-

Contact the PP Team

Connect with us

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Started reading on G20. Why is Pakistan not in there?

- Thread starter Snak3eye5

- Start date

Buffet

Post of the Week winner

- Joined

- Aug 1, 2011

- Runs

- 27,662

- Post of the Week

- 3

Argentina has the lowest trade per year among G20 and that is in the range of 140-150B.

Pakistan's trade volume is somewhere half of that.

Pakistan's trade volume is somewhere half of that.

The attachment isn't clear. You can find the list here:

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2001rank.html

JaDed

T20I Captain

- Joined

- May 5, 2014

- Runs

- 41,582

Never understood the point of these organizations,does it benefit anyone or is it just some show off boys club types?

Varun

Senior Test Player

- Joined

- Dec 25, 2012

- Runs

- 26,410

- Post of the Week

- 1

Never understood the point of these organizations,does it benefit anyone or is it just some show off boys club types?

The G20 actually sign their fair share of deals. Unlike the overrated BRICS which is pretty much IC these days.

DW44

T20I Debutant

- Joined

- Apr 12, 2009

- Runs

- 7,314

G20 is group of "major" economies. The Pakistani economy, at $290 billion and 42nd place in the world (despite a population that's officially the 6th largest and in reality almost certainly the 5th largest in the world), is not a major one by any stretch of the imagination. It's slightly smaller than South Africa's, who're in the G20 and have by far the smallest economy in that bloc, but they have a quarter of our population and four times the trade volume so they're far more integrated in the global economy. The second smallest economy in G20, Argentina, is more than twice as large as Pakistan's.

enkidu_

Local Club Captain

- Joined

- Nov 15, 2014

- Runs

- 2,206

Some economic predictions for 2030, perhaps then there'll be a chance ?

http://www.independent.co.uk/news/b...most-powerful-economies-in-2030-a7569941.html

20. Pakistan — $1.868 trillion

19. Egypt — $2.049 trillion

18. Canada — $2.141 trillion

17. Spain — $2.159 trillion

16. Iran — $2.354 trillion

15. Italy — $2.541 trillion

14. South Korea — $2.651 trillion

13. Saudi Arabia — $2.755 trillion

12. Turkey — $2.996 trillion

11. France — $3.377 trillion

10. United Kingdom — $3.638 trillion

9. Mexico — $3.661 trillion

8. Brazil — $4.439 trillion

7. Germany — $4.707 trillion

6. Russia — $4.736 trillion

5. Indonesia — $5.424 trillion

4. Japan — $5.606 trillion

3. India — $19.511 trillion

2. United States — $23.475 trillion

1. China — $38.008 trillion

http://www.independent.co.uk/news/b...most-powerful-economies-in-2030-a7569941.html

Some economic predictions for 2030, perhaps then there'll be a chance ?

http://www.independent.co.uk/news/b...most-powerful-economies-in-2030-a7569941.html

To get to $1.868 trillion from the current $0.988 trillion in 13 years requires a growth rate of 5%. The Pakistani economy has been growing at about 4.4% the last 3 years, so it seems possible.

I do not attach much credence to PWC forecasts, they have a poor understanding of the world. For the economy to sustain a 5% growth rate requires the introduction of modern industries like automobiles, software, pharma, etc. Unless the Pakistani Army gets out of running industries, and the religious jihadi forces are curbed, that is not going to happen. Many of these industries need foreign investment and collaboration and that is not going to happen till investors believe their investment is safe.

Last edited:

Varun

Senior Test Player

- Joined

- Dec 25, 2012

- Runs

- 26,410

- Post of the Week

- 1

To get to $1.868 trillion from the current $0.988 trillion in 13 years requires a growth rate of 5%. The Pakistani economy has been growing at about 4.4% the last 3 years, so it seems possible.

I do not attach much credence to PWC forecasts, they have a poor understanding of the world. For the economy to sustain a 5% growth rate requires the introduction of modern industries like automobiles, software, pharma, etc. Unless the Pakistani Army gets out of running industries, and the religious jihadi forces are curbed, that is not going to happen. Many of these industries need foreign investment and collaboration and that is not going to happen till investors believe their investment is safe.

Funnily enough, it'll happen if an army chief himself is in charge, like Musharaff.

DW44

T20I Debutant

- Joined

- Apr 12, 2009

- Runs

- 7,314

To get to $1.868 trillion from the current $0.988 trillion in 13 years requires a growth rate of 5%. The Pakistani economy has been growing at about 4.4% the last 3 years, so it seems possible.

I do not attach much credence to PWC forecasts, they have a poor understanding of the world. For the economy to sustain a 5% growth rate requires the introduction of modern industries like automobiles, software, pharma, etc. Unless the Pakistani Army gets out of running industries, and the religious jihadi forces are curbed, that is not going to happen. Many of these industries need foreign investment and collaboration and that is not going to happen till investors believe their investment is safe.

