR placees to be more sticky and long term supporters of what is a great story.

AOR top of the leader board today after news on a new US Patent for its bio-material which could revolutionise heart valve technology

Potential here is incredible with Brokers positing a '400p conservative target price'

Chart looks to be breaking out on volume so has a lot of fundamental, news and technical catalysts right now

AssassinatedDevil

Local Club Star

- Joined

- Nov 6, 2017

- Runs

- 2,035

- Post of the Week

- 1

Curious to know if any posters here have bought shares in big tech companies like Apple and Google etc.

AXM someone attended the AGM yesterday

temelco 28 Jun '18 - 12:47 - 4146 of 4152

What an AGM!

There’s only one word for the AGM today – WOW!

Most AGMs are dull and uninformative, this one was anything but!

Martin Rosser gave a very good presentation on all the current initiatives, but also said they were very busy with other things, which they could not mention as they had not made any announcement. There would, he said, be more " in the near future".Part of the presentation today described the impact that electric vehicles were going to have on world requirements for copper, cobalt and other so called “technology” metals – it will be explosive and huge.

But the two really important things were the project with Accudo and the announcement today about Sivas.

The Chairman, Alan Clegg, gave a detailed description of this project. He was talking about things happening Q4 this year and Q2 next with production of 50-75,000 tons “well within 3 years”.

Forget all the bits and pieces – focus on the present price of copper which is around $8000 per ton. Multiply that by 50,000 and take 2.5% ( royalty) That is $10,000,000 pa. It’s easy to work out the present value of that to AXM and consequently where the share price ought to be.

Accudo is, they believe, close to bringing their project to fruition, and whether it or Sivas would be first to produce income was a moot point. The Chairman plumped for Sivas. He mentioned that 99% of the due diligence and funding by DSR was in place. As an aside, Clegg is a seriously well connected gentleman, and a definitive go-getter who, I believe, is in the process of transforming AXM. He quite rightly pointed out the deeply conservative nature of mining companies. As he said, the first question they ask is “ Where is it operational?”

Now, with Sivas, they are going to be able to say “ Here.”

He agreed when asked that Sivas was “ The breakthrough” they had been working towards. He also agreed that once it was up and running, he felt sure many more mining companies would want to engage with AXM, which I don’t doubt.

All in all, I would rate this as very good news and an excellent AGM.

Oh and I actually forgot perhaps the single most important thing.

There is no value in their balance sheet ascribed to all the R&D and IP they have bought and paid for. According to BDO, as long as they do NOT have a working site, they cannot add any of this to their balance sheet. But the minute they do, they can. So when Sivas goes live....Their CFO when questioned, agreed that the sums involved were not " hundreds of thousands" but "millions"

temelco 28 Jun '18 - 12:47 - 4146 of 4152

What an AGM!

There’s only one word for the AGM today – WOW!

Most AGMs are dull and uninformative, this one was anything but!

Martin Rosser gave a very good presentation on all the current initiatives, but also said they were very busy with other things, which they could not mention as they had not made any announcement. There would, he said, be more " in the near future".Part of the presentation today described the impact that electric vehicles were going to have on world requirements for copper, cobalt and other so called “technology” metals – it will be explosive and huge.

But the two really important things were the project with Accudo and the announcement today about Sivas.

The Chairman, Alan Clegg, gave a detailed description of this project. He was talking about things happening Q4 this year and Q2 next with production of 50-75,000 tons “well within 3 years”.

Forget all the bits and pieces – focus on the present price of copper which is around $8000 per ton. Multiply that by 50,000 and take 2.5% ( royalty) That is $10,000,000 pa. It’s easy to work out the present value of that to AXM and consequently where the share price ought to be.

