shortbread

First Class Player

- Joined

- Mar 30, 2011

- Runs

- 2,622

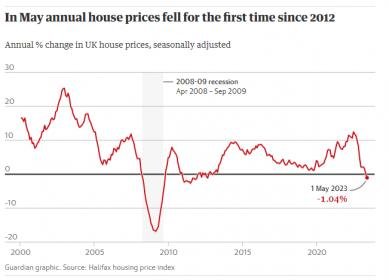

While real/official data in the UK has a massive lag and takes time to trickle down into definitive reporting..... all signs point in one direction ie. DOWN!

There are two arguments that it can fall of a cliff ie. crash (which I think is likely) or a correction, following the post pandemic jump.

While the sector is important to any nation, the implications are especially massive for the UK. No other developed economy is so heavily reliant on the property sector.

This is ongoing and I think in the coming months the fall will be more conclusive.

https://www.bbc.co.uk/news/business-65774620

There are two arguments that it can fall of a cliff ie. crash (which I think is likely) or a correction, following the post pandemic jump.

While the sector is important to any nation, the implications are especially massive for the UK. No other developed economy is so heavily reliant on the property sector.

This is ongoing and I think in the coming months the fall will be more conclusive.

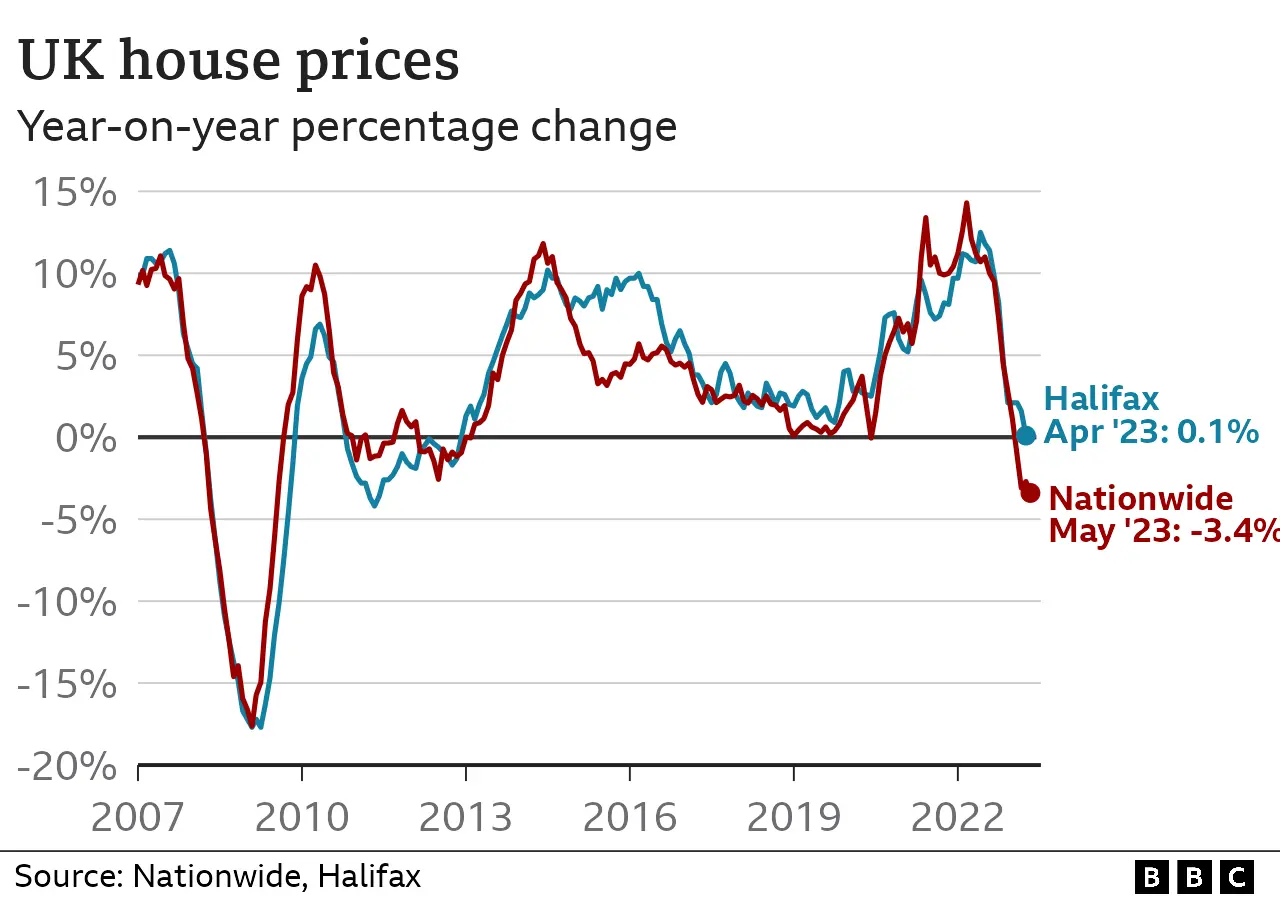

House prices fall at fastest pace in nearly 14 years

UK house prices fell at their fastest annual pace for nearly 14 years in May, the Nationwide has said. The building society said prices in the year to May dropped by 3.4%, the biggest decline since July 2009.

It also warned that more rises in mortgage interest rates could hit the housing market.

Mortgage rates have risen recently on expectations that the Bank of England will have to lift interest rates again because of stubbornly high inflation.

As a result, the Nationwide said "headwinds to the housing market look set to strengthen in the near term".

House prices edged down by 0.1% in May itself, the Nationwide said, and the average property price now stands at £260,736.

Average prices are still 4% below their August 2022 peak, it added.

A drop in house prices would generally be welcomed by first-time buyers, who have watched property values continue to climb in recent years, even during the pandemic.

However, rising interest rates means that mortgage costs are now higher than many people looking to get on the housing ladder might have planned for.

New figures from the Bank of England showed the amount of mortgage debt borrowed was at its lowest level on record in April, excluding the period since the beginning of the Covid pandemic. Overall, borrowers repaid £1.4bn more on their mortgages than banks lent out.

The Bank also said net mortgage approvals for house purchases fell to 48,700 from 51,500 in March.

Official figures last week showed the UK inflation rate - which charts rising prices - slowed in April by less than expected to 8.7%.

That led analysts to predict that the Bank of England will have to raise interest rates above their current level of 4.5% to as high as 5.5% to try to slow price rises.

In the wake of the inflation data, a range of lenders increased their mortgage interest rates, with Nationwide making the most significant move with a rise of up to 0.45 percentage points.

According to financial data firm Moneyfacts, the current average interest rate on a two-year fixed-rate mortgage is now 5.49% compared to a year ago when it was 3.25%.

A five-year fixed-rate deal is currently 5.17%, above a 3.37% rate this time last year.

https://www.bbc.co.uk/news/business-65774620