That's not how GDP growth works. Those are PPP figures and the PPP GDP needs to grow 5% a year to get to that figure which is not the same as real GDP growth which is what that 4.4% figure is. PPP(and nominal) figures usually grows faster than the real growth rate. For Pakistan, the generally agreed upon figure for real GDP growth through to 2030 is in the 5.7-6.0% range so that 5% PPP GDP growth is, if anything, a serious underestimate.

That's not how GDP growth works. Those are PPP figures and the PPP GDP needs to grow 5% a year to get to that figure which is not the same as real GDP growth which is what that 4.4% figure is. <b>PPP(and nominal) figures usually grows faster than the real growth rate.</b> For Pakistan, the generally agreed upon figure for real GDP growth through to 2030 is in the 5.7-6.0% range so that 5% PPP GDP growth is, if anything, a serious underestimate.

PPP will grow slower than the real growth rate because at higher levels of income, the PPP correction is smaller.

To get to 6%, you need some fundamental changes to your economy as I mentioned in my earlier post.

Funnily enough, it'll happen if an army chief himself is in charge, like Musharaff.

No it won't, the economy stagnated under Musharaff. Generals cannot create and run world class companies. If the Army took power and gave the entrepreneurs the freedom and security (something like that happened in Korea, Singapore, Taiwan etc.) then it would be a different matter. But the Pakistani Army shows no interest and desire for any such program.

DW44

T20I Debutant

- Joined

- Apr 12, 2009

- Runs

- 7,314

Not necessarily. PPP is simply a reference figure calculated using nominal GDP which factors in stuff like inflation so, in practice, for an underdeveloped economy growing relatively quickly, PPP figure will rise faster than the real growth rate. Feel free to use actual GDP(PPP) and real growth rate data for any country to verify that fact. Here's China's for reference: https://en.wikipedia.org/wiki/Historical_GDP_of_ChinaPPP will grow slower than the real growth rate because at higher levels of income, the PPP correction is smaller.

A large influx of cash can create rapid growth in the short term even with poor fundamentals and that's what's set to drive growth for the next ten to fifteen years. While the long term impact of Chinese money flooding Pakistan will be pretty detrimental to Pakistan, it will create a fair bit of growth in the short term.To get to 6%, you need some fundamental changes to your economy as I mentioned in my earlier post.

Not necessarily. PPP is simply a reference figure calculated using nominal GDP which factors in stuff like inflation so, in practice, for an underdeveloped economy growing relatively quickly, PPP figure will rise faster than the real growth rate. Feel free to use actual GDP(PPP) and real growth rate data for any country to verify that fact. Here's China's for reference: https://en.wikipedia.org/wiki/Historical_GDP_of_China

Let me put it this way. The PPP multiplier for countries at say India or Pakistan's level of income is currently around 3.5. For countries that are richer, like Brazil it is 1.8 and for Malaysia it is 2.8.

The PPP correction basically acknowledges that for poorer countries, the exchange rate is skewed against them and basic necessities of life are available at much lower prices (after accounting for exchange rates) than they are in rich countries. So as a country gets richer, the PPP adjustment gets smaller. Equivalently the PPP growth rate is smaller than the real growth rate.

A large influx of cash can create rapid growth in the short term even with poor fundamentals and that's what's set to drive growth for the next ten to fifteen years. While the long term impact of Chinese money flooding Pakistan will be pretty detrimental to Pakistan, it will create a fair bit of growth in the short term.

Any growth has to be based on read production, not just a whole lot of loans that do not create any long-lived industries.

I am a bit skeptical of Chinese investment. US firms invested abroad to take advantage of lower wages. China already has a large population of low wage labor, so it is not going to be investing in Pakistan to provide Pakistanis jobs. What it does do is to invest to secure raw materials (Africa) or trade routes (Gwadar port). China is not going to set up huge operations in Pakistan like Accenture and IBM (majority of IBM employees are now in India) did in India, because 1) China doesn't have such firms 2) if it did it would keep the employment in its own country. American corporations have too much political power which let them ship these white collar jobs to the low wage reasonable secure country India.

Last edited:

While the long term impact of Chinese money flooding Pakistan will be pretty detrimental to Pakistan, it will create a fair bit of growth in the short term.

Yes, you are right about this. The Chinese money seems to be geared towards creating a transportation infrastructure for its needs, rather than industries in Pakistan. While transportation can provide some income, in the long run it is limited.

Last edited:

DW44

T20I Debutant

- Joined

- Apr 12, 2009

- Runs

- 7,314

Let me put it this way. The PPP multiplier for countries at say India or Pakistan's level of income is currently around 3.5. For countries that are richer, like Brazil it is 1.8 and for Malaysia it is 2.8.