Accudo is, they believe, close to bringing their project to fruition, and whether it or Sivas would be first to produce income was a moot point. The Chairman plumped for Sivas. He mentioned that 99% of the due diligence and funding by DSR was in place. As an aside, Clegg is a seriously well connected gentleman, and a definitive go-getter who, I believe, is in the process of transforming AXM. He quite rightly pointed out the deeply conservative nature of mining companies. As he said, the first question they ask is “ Where is it operational?”

Now, with Sivas, they are going to be able to say “ Here.”

He agreed when asked that Sivas was “ The breakthrough” they had been working towards. He also agreed that once it was up and running, he felt sure many more mining companies would want to engage with AXM, which I don’t doubt.

All in all, I would rate this as very good news and an excellent AGM.

Oh and I actually forgot perhaps the single most important thing.

There is no value in their balance sheet ascribed to all the R&D and IP they have bought and paid for. According to BDO, as long as they do NOT have a working site, they cannot add any of this to their balance sheet. But the minute they do, they can. So when Sivas goes live....Their CFO when questioned, agreed that the sums involved were not " hundreds of thousands" but "millions"

AXM this is the Presentation delivered at AGM

https://www.alexandermining.com/Presentations/AGM_28_June_2018_FINAL.pdf

https://www.alexandermining.com/Presentations/AGM_28_June_2018_FINAL.pdf

AOR has been on fire

Breast Implant patent RNS seems very underappreciated

Stock is 70p, with a 'conservative Broker target of 400p' just for the Heart Valve IP

My estimate of the value of Breast Implant part of Company is 400-800p giving a potential target of over 1000p

Breast Implant patent RNS seems very underappreciated

Stock is 70p, with a 'conservative Broker target of 400p' just for the Heart Valve IP

My estimate of the value of Breast Implant part of Company is 400-800p giving a potential target of over 1000p

https://www.investegate.co.uk/aortech-inter-plc--aor-/rns/new-patent-issued/201807040700045006T/

New Patent Issued

AorTech is pleased to announce that the Brazilian Patent Office has recently granted Patent Number PI 0711694-2 entitled Biostable Gels. The invention relates to biostable gels, the processes for their preparation and their use in the manufacture and repair of biomaterials and medical devices or implants, in particular soft tissue implants such as breast implants.

Bill Brown, Chairman of AorTech said: "The issue of this patent further expands AorTech's patent portfolio, particularly in the area of breast implants. Brazil is one of the largest markets for breast enhancement outside of the USA and is therefore an important patent territory. The portfolio of IP relating to Breast Implants is not currently licensed by AorTech."

New Patent Issued

AorTech is pleased to announce that the Brazilian Patent Office has recently granted Patent Number PI 0711694-2 entitled Biostable Gels. The invention relates to biostable gels, the processes for their preparation and their use in the manufacture and repair of biomaterials and medical devices or implants, in particular soft tissue implants such as breast implants.

Bill Brown, Chairman of AorTech said: "The issue of this patent further expands AorTech's patent portfolio, particularly in the area of breast implants. Brazil is one of the largest markets for breast enhancement outside of the USA and is therefore an important patent territory. The portfolio of IP relating to Breast Implants is not currently licensed by AorTech."

AOR

http://www.heraldscotland.com/busin...-international-returns-to-its-scottish-roots/

7th July

Heart-valve pioneer AorTech International returns to its Scottish roots

Karen Peattie

IT IS the heart-valve pioneer that was once the darling of the stock exchange before – in chairman Bill Brown’s own words – “things started to go wrong”. Fast forward to 2018, however, and AorTech International’s fortunes are flowing once again on the back of a successful £2.6 million fundraise that will enable the development of new products over the next two years.

What’s more, the AIM-listed biomaterials and medical device company, which started life in Lanarkshire, is coming home to Scotland to develop a new generation of patches, grafts and heart-valve products using its groundbreaking Elast-Eon technology. “We’re returning to our roots,” said Lenzie-born Mr Brown.

“It’s no secret that we’ve had a history of problems but we’re ready for a fresh start and what’s really exciting for me is that we’re back working in Scotland, tapping into the fantastic talent pool that we have here with a refreshed company and excellent prospects for the future.”

