ASA - after a big short term move from 0.4p to 2.8p in a few weeks there was always likely to be a pause for breath. I've been quite shocked at the level of the retrace and it's ruined an otherwise great chart but we seem to be consolidating within the 50 and 200 day MA and one would hope that once short term overbought indicators have corrected the stock can push on again as I still maintain the fundamental value here is several multiples of the current share price. (NTAV is circa 2.4p/share and Revenue/share is circa 5p/share)

-

Contact the PP Team

Connect with us

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying shares?

- Thread starter DeadlyVenom

- Start date

VAST - illustrating the dangers of Companies pursuing death spiral financings

Management either complicit or incompetent

http://www.shareprophets.com/views/...arrants-shareprophets-rns-translation-service

Management either complicit or incompetent

http://www.shareprophets.com/views/...arrants-shareprophets-rns-translation-service

CPX nice award and pointed reference to them beating likes of Ford / GM entries

http://www.investegate.co.uk/cap-xx...-a-s-2016-platinum-award/201611220700127657P/

CAP-XX is pleased to announce that it has been awarded the Society of Automotive Engineers - Australasia's (SAE-A) 2016 Platinum Award for overall engineering excellence, for the Company's 'Advanced Supercapacitors Make High Performance Modules' project, having faced tough competition from Ford, GM, SC Innovation and others. CAP-XX's award winning project concerned the development of supercapacitors suitable for automotive applications, namely its powerModule and truckStart products. CAP-XX also won the SAE-A's 2016 Gold Award in the Manufacturing/non-OE (non-Original Equipment) category

The judges' comments in respect of CAP-XX's project were as follow:

"CAP-XX have developed super capacitors for applications in both hybrid vehicles and, in a different mode, Heavy Trucks. The Super Capacitors will enable a broader range of small hybrids to utilise stop/start technology, with a beneficial effect on emissions and fuel economy. The Super Capacitors provided extremely low series resistance over a wide temperature range making them superior to storage batteries for many high power vehicle functions - in particular for numerous Stop/Start situations and where it enables heavy trucks to readily restart in very cold conditions and where batteries suffer from degraded performance. These Capacitors have almost unlimited cycle life and do not have the variable dynamic charging issues typical of batteries. The CAP-XX design utilises thin prismatic elements, with very low Equivalent Series Resistance, providing high power capability in a smaller package size and thus higher power density."

The judging panel of eight cited CAP-XX's combination of innovation, economic and social benefits, and widespread and wide scale appeal.

The full text of the SAE-A awards press release can be accessed via the following link: http://www.saea.com.au

http://www.investegate.co.uk/cap-xx...-a-s-2016-platinum-award/201611220700127657P/

CAP-XX is pleased to announce that it has been awarded the Society of Automotive Engineers - Australasia's (SAE-A) 2016 Platinum Award for overall engineering excellence, for the Company's 'Advanced Supercapacitors Make High Performance Modules' project, having faced tough competition from Ford, GM, SC Innovation and others. CAP-XX's award winning project concerned the development of supercapacitors suitable for automotive applications, namely its powerModule and truckStart products. CAP-XX also won the SAE-A's 2016 Gold Award in the Manufacturing/non-OE (non-Original Equipment) category

The judges' comments in respect of CAP-XX's project were as follow:

"CAP-XX have developed super capacitors for applications in both hybrid vehicles and, in a different mode, Heavy Trucks. The Super Capacitors will enable a broader range of small hybrids to utilise stop/start technology, with a beneficial effect on emissions and fuel economy. The Super Capacitors provided extremely low series resistance over a wide temperature range making them superior to storage batteries for many high power vehicle functions - in particular for numerous Stop/Start situations and where it enables heavy trucks to readily restart in very cold conditions and where batteries suffer from degraded performance. These Capacitors have almost unlimited cycle life and do not have the variable dynamic charging issues typical of batteries. The CAP-XX design utilises thin prismatic elements, with very low Equivalent Series Resistance, providing high power capability in a smaller package size and thus higher power density."

The judging panel of eight cited CAP-XX's combination of innovation, economic and social benefits, and widespread and wide scale appeal.