The PPP correction basically acknowledges that for poorer countries, the exchange rate is skewed against them and basic necessities of life are available at much lower prices (after accounting for exchange rates) than they are in rich countries. So as a country gets richer, the PPP adjustment gets smaller. Equivalently the PPP growth rate is smaller than the real growth rate.

It's not nearly that simple nor is it exactly how it works. PPP multiplier varies with many factors including but not limited to exchange rates, inflation, exactly what the basket of goods used to calculate it contains, and real GDP growth. Brazil's PPP multiplier was less than 1 around 2010-11. A few years ago, the methodology was revised and the current figures for those years have it at around 1-1.2ish. Pakistan and India's were around 2.7-2.8 in 2010-11 before the methodology was revised and new figures of around 3 were reached. An intangible quantity like PPP is subject to a lot of variation and you can not treat it as an absolute the way you are. Besides, I've actually given you a dataset containing real growth rates and PPP GDP figures for a major developing economy which clearly indicate that the PPP GDP grew faster than real GDP so I don't see what the confusion is here.

It's not nearly that simple nor is it exactly how it works. PPP multiplier varies with many factors including but not limited to exchange rates, inflation, exactly what the basket of goods used to calculate it contains, and real GDP growth. Brazil's PPP multiplier was less than 1 around 2010-11. A few years ago, the methodology was revised and the current figures for those years have it at around 1-1.2ish. Pakistan and India's were around 2.7-2.8 in 2010-11 before the methodology was revised and new figures of around 3 were reached. An intangible quantity like PPP is subject to a lot of variation and you can not treat it as an absolute the way you are.

There is always noise, but I have given you an underlying reason. There is no persistent reason for PPP to grow faster than Nominal. If it does, it can happen for short periods due to noise.

Besides, I've actually given you a dataset containing real growth rates and PPP GDP figures for a major developing economy which clearly indicate that the PPP GDP grew faster than real GDP so I don't see what the confusion is here.

Okay, let us use the data that you provided from the first table in the article "China's Historical GDP for 1952 –present".

Start with China similar to where Pakistan is now in terms of affluence. Pakistan's per cap PPP GDP is currently $5,200, which is approximately where China was back in 2005 ($5,026). From 2005 to 2016 China's PPP GDP has grown from $6,552 bn to $21,255, that is a growth of 224%. During the same period nominal GDP has grown from $2,287 to $11,202, that is a growth of 390%.

Your data supports the point I have been making.

Last edited:

DW44

T20I Debutant

- Joined

- Apr 12, 2009

- Runs

- 7,314

There is always noise, but I have given you an underlying reason. There is no persistent reason for PPP to grow faster than Nominal. If it does, it can happen for short periods due to noise.

Okay, let us use the data that you provided from the first table in the article "China's Historical GDP for 1952 –present".

Start with China similar to where Pakistan is now in terms of affluence. Pakistan's per cap PPP GDP is currently $5,200, which is approximately where China was back in 2005 ($5,026). From 2005 to 2016 China's PPP GDP has grown from $6,552 bn to $21,255, that is a growth of 224%. During the same period nominal GDP has grown from $2,287 to $11,202, that is a growth of 390%.

Your data supports the point I have been making.

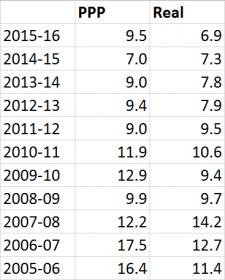

Again, that's not how it works. You're using the term nominal instead of real which suggests that you think they're the same thing and the terms are interchangeable which is not the case. When we talk about GDP growth rates, we're talking about real GDP growth rate which is not the same thing as nominal. Your interpretation of the dataset is flawed precisely for that reason. Here's how the real and PPP growth figures from that dataset for the last 10 or so years read:

As you can see, PPP GDP grows at a much faster clip eight years out of eleven and as a whole from 2006-07 through to 2015-16. That's because nominal GDP grows much faster than real GDP - nominal GDP growth rate is basically real + inflation - and PPP is basically nominal multiplied by a constant which, in turn, is subject to a lot of variation as evident by the fact that PPP multipliers for, say, 2010 are very different now than they were then. The current PPP multiplier for the year 2000 for India and Pakistan is over 4. Ten years ago, the corresponding figure for the same year was around 3.2-3.3. My point is that PPP is only a reference that is subject to a lot of variation and isn't generally used when discussing growth rates etc. For that, real GDP growth is used.

Yes, you are correct that I should have looked at real rather than nominal.

However, my initial point that Pakistan is likely to experience a falling PPP multiplier as it grow richer remains correct. China is an exception.

You can look at a bunch of countries instead of just China and calculate their PPP multipliers (PPP GDP / nominal GDP).

