Savak

Test Captain

- Joined

- Feb 16, 2006

- Runs

- 47,833

- Post of the Week

- 3

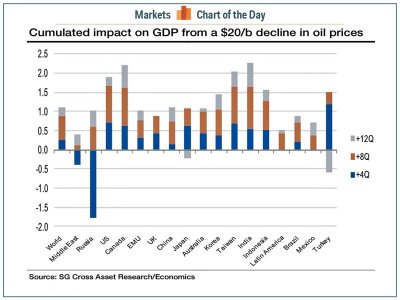

Oil Prices went up as high as $147-148 per barrel in July. It i believe was the primary driver of this 20-30% inflation most consumer's around the world have been facing for the 8 months especially on basic household commodities.

Many people in my company Arif Habib Investment's were predicting this would go as high as $200 per barrel.

And today oil is $63 per barrel. The Opec nations have announced they will cut now cut production of Oil by 1.5 million barrels from Nov 1. There are now 2 schools of thought, some people tell me that oil prices are more or less stable now irrespective of the cut in production from Opec due to the decline in demand bought about by the global reccession. The other opinion is that oil prices could well increase again due to the reduction in oil production.

So what do you guys think? If lets say Oil prices remain at $50-60 per barrel from now on without an increase further, can it be a turnaround for most economies? Will it be possible to now see a reduction in oil prices, inflation and misery most people especially the poor have had to endure for the last 6-8 months.

Many people in my company Arif Habib Investment's were predicting this would go as high as $200 per barrel.

And today oil is $63 per barrel. The Opec nations have announced they will cut now cut production of Oil by 1.5 million barrels from Nov 1. There are now 2 schools of thought, some people tell me that oil prices are more or less stable now irrespective of the cut in production from Opec due to the decline in demand bought about by the global reccession. The other opinion is that oil prices could well increase again due to the reduction in oil production.

So what do you guys think? If lets say Oil prices remain at $50-60 per barrel from now on without an increase further, can it be a turnaround for most economies? Will it be possible to now see a reduction in oil prices, inflation and misery most people especially the poor have had to endure for the last 6-8 months.

.

.