The full text of the SAE-A awards press release can be accessed via the following link: http://www.saea.com.au

doh!

oops ten bagged

Was right on there being a Lithium fad. Graphene will be the real thing.

oops ten bagged

Was right on there being a Lithium fad. Graphene will be the real thing.

Well Done Sir...

VRS - starting to move

Graphene is going to be a huge growth sector and this Company which looks to have a lot of validation for it's positioning is only valued at c.£10m, claims to have made transformational acquisition and is due to hold an Investor Day in a few weeks. Looks like it's gearing up for a move.

Versarien plc

("Versarien" or the "Company" or the "Group")

Investor Event

Versarien plc (AIM:VRS), the advanced materials group, is pleased to announce that it will be hosting a site visit to its newly acquired facility at AAC Cyroma in Banbury, Oxfordshire, for private investors on 9 of November 2016 between 9am and 11am.

Investors and shareholders should register their interest in attending this event at https://www.eventbrite.co.uk/e/versarien-investor-meeting-tickets-28652122269

VRS Versarien setting up nicely. Results announcement due on 29th November. Got a mention in this weeks issue of Share Mag as well apparently. (I personally don't care what Shares Mag have to say about anything)

ASA chart

If it breaks up from this set up should have a lot of upside, my target on fundamentals would be c.4-5p

TRK I first met them in the 1990s pushing their Infinitely Variable Transmission system. It never took off despite years of development and engagement with Auto OEMs (I read somewhere I think from a TRT Investor Presentation that getting new tech into cars can take 20 years !)

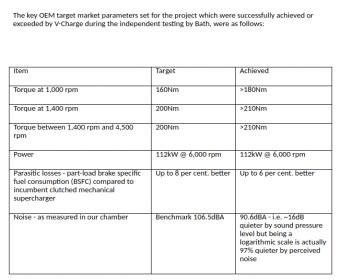

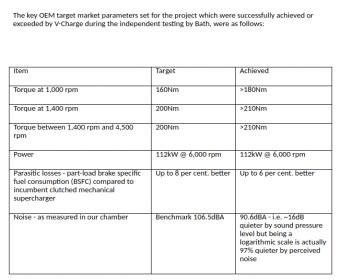

TRK have switched tracks/tech/managements several times. Maybe the new engine downsizing tech V-Charge could finally see them deliver ? These results look impressive

Downsizing a Ford 1.0 engine to deliver 1.5 engine results looks huge

http://www.investegate.co.uk/torotrak-plc--trk-/rns/final-results/201606290700085695C/

TRK have switched tracks/tech/managements several times. Maybe the new engine downsizing tech V-Charge could finally see them deliver ? These results look impressive

Downsizing a Ford 1.0 engine to deliver 1.5 engine results looks huge

http://www.investegate.co.uk/torotrak-plc--trk-/rns/final-results/201606290700085695C/

Last edited:

http://www.investegate.co.uk/torotrak-plc--trk-/rns/v-charge-test-results/201605170700094054Y/

17 May 2016

Torotrak plc

V-Charge testing milestone successfully achieved, meeting OEM target requirements

Torotrak, (LSE: TRK), a leading developer and supplier of emissions reduction and fuel efficiency technology for vehicles, is pleased to announce the on-engine V-Charge testing programme, conducted by University of Bath ('Bath') in collaboration with a global Tier 1 supplier of engine boosting systems and with the participation of the Ford Motor Company ('Ford'), has successfully met the key target requirements.

The results of the independent V-Charge on-engine performance testing, in summary, were:

· Key performance targets successfully achieved or exceeded

· V-Charge in a twin-stage boosting configuration meets the target torque requirements to enable significant engine downsizing

· V-Charge outperforms other advanced boosting systems

Further tests are being completed as Torotrak continues to progress towards demonstrating V-Charge in a Ford Focus from summer 2016 onwards

V-Charge is a variable speed supercharger for gasoline and diesel engines, enabling the level of engine boosting to be adjusted independently of engine speed and providing rapid torque response at any engine speed. V-Charge uses the Group's unique traction drive technology to do this and as a result eliminates the 'lag' associated with conventional boosting technologies, particularly at low engine speed where other boosting systems struggle. V-Charge enables OEMs to radically downsize and downspeed engines by producing more torque from smaller engines at lower engine speeds and therefore delivering lower emissions whilst maintaining the driving feel of a larger engine. Engine downsizing and downspeeding is seen by the industry as critical to meet the challenging post 2020/21 emissions regulations in passenger cars in a cost-effective way.