Eighteen years ago, AorTech was very much at the cutting edge of Scotland’s burgeoning life sciences sector. Its high profile saw it secure many column inches in the business press, particularly after it emerged that AorTech had manufactured former First Minister Donald Dewar’s artificial heart valve.

“We invested heavily and tried to develop a lot of new products, including the heart valve,” Mr Brown said. “Our biggest issue commercially, however, was that the valve was very much ahead of its time so it wasn’t tried and tested. Fortunately, things have moved on and our polymer valve is of major interest.”

The company, registered in Scotland but based in Surrey, also found itself in a long-running dispute with St Jude Medical (now Abbott) over the supply of Elast-Eon plastics for use in the US firm’s medical devices. There was also litigation against former chief executive Frank Maguire. “We’ve had a lot of challenges to contend with,” Mr Brown added.

“In 2002, we were losing £6-7m per annum and the board decided to massively reduce the size of the company and shut Scotland down and focus on our polymer business in Australia.”

With these issues now firmly in the past, AorTech is looking to the future. “It’s hugely exciting,” said Mr Brown, a venture capitalist who graduated from the University of Glasgow in 1983. “Devices using our Elast-Eon technology are in more than five million patients and now we have this new strategy in place to make advances in three main growth platforms – soft tissue patches, grafts and advancing AorTech’s artificial heart valve.”

Elast-Eon, a co-polymer of silicone and polyurethane, combines the biocompatibility of silicone with the flexibility, durability and other mechanical properties of polyurethane. AorTech says it will bring significant improvements to existing types of soft tissue patches and grafts – and enable further important enhancements to the heart-valve product.

The firm will utilise existing Scottish medical device infrastructure to develop the products, working with Ayrshire-based RUA Medical, a contract medical device manufacturer, and Dundee’s Vascular Flow Technologies. “I’ve already alluded to Scotland’s outstanding skills base in the medical devices sector so we’ll be working with these talented people to take our products forward,” said Mr Brown.

Rather than investing bricks and mortar, equipment and people to take these projects forward, it makes sense for AorTech to partner with existing specialists with a proven track record. “They have outstanding resources and people that would cost us millions of pounds to pull together ourselves,” he added. “It’s a slightly different business model but one that is right for us.”

Vascular Flow Technologies, a leading innovator focused on the research and development of proprietary platform technology to improve blood flow in compromised or diseased blood vessels, will be involved in AorTech’s heart valve development along with teams at Ninewells Hospital and the University of Dundee.

“They are the best in Europe, and globally, at what they do,” said Mr Brown, “and will take our work to a new level.” The plan is for the patches and grafts to be ready for sale in the next two years while in the same timescale advancing the heart valve to be ready for human trials.

All the same, developing a medical device is a long process. “You start with an idea and to get to the point where you are ready to start human trials can take around seven years,” he explained. “We’re hoping to speed up the process because there’s a growing need for replacement heart valves all over the world.”

Typically in the Western world an individual’s heart valves will start to calcify around the age of 65. Mechanical valves last for a long time but turbulent blood flow can lead to clots and strokes, so patients with this type of valve also require anti-coagulation treatment. Valves made from animal tissue – usually from cows or pigs – don’t need to be accompanied by anti-coagulation treatment but because they are natural they don’t have same longevity and eventually also start to calcify.

“The benefit of the polymer valve is that it has the durability of a mechanical valve and should not require the patient to need anti-coagulation treatment,” Mr Brown explained. “All of this makes it an attractive option for patients.”

He pointed to the opportunities for the product in the developing medical world, highlighting India as an example. “There are five million people in India with heart disease, mainly rheumatic heart disease,” he said. “These patients have an average age of 25 and have usually had strep throat as a child then rheumatic fever leading to inflammation of the heart valve and subsequent calcification.

