- Joined

- Apr 13, 2025

- Runs

- 5,439

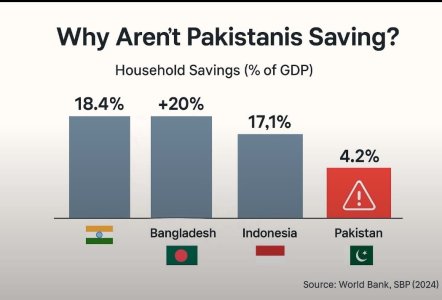

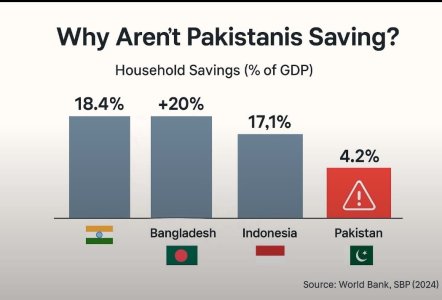

Have a look at this graph:

This graphic is honestly quite alarming. Pakistan's household savings rate is at just 4.2% of GDP, while neighboring countries like Bangladesh (20%+), India (18.4%), and Indonesia (17.1%) are doing significantly better. As a Pakistani, I can say this isn’t surprising but it is worrying.

From personal experience, savings feel like a luxury. With skyrocketing inflation, unemployment, and daily expenses eating away earnings, most people can barely manage month to month. Even middle-class families are now living paycheck to paycheck. I know so many friends who want to save but just can't because:

Rent, fuel, and utility bills are consuming most of their income.

Medical and education costs are out of control.

People are forced to rely on credit cards, BNPL services, or loans to survive.

There’s also a growing lack of trust in financial institutions and the currency itself due to political instability and the rupee’s devaluation.

If we look at the State Bank of Pakistan and World Bank reports, they point to the lack of financial literacy, poor formal banking access, and a shrinking middle class as some core issues. On the other hand, Bangladesh has focused heavily on microfinance, women's financial inclusion, and export-driven income stability—all of which encourage savings.

Why do you think Pakistanis aren’t saving? Is it just about income vs expenses or a deeper cultural/economic issue? Do you feel safe keeping money in banks? Let’s talk about it in this thread

This graphic is honestly quite alarming. Pakistan's household savings rate is at just 4.2% of GDP, while neighboring countries like Bangladesh (20%+), India (18.4%), and Indonesia (17.1%) are doing significantly better. As a Pakistani, I can say this isn’t surprising but it is worrying.

From personal experience, savings feel like a luxury. With skyrocketing inflation, unemployment, and daily expenses eating away earnings, most people can barely manage month to month. Even middle-class families are now living paycheck to paycheck. I know so many friends who want to save but just can't because:

Rent, fuel, and utility bills are consuming most of their income.

Medical and education costs are out of control.

People are forced to rely on credit cards, BNPL services, or loans to survive.

There’s also a growing lack of trust in financial institutions and the currency itself due to political instability and the rupee’s devaluation.

If we look at the State Bank of Pakistan and World Bank reports, they point to the lack of financial literacy, poor formal banking access, and a shrinking middle class as some core issues. On the other hand, Bangladesh has focused heavily on microfinance, women's financial inclusion, and export-driven income stability—all of which encourage savings.

Why do you think Pakistanis aren’t saving? Is it just about income vs expenses or a deeper cultural/economic issue? Do you feel safe keeping money in banks? Let’s talk about it in this thread