The successful results announced today, provide an important independent validation of the performance advantages of V-Charge compared to other advanced engine boosting technologies and confirms the inherent advantages of V-Charge to enable significant engine downsizing and downspeeding. Delivering this important milestone is expected to generate increased market pull from a wider range of OEMs and to be the catalyst to securing technology licensing deals with Tier 1 partners.

Chris Brace, Professor of Automotive Propulsion, University of Bath: "The results of our on-engine dynamometer testing and analysis confirm that V-Charge can match or exceed the performance of other advanced boosting systems over a broad range of performance attributes. We believe that the technology offers a unique, purely mechanical solution, to engine boosting systems and is a key enabler for engine downsizing, a critical element of OEMs roadmaps to meet the challenging emissions targets whilst maintaining vehicle performance and driveability."

Adam Robson, Chief Executive Torotrak: "We are very excited about the results achieved from the independent Bath study. The achievement of this major milestone confirms the significant advantages of our V-Charge boosting product and the contribution that the technology can make to the delivery by OEM's of the post 2020/21 emissions targets with cars that customers want to buy. We next look forward to reporting to shareholders on our progress in licensing this important technology into the global passenger car market."

17 May 2016

Torotrak plc

V-Charge testing milestone successfully achieved, meeting OEM target requirements

Torotrak, (LSE: TRK), a leading developer and supplier of emissions reduction and fuel efficiency technology for vehicles, is pleased to announce the on-engine V-Charge testing programme, conducted by University of Bath ('Bath') in collaboration with a global Tier 1 supplier of engine boosting systems and with the participation of the Ford Motor Company ('Ford'), has successfully met the key target requirements.

The results of the independent V-Charge on-engine performance testing, in summary, were:

· Key performance targets successfully achieved or exceeded

· V-Charge in a twin-stage boosting configuration meets the target torque requirements to enable significant engine downsizing

· V-Charge outperforms other advanced boosting systems

Further tests are being completed as Torotrak continues to progress towards demonstrating V-Charge in a Ford Focus from summer 2016 onwards

V-Charge is a variable speed supercharger for gasoline and diesel engines, enabling the level of engine boosting to be adjusted independently of engine speed and providing rapid torque response at any engine speed. V-Charge uses the Group's unique traction drive technology to do this and as a result eliminates the 'lag' associated with conventional boosting technologies, particularly at low engine speed where other boosting systems struggle. V-Charge enables OEMs to radically downsize and downspeed engines by producing more torque from smaller engines at lower engine speeds and therefore delivering lower emissions whilst maintaining the driving feel of a larger engine. Engine downsizing and downspeeding is seen by the industry as critical to meet the challenging post 2020/21 emissions regulations in passenger cars in a cost-effective way.

The successful results announced today, provide an important independent validation of the performance advantages of V-Charge compared to other advanced engine boosting technologies and confirms the inherent advantages of V-Charge to enable significant engine downsizing and downspeeding. Delivering this important milestone is expected to generate increased market pull from a wider range of OEMs and to be the catalyst to securing technology licensing deals with Tier 1 partners.

Chris Brace, Professor of Automotive Propulsion, University of Bath: "The results of our on-engine dynamometer testing and analysis confirm that V-Charge can match or exceed the performance of other advanced boosting systems over a broad range of performance attributes. We believe that the technology offers a unique, purely mechanical solution, to engine boosting systems and is a key enabler for engine downsizing, a critical element of OEMs roadmaps to meet the challenging emissions targets whilst maintaining vehicle performance and driveability."