“These people then have a life expectancy of two-three years and are not treated on the whole because of the cost but also because with a mechanical valve they would require ongoing anti-coagulation treatment. So there is a big opportunity in the developing medical world to really make a difference to the quality of people’s lives and their life expectancy prospects.”

Meanwhile, AorTech also intends to apply for a Scottish Government research and development grant. Mr Brown confirmed that the company had already had “positive” discussions with Scottish Enterprise. “We’re in an excellent position to take AorTech to the next level,” said Mr Brown.

Changes to the AorTech board have seen the arrival of Geoff Berg, formerly a consultant heart surgeon at the Golden Jubilee Hospital in Glasgow where he specialised in surgical treatment of valvular heart disease, as a non-executive director. John Ely, a recognised expert in cardiovascular devices who spent seven years at the US Food & Drug Administration (FDA), is also a non-executive director.

“These guys are the best in the world at what they do so we have a great team to guide AorTech in the next phase of its evolution,” said Mr Brown.

Six questions …

What countries have you most enjoyed travelling to, for business or leisure, and why?

I’ve spent a lot of time in North America – not always for the right reasons. I found Salt Lake City in Utah fascinating with the extremes of temperature, desert, magnificent mountains and its interesting culture. It also has some of the best micro-breweries you’ll find anywhere. I didn’t choose to go there but bizarrely I enjoyed it.

When you were a child, what was your ideal job? Why did it appeal?

I had an uncle who was a lawyer in Glasgow and he advised me to be an accountant and although it didn’t really appeal it has been extremely useful in life.

What was your biggest break in business?

I hope the current developments in AorTech will be my biggest break. Being a fund manager and helping different types of companies has been satisfying but I think where we are now is the most exciting because of the people I’m working with.

What was your worst moment in business?

Being a fund manager in 2008 when the markets crashed.

Who do you most admire and why?

Harry Vardon. From a humble background he became golf’s first global superstar.

What book are you reading and what music are you listening to? What was the last film you saw?

I’m reading A Brief History of Everyone Who Ever Lived: The Stories In Our Genes by Adam Rutherford. It’s a fascinating read. I listen to anything by Billy Joel and was disappointed to miss out on tickets to see him in Manchester. Last film I saw was Lion, about the young Indian boy who gets lost on the streets of Calcutta.

CV

Bill Brown has been advising and investing in small companies for over 20 years. Having qualified as a chartered accountant in 1986, he started a career in venture capital with INVESCO before moving to Baronsmead (which later became Ivory & Sime, Friends Ivory & Sime, then ISIS).

In 1996, he launched the seminal AIM Trust, the first dedicated fund for the AIM market. Mr Brown went on to become head of ISIS’s small company investment teams based in Edinburgh and London before leaving to found Bluehone Investors LLP in 2005. He is a former chairman of the London Stock Exchange’s AIM Advisory Group.

http://www.heraldscotland.com/busin...-international-returns-to-its-scottish-roots/

7th July

Heart-valve pioneer AorTech International returns to its Scottish roots

Karen Peattie

IT IS the heart-valve pioneer that was once the darling of the stock exchange before – in chairman Bill Brown’s own words – “things started to go wrong”. Fast forward to 2018, however, and AorTech International’s fortunes are flowing once again on the back of a successful £2.6 million fundraise that will enable the development of new products over the next two years.

What’s more, the AIM-listed biomaterials and medical device company, which started life in Lanarkshire, is coming home to Scotland to develop a new generation of patches, grafts and heart-valve products using its groundbreaking Elast-Eon technology. “We’re returning to our roots,” said Lenzie-born Mr Brown.

“It’s no secret that we’ve had a history of problems but we’re ready for a fresh start and what’s really exciting for me is that we’re back working in Scotland, tapping into the fantastic talent pool that we have here with a refreshed company and excellent prospects for the future.”