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2004rank.html

You will see 3 trends:

1) Richer countries like Liechtenstein have smaller multipliers while poorer countries like Tunisia have larger multipliers.

2) Countries that artificially keep their currencies low with large foreign currency reserves like the Saudis have larger multipliers.

3) Countries that provide large amount of social services to their citizens like Spain have large multipliers.

2) is only for static comparison, it does not apply when you are considering the same country over time, so we will drop this from consideration.

3) does not apply to Pakistan. Its fiscal situation (especially the foreign trade deficits) is not going to allow it to greatly expand social services.

You are only left with 1) for Pakistan, which is why I believe that its PPP multiplier will shrink as it gets richer. Why did China's multiplier not shrink? Maybe they increased their social services significantly as they got richer. They were able to do that as the foreign trade surpluses gave them room for maneuver.

However, my initial point that Pakistan is likely to experience a falling PPP multiplier as it grow richer remains correct. China is an exception.

You can look at a bunch of countries instead of just China and calculate their PPP multipliers (PPP GDP / nominal GDP).

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2004rank.html

You will see 3 trends:

1) Richer countries like Liechtenstein have smaller multipliers while poorer countries like Tunisia have larger multipliers.

2) Countries that artificially keep their currencies low with large foreign currency reserves like the Saudis have larger multipliers.

3) Countries that provide large amount of social services to their citizens like Spain have large multipliers.

2) is only for static comparison, it does not apply when you are considering the same country over time, so we will drop this from consideration.

3) does not apply to Pakistan. Its fiscal situation (especially the foreign trade deficits) is not going to allow it to greatly expand social services.

You are only left with 1) for Pakistan, which is why I believe that its PPP multiplier will shrink as it gets richer. Why did China's multiplier not shrink? Maybe they increased their social services significantly as they got richer. They were able to do that as the foreign trade surpluses gave them room for maneuver.

English August

Tape Ball Star

- Joined

- Dec 31, 2016

- Runs

- 982

Some economic predictions for 2030, perhaps then there'll be a chance ?

http://www.independent.co.uk/news/b...most-powerful-economies-in-2030-a7569941.html

I don't think so. These are PPP-adjusted numbers, so not a good indicator of a country's global influence. In my mind absolute value of real GDP is a good indicator of global influence / seat-at-the-table while per capita value of PPP-adjusted GDP is a good indicator of how well off the citizens are from financial standpoint.

For example, today India is already a top 5 economy when you look at PPP-adjusted GDP numbers, but I wouldn't say India wields influence commensurate with a top 5 position. OTOH, in real terms, India is a top 10 economy, which I think is an accurate indication of how influential India is today when it comes to global economic affairs.

English August

Tape Ball Star

- Joined

- Dec 31, 2016

- Runs

- 982

The G20 actually sign their fair share of deals. Unlike the overrated BRICS which is pretty much IC these days.

Agree the concept of BRICS has outlived its relevance. Very soon China will start going toe-to-toe with the US (if not already) in a bi-polar world. B and R will become irrelevant from economics standpoint. Should disband it.

I don't understand why Modi agreed to creation of the BRICS Bank.

English August

Tape Ball Star

- Joined

- Dec 31, 2016

- Runs

- 982

I am a bit skeptical of Chinese investment. US firms invested abroad to take advantage of lower wages. China already has a large population of low wage labor, so it is not going to be investing in Pakistan to provide Pakistanis jobs. What it does do is to invest to secure raw materials (Africa) or trade routes (Gwadar port). China is not going to set up huge operations in Pakistan like Accenture and IBM (majority of IBM employees are now in India) did in India, because 1) China doesn't have such firms 2) if it did it would keep the employment in its own country. American corporations have too much political power which let them ship these white collar jobs to the low wage reasonable secure country India.

Excellent post. Very insightful.

The only point where I have a (minor) quibble is about American corporations needing the political power to ship white-collar jobs abroad. More than "political power" I'd attribute it to (a) deep structural commitment to capitalism / generating shareholder value as opposed to having to pay lip service to socialist ideals like worker rights and generating employment and (b) senior executive compensation linked to delivering short-term gains

Varun

Senior Test Player

- Joined

- Dec 25, 2012

- Runs

- 26,410

- Post of the Week

- 1

Agree the concept of BRICS has outlived its relevance. Very soon China will start going toe-to-toe with the US (if not already) in a bi-polar world. B and R will become irrelevant from economics standpoint. Should disband it.

And South Africa were irrelevant to begin with.

I don't understand why Modi agreed to creation of the BRICS Bank.

Nothing to lose?

Similar threads

- Replies

- 3

- Views

- 330

- Replies

- 35

- Views

- 460

- Replies

- 34

- Views

- 552

- Replies

- 71

- Views

- 2K

- Replies

- 62

- Views

- 812