Adam Robson, Chief Executive Torotrak: "We are very excited about the results achieved from the independent Bath study. The achievement of this major milestone confirms the significant advantages of our V-Charge boosting product and the contribution that the technology can make to the delivery by OEM's of the post 2020/21 emissions targets with cars that customers want to buy. We next look forward to reporting to shareholders on our progress in licensing this important technology into the global passenger car market."

ASA chart

Big move, retrace, consolidation... setting up for another run at that 2.8p resistance and a go at my target of 4-5p I hope

Big move, retrace, consolidation... setting up for another run at that 2.8p resistance and a go at my target of 4-5p I hope

good endto the day, your 4.5p target, looks very likely

ASA - The only caveat on technical side was the (lack of) volume but happy to stick with it for the fundamentals.

Expecting statements from VRS, CPX, TRK amongst others tomorrow. Not expecting anything gamechanging but interesting to monitor progress.

Expecting statements from VRS, CPX, TRK amongst others tomorrow. Not expecting anything gamechanging but interesting to monitor progress.

VRS - wow!

Sounding very confident in Interim Results statement :-

http://www.investegate.co.uk/versarien-plc--vrs-/rns/interim-results/201611290701063633Q/

"With so much progress made following the positive test results from the University of Manchester and National Graphene Institute we can clearly demonstrate an exceptional performance improvement from incorporating graphene into carbon fibre composites. Consequently, the Group is focusing on accelerating development and commercialisation of its graphene enhanced products through partnerships and its own manufacturing capability."

and also announce significant graphene order

http://www.investegate.co.uk/versarien-plc--vrs-/rns/significant-graphene-order/201611290700113616Q/

On 13 October 2016, the Company announced that following the positive test results from the composite project with the National Graphene Institute ("NGI") that the NGI was purchasing a significant quantity from Versarien for a specific project with a major OEM.

The addition of Versarien's GNPs is expected to provide a significant performance improvement to the customers' product and further significant orders would be required to fulfil market potential.

Sounding very confident in Interim Results statement :-

http://www.investegate.co.uk/versarien-plc--vrs-/rns/interim-results/201611290701063633Q/

"With so much progress made following the positive test results from the University of Manchester and National Graphene Institute we can clearly demonstrate an exceptional performance improvement from incorporating graphene into carbon fibre composites. Consequently, the Group is focusing on accelerating development and commercialisation of its graphene enhanced products through partnerships and its own manufacturing capability."

and also announce significant graphene order

http://www.investegate.co.uk/versarien-plc--vrs-/rns/significant-graphene-order/201611290700113616Q/

On 13 October 2016, the Company announced that following the positive test results from the composite project with the National Graphene Institute ("NGI") that the NGI was purchasing a significant quantity from Versarien for a specific project with a major OEM.

The addition of Versarien's GNPs is expected to provide a significant performance improvement to the customers' product and further significant orders would be required to fulfil market potential.

TRK - nice

http://www.investegate.co.uk/torotrak-plc--trk-/rns/half-year-report/201611290700123630Q/

V-Charge - delivering lower fuel consumption and lower emissions engines

· Technology has exceeded expectations in on-engine performance and responsiveness.

· Ford Focus demonstrator test drives with 12 OEMs and 6 Tier 1s successfully completed, generating strong interest in V-Charge.

· On track to complete second demonstrator vehicle, Ford S-MAX (with V-Charge enabled 1.0L 3 cylinder engine replacing a 1.5L 4 cylinder engine).

· Significant interest being shown by multiple global OEMs and Tier 1s in V-Charge technology.

http://www.investegate.co.uk/torotrak-plc--trk-/rns/half-year-report/201611290700123630Q/

V-Charge - delivering lower fuel consumption and lower emissions engines

· Technology has exceeded expectations in on-engine performance and responsiveness.

· Ford Focus demonstrator test drives with 12 OEMs and 6 Tier 1s successfully completed, generating strong interest in V-Charge.

· On track to complete second demonstrator vehicle, Ford S-MAX (with V-Charge enabled 1.0L 3 cylinder engine replacing a 1.5L 4 cylinder engine).