Eighteen years ago, AorTech was very much at the cutting edge of Scotland’s burgeoning life sciences sector. Its high profile saw it secure many column inches in the business press, particularly after it emerged that AorTech had manufactured former First Minister Donald Dewar’s artificial heart valve.

“We invested heavily and tried to develop a lot of new products, including the heart valve,” Mr Brown said. “Our biggest issue commercially, however, was that the valve was very much ahead of its time so it wasn’t tried and tested. Fortunately, things have moved on and our polymer valve is of major interest.”

The company, registered in Scotland but based in Surrey, also found itself in a long-running dispute with St Jude Medical (now Abbott) over the supply of Elast-Eon plastics for use in the US firm’s medical devices. There was also litigation against former chief executive Frank Maguire. “We’ve had a lot of challenges to contend with,” Mr Brown added.

“In 2002, we were losing £6-7m per annum and the board decided to massively reduce the size of the company and shut Scotland down and focus on our polymer business in Australia.”

With these issues now firmly in the past, AorTech is looking to the future. “It’s hugely exciting,” said Mr Brown, a venture capitalist who graduated from the University of Glasgow in 1983. “Devices using our Elast-Eon technology are in more than five million patients and now we have this new strategy in place to make advances in three main growth platforms – soft tissue patches, grafts and advancing AorTech’s artificial heart valve.”

Elast-Eon, a co-polymer of silicone and polyurethane, combines the biocompatibility of silicone with the flexibility, durability and other mechanical properties of polyurethane. AorTech says it will bring significant improvements to existing types of soft tissue patches and grafts – and enable further important enhancements to the heart-valve product.

The firm will utilise existing Scottish medical device infrastructure to develop the products, working with Ayrshire-based RUA Medical, a contract medical device manufacturer, and Dundee’s Vascular Flow Technologies. “I’ve already alluded to Scotland’s outstanding skills base in the medical devices sector so we’ll be working with these talented people to take our products forward,” said Mr Brown.

Rather than investing bricks and mortar, equipment and people to take these projects forward, it makes sense for AorTech to partner with existing specialists with a proven track record. “They have outstanding resources and people that would cost us millions of pounds to pull together ourselves,” he added. “It’s a slightly different business model but one that is right for us.”

Vascular Flow Technologies, a leading innovator focused on the research and development of proprietary platform technology to improve blood flow in compromised or diseased blood vessels, will be involved in AorTech’s heart valve development along with teams at Ninewells Hospital and the University of Dundee.

“They are the best in Europe, and globally, at what they do,” said Mr Brown, “and will take our work to a new level.” The plan is for the patches and grafts to be ready for sale in the next two years while in the same timescale advancing the heart valve to be ready for human trials.

All the same, developing a medical device is a long process. “You start with an idea and to get to the point where you are ready to start human trials can take around seven years,” he explained. “We’re hoping to speed up the process because there’s a growing need for replacement heart valves all over the world.”

Typically in the Western world an individual’s heart valves will start to calcify around the age of 65. Mechanical valves last for a long time but turbulent blood flow can lead to clots and strokes, so patients with this type of valve also require anti-coagulation treatment. Valves made from animal tissue – usually from cows or pigs – don’t need to be accompanied by anti-coagulation treatment but because they are natural they don’t have same longevity and eventually also start to calcify.

“The benefit of the polymer valve is that it has the durability of a mechanical valve and should not require the patient to need anti-coagulation treatment,” Mr Brown explained. “All of this makes it an attractive option for patients.”

He pointed to the opportunities for the product in the developing medical world, highlighting India as an example. “There are five million people in India with heart disease, mainly rheumatic heart disease,” he said. “These patients have an average age of 25 and have usually had strep throat as a child then rheumatic fever leading to inflammation of the heart valve and subsequent calcification.

“These people then have a life expectancy of two-three years and are not treated on the whole because of the cost but also because with a mechanical valve they would require ongoing anti-coagulation treatment. So there is a big opportunity in the developing medical world to really make a difference to the quality of people’s lives and their life expectancy prospects.”

Meanwhile, AorTech also intends to apply for a Scottish Government research and development grant. Mr Brown confirmed that the company had already had “positive” discussions with Scottish Enterprise. “We’re in an excellent position to take AorTech to the next level,” said Mr Brown.

Changes to the AorTech board have seen the arrival of Geoff Berg, formerly a consultant heart surgeon at the Golden Jubilee Hospital in Glasgow where he specialised in surgical treatment of valvular heart disease, as a non-executive director. John Ely, a recognised expert in cardiovascular devices who spent seven years at the US Food & Drug Administration (FDA), is also a non-executive director.

“These guys are the best in the world at what they do so we have a great team to guide AorTech in the next phase of its evolution,” said Mr Brown.

Six questions …

What countries have you most enjoyed travelling to, for business or leisure, and why?

I’ve spent a lot of time in North America – not always for the right reasons. I found Salt Lake City in Utah fascinating with the extremes of temperature, desert, magnificent mountains and its interesting culture. It also has some of the best micro-breweries you’ll find anywhere. I didn’t choose to go there but bizarrely I enjoyed it.

When you were a child, what was your ideal job? Why did it appeal?

I had an uncle who was a lawyer in Glasgow and he advised me to be an accountant and although it didn’t really appeal it has been extremely useful in life.

What was your biggest break in business?

I hope the current developments in AorTech will be my biggest break. Being a fund manager and helping different types of companies has been satisfying but I think where we are now is the most exciting because of the people I’m working with.

What was your worst moment in business?

Being a fund manager in 2008 when the markets crashed.

Who do you most admire and why?

Harry Vardon. From a humble background he became golf’s first global superstar.

What book are you reading and what music are you listening to? What was the last film you saw?

I’m reading A Brief History of Everyone Who Ever Lived: The Stories In Our Genes by Adam Rutherford. It’s a fascinating read. I listen to anything by Billy Joel and was disappointed to miss out on tickets to see him in Manchester. Last film I saw was Lion, about the young Indian boy who gets lost on the streets of Calcutta.

CV

Bill Brown has been advising and investing in small companies for over 20 years. Having qualified as a chartered accountant in 1986, he started a career in venture capital with INVESCO before moving to Baronsmead (which later became Ivory & Sime, Friends Ivory & Sime, then ISIS).

In 1996, he launched the seminal AIM Trust, the first dedicated fund for the AIM market. Mr Brown went on to become head of ISIS’s small company investment teams based in Edinburgh and London before leaving to found Bluehone Investors LLP in 2005. He is a former chairman of the London Stock Exchange’s AIM Advisory Group.

SALV chart

on an absolute charge

this from an old research note

Four portfolio companies: SalvaRx now has exposure to four portfolio companies, giving it access to several immuno-oncology programmes—many of which have enough funding to complete early to midstage clinical trials.

Intensity Therapeutics moving into the clinic: we expect patient dosing with lead product INT230-6 to commence imminently, which would represent a major milestone for SalvaRx, as it would be its first portfolio company to move into the clinic.

Substantial market: The immuno-oncology market is forecast to expand to over $80bn by 2020.

Valuation: Our updated DCF model indicates a 180p price target (up from 149p previously).

Positive read-across from Biohaven IPO: We note Biohaven's (BHVN) recent successful IPO on the NYSE, raising $168m. The group's market capitalisation is c. $660m. Biohaven shares several Directors and investors with SalvaRx. As such, we estimate that Biohaven's success provides positive read across for SalvaRx.

Big overweight concentration in biotechs in my portfolio right now.