· Significant interest being shown by multiple global OEMs and Tier 1s in V-Charge technology.

TRK - upgrading to wow

The Group has recently completed an in-depth market study identifying the potential sales opportunities for V-Charge. Using detailed engine data supplied by IHS Markit Ltd, and following discussions with a range of OEMs and Tier 1 suppliers, we believe that V-Charge is applicable to a substantial proportion of both single-stage and twin-stage boosted engines, offering fuel economy and emissions benefits which other boosting technologies such as variable geometry turbochargers and eboosters cannot deliver. The results of the study, which have been shared with our potential OEM / Tier 1 partners, show that there is a market opportunity in 2020 of around 25m engines per annum that could be addressed with V-Charge, rising to around 45m engines per annum in 2025.

The Group has recently completed an in-depth market study identifying the potential sales opportunities for V-Charge. Using detailed engine data supplied by IHS Markit Ltd, and following discussions with a range of OEMs and Tier 1 suppliers, we believe that V-Charge is applicable to a substantial proportion of both single-stage and twin-stage boosted engines, offering fuel economy and emissions benefits which other boosting technologies such as variable geometry turbochargers and eboosters cannot deliver. The results of the study, which have been shared with our potential OEM / Tier 1 partners, show that there is a market opportunity in 2020 of around 25m engines per annum that could be addressed with V-Charge, rising to around 45m engines per annum in 2025.

CPX - AGM Statement. Reads well.

http://www.investegate.co.uk/cap-xx...chairman-s-agm-statement/201611290722093553Q/

Our customers and potential partners have continued with rigorous testing of our existing products, both in the field and in the lab, over the last year, with excellent results. At the same time, we have responded to customer feedback and developed product variations for particular customer needs. The Board looks forward to potentially providing additional updates on our automotive applications over the remainder of this quarter and through 2017."

http://www.investegate.co.uk/cap-xx...chairman-s-agm-statement/201611290722093553Q/

Our customers and potential partners have continued with rigorous testing of our existing products, both in the field and in the lab, over the last year, with excellent results. At the same time, we have responded to customer feedback and developed product variations for particular customer needs. The Board looks forward to potentially providing additional updates on our automotive applications over the remainder of this quarter and through 2017."

VAL - nice update on clinical trials

http://www.proactiveinvestors.co.uk...ad-candidate-study-to-be-expanded-169655.html

http://www.proactiveinvestors.co.uk...ad-candidate-study-to-be-expanded-169655.html

The market really doesn't seem to have cottoned on to the real good news from VRS and the hints of good news from CPX and TRK.

A £100k order for graphene might not seem much to the casual observer of VRS

However it in context is a hugely significant development.

The OEM has moved incredibly quickly from first engagement to trial order sizes and holds out promise of much bigger contract values in future from the same customer. Furthermore the Gross Margin on VRS graphene production is 'very high' (I'd guess 70%+).

If VRS can get high margin million pound contracts this early in the market demonstrates how massive the eventual market will be and their leading position in it.

A £100k order for graphene might not seem much to the casual observer of VRS

However it in context is a hugely significant development.

The OEM has moved incredibly quickly from first engagement to trial order sizes and holds out promise of much bigger contract values in future from the same customer. Furthermore the Gross Margin on VRS graphene production is 'very high' (I'd guess 70%+).

If VRS can get high margin million pound contracts this early in the market demonstrates how massive the eventual market will be and their leading position in it.

Last edited:

VAL held a presentation to investors last night. I have no idea on the science and the Management of VAL are very low grade and utilise death spiral financing which kills their own investors. However in my opinion £6m Market Cap is far too low for a cancer drug in Phase I/II trials which is demonstrating safety and efficacy to some extent.

Today 08:05 Price: 6.63

johngilchrist 6,752 posts

RE: Presentation nores

Good to see a few familiar faces last night.

It was an excellent and very well attended presentation, which did provide some answers

1. No more funding required before end of Q1.

2. 15 patients on 201 now, which will report by end of year. Following 3+3 model. I.e.3 on each dose escalation. About 45 patients have gone through screening, and either failed the criterion or couldn't commit to one day a week in London.

3. However trial is to be expanded into full phase 2 efficacy, starting in the new year. That will be for one calendar year. Will involve multiple sites and 2 groups with daily and twice daily 5mg doses. The clinical trial site will be updated sometime in December, including the phase2b outcomes and date shift. The MHRA seem happy with this plan.

4. Going to daily would be difficult now, due to the volume of the solution. So the phase 2b they will use a concentrate, which addresses that problem. They needed the current format so they could cost efficiently do dose escalation.

5. A number of pharmas are having serious discussions on licensing.

Today 08:05 Price: 6.63

johngilchrist 6,752 posts

RE: Presentation nores

Good to see a few familiar faces last night.

It was an excellent and very well attended presentation, which did provide some answers

1. No more funding required before end of Q1.

2. 15 patients on 201 now, which will report by end of year. Following 3+3 model. I.e.3 on each dose escalation. About 45 patients have gone through screening, and either failed the criterion or couldn't commit to one day a week in London.

3. However trial is to be expanded into full phase 2 efficacy, starting in the new year. That will be for one calendar year. Will involve multiple sites and 2 groups with daily and twice daily 5mg doses. The clinical trial site will be updated sometime in December, including the phase2b outcomes and date shift. The MHRA seem happy with this plan.

4. Going to daily would be difficult now, due to the volume of the solution. So the phase 2b they will use a concentrate, which addresses that problem. They needed the current format so they could cost efficiently do dose escalation.

5. A number of pharmas are having serious discussions on licensing.

Waseem Shakoor explains how a Death Spiral Financing works

http://www.shareprophets.com/views/...-death-spiral-works-for-rubbish-aim-companies

http://www.shareprophets.com/views/...-death-spiral-works-for-rubbish-aim-companies

Gervais Williams makes my point but better

http://www.investegate.co.uk/small-...ger-says-big-bumps-ahead/201612020949578178Q/

Really is a time to invest in radical innovative companies.

http://www.investegate.co.uk/small-...ger-says-big-bumps-ahead/201612020949578178Q/

Really is a time to invest in radical innovative companies.

CPX Murata video demo of their Supercap/Battery combo product UMA for which they licensed CPX IPR

<iframe src='http://players.brightcove.net/4741948346001/r1QLbAyn_default/index.html?videoId=5109511460001' allowfullscreen frameborder=0></iframe>

http://www.murata.com/en-global/pro...1bW1ubjNnUWV4OVJvaXhxNmFTdmZMcjRtRzZWQT0ifQ==

<iframe src='http://players.brightcove.net/4741948346001/r1QLbAyn_default/index.html?videoId=5109511460001' allowfullscreen frameborder=0></iframe>

http://www.murata.com/en-global/pro...1bW1ubjNnUWV4OVJvaXhxNmFTdmZMcjRtRzZWQT0ifQ==

CPX Murata video demo of their Supercap/Battery combo product UMA for which they licensed CPX IPR

Looks positive

Last edited by a moderator:

CPX - a very significant RNS. Looks like technology validated in evaluations by Auto OEMs and they've come back on commercial terms / production cost down initiatives and it's been a success. This should open the floodgates to major licensing agreements now. The Truckstart opportunity alone was described as a $1bn p.a. Total Addressable Market previously. Success for CPX should see it valued in the hundreds of millions. (vs current £16m odd Mkt Cap)

http://www.investegate.co.uk/cap-xx...ive-supercapacitor-units/201612070700061038R/

http://www.investegate.co.uk/cap-xx...ive-supercapacitor-units/201612070700061038R/

jaspa888

Local Club Star

- Joined

- Aug 1, 2007

- Runs

- 2,022

Thanks again for your CPX tip, s28. I've not been this excited about a company for a many years. Huge potential, great product, growing sector. Surely only bad management can xxxx this up from here...