I like the fact these stocks tend to have strong secular independent growth drivers. They are not plays on the economic cycle and thus subject to whim of policy errors by fiscal/monetary authorities/trade wars etc

That threat with unpredictableness of Brexit and Trump puts me off tech / oil / commodities etc

There will always be demand for cancer/heart issues. The growing elderly population want to live longer more fulfilling lives and thus can/will pay up for longevity cures/treatments etc maintaining healthy private medical biotech market growth drivers

Expect Sanders to eventually win US healthcare reform debate and expect more public provision and less siphoning off of profit should increase spending in biotech/medtech sector

I like the fact these stocks tend to have strong secular independent growth drivers. They are not plays on the economic cycle and thus subject to whim of policy errors by fiscal/monetary authorities/trade wars etc

That threat with unpredictableness of Brexit and Trump puts me off tech / oil / commodities etc

There will always be demand for cancer/heart issues. The growing elderly population want to live longer more fulfilling lives and thus can/will pay up for longevity cures/treatments etc maintaining healthy private medical biotech market growth drivers

Expect Sanders to eventually win US healthcare reform debate and expect more public provision and less siphoning off of profit should increase spending in biotech/medtech sector

Hope it's just the beginningAOR ended at new 52 week high (actually apparently a 4 year closing high)

Bewal Express

T20I Captain

- Joined

- Nov 6, 2005

- Runs

- 41,495

If anyone wants a tip for the UK then BT is worth a punt. Its around 220p atm down from from the highs of 400p, this is due to an Italian Accounting scandal and competition at home but my estimate is that it will be around 320p in the next 2 years. Its risky but worth a punt.

mmkextreme_1

T20I Debutant

- Joined

- Dec 12, 2007

- Runs

- 6,515

- Post of the Week

- 1

For those in the UK, what are the sentiments of Lloyd Banking stock? I like following the ADR here in the US.

Bewal Express

T20I Captain

- Joined

- Nov 6, 2005

- Runs

- 41,495

AOR has been on fire

Breast Implant patent RNS seems very underappreciated

Stock is 70p, with a 'conservative Broker target of 400p' just for the Heart Valve IP

My estimate of the value of Breast Implant part of Company is 400-800p giving a potential target of over 1000p

Have you invested?

jaspa888

Local Club Star

- Joined

- Aug 1, 2007

- Runs

- 2,022

If anyone wants a tip for the UK then BT is worth a punt. Its around 220p atm down from from the highs of 400p, this is due to an Italian Accounting scandal and competition at home but my estimate is that it will be around 320p in the next 2 years. Its risky but worth a punt.

BT will stagnate IMHO. Their voice wholesale business loses millions, they've massively overpaid for their PL football rights, and are under huge pressure from smaller, more nimble rivals in the broadband market.

They've also recently announced that they will not compete on price in the broadband market, meaning they'll lose more customers.

Bewal Express

T20I Captain

- Joined

- Nov 6, 2005

- Runs

- 41,495

BT will stagnate IMHO. Their voice wholesale business loses millions, they've massively overpaid for their PL football rights, and are under huge pressure from smaller, more nimble rivals in the broadband market.

They've also recently announced that they will not compete on price in the broadband market, meaning they'll lose more customers.

What you say is not wrong but they are still a decent business and i reckon they will be worth 300p per share in a couple years of time.

jaspa888

Local Club Star

- Joined

- Aug 1, 2007

- Runs

- 2,022

What you say is not wrong but they are still a decent business and i reckon they will be worth 300p per share in a couple years of time.

Based on what though? The market rarely lies.

Madplayer

Senior Test Player

- Joined

- Aug 30, 2012

- Runs

- 28,686

- Post of the Week

- 1

Brothers, how does a lay man with no knowledge of the share market understand it in order to invest? Are there any books or online sources that you would suggest?

Have you invested?

Yes.

AOR is a great company. Potentially could be massive.

One of my good friends is a cardiac specialist and confirmed this is an area requiring new technology for which AOR seems very well placed.

Similar threads

- Replies

- 23

- Views

- 1K

- Replies

- 98

- Views

- 3K

- Replies

- 1

- Views

- 186

- Replies

- 2

- Views

- 181

- Replies

- 33

- Views

- 470