I agree, still have to be reservations about Management but the more licences they sign the more the commercial success will be in hands of bigger companies with existing routes to market. Thus I hope it could be like ARM another licensing model stock.

jaspa888

Local Club Star

- Joined

- Aug 1, 2007

- Runs

- 2,022

Im retiring if its half as successful as ARM haha

On the subject of multibaggers I was just reading an Red Hot Penny Shares newsletter about some sister publication analysing historic '100 baggers'. They make the point that frequently a characteristic shared by such stocks is a 'twin engine' propelling the growth.

i.e. it is much harder for a single engine stock to go up 100x because it would require either the E to go up 100x or the PER (Price Earnings Ratio) to go up 100x (all other things being equal)

it is 'easier' if both the E and PER go up say 10x for a combined 100x result on the P

The additional point to make with CPX is that it doesn't have an E (yet). However it does have a 'hidden dividend' in the form of annual R&D expenditure which currently equates to 30% of annual turnover. One would expect this to normalise once the tech is licensed and allow a big hockey stick when combined with operational leverage of the model.

i.e. it is much harder for a single engine stock to go up 100x because it would require either the E to go up 100x or the PER (Price Earnings Ratio) to go up 100x (all other things being equal)

it is 'easier' if both the E and PER go up say 10x for a combined 100x result on the P

The additional point to make with CPX is that it doesn't have an E (yet). However it does have a 'hidden dividend' in the form of annual R&D expenditure which currently equates to 30% of annual turnover. One would expect this to normalise once the tech is licensed and allow a big hockey stick when combined with operational leverage of the model.

HZD

Quite a messy chart, no real discernible trend. Has had recent history of steady declines with a 50% odd retracement before resumption of downtrend. We've recently had what looks like an impressive short term bounce (50% retrace) from another fall but my fear is this has simply seen the stock spike into a resistance area (135-150 has been significant level of both support and resistance) and the moving average level.

At best i can only see consolidation right now setting a base for a larger move later (ie could be dead money for a while) whilst my more likely expectation would be having just challenged resistance it may go down and challenge / re-test support in short term. The longer it stays below the 200 day MA the more nervous i'd be that something fundamentally wrong with story. (and vice versa if it goes over 200 day MA)

Having said that note there was a bullish Golden Cross a few months back and it broke down so the signals on this stock not very reliable.

Quite a messy chart, no real discernible trend. Has had recent history of steady declines with a 50% odd retracement before resumption of downtrend. We've recently had what looks like an impressive short term bounce (50% retrace) from another fall but my fear is this has simply seen the stock spike into a resistance area (135-150 has been significant level of both support and resistance) and the moving average level.

At best i can only see consolidation right now setting a base for a larger move later (ie could be dead money for a while) whilst my more likely expectation would be having just challenged resistance it may go down and challenge / re-test support in short term. The longer it stays below the 200 day MA the more nervous i'd be that something fundamentally wrong with story. (and vice versa if it goes over 200 day MA)

Having said that note there was a bullish Golden Cross a few months back and it broke down so the signals on this stock not very reliable.

Last edited:

What's going on in cars is incredible. Never seen tech moving so fast in this area. People seriously talking about Energy Independent Vehicles now ! (i.e. use of some energy harvesting/energy production on board)

4. ENERGY INDEPENDENT VEHICLES ON LAND 4.1. Case Western Reserve University USA cars 4.2. Dalian sightseeing car China 4.3. IFEVS microcar Italy 4.4. Immortus car Australia 4.5. NFH-H microbus China 4.6. Solar powered power chair in 2013 4.7. Solar racing cars worldwide 4.8. Venturi Eclectic car France 4.9. VineRobot Europe

Read more at: http://www.idtechex.com/research/reports/energy-independent-vehicles-2016-2026-000446.asp

Hoping/expecting 2017 will be a great year for CPX, TRK, VRS

4. ENERGY INDEPENDENT VEHICLES ON LAND 4.1. Case Western Reserve University USA cars 4.2. Dalian sightseeing car China 4.3. IFEVS microcar Italy 4.4. Immortus car Australia 4.5. NFH-H microbus China 4.6. Solar powered power chair in 2013 4.7. Solar racing cars worldwide 4.8. Venturi Eclectic car France 4.9. VineRobot Europe

Read more at: http://www.idtechex.com/research/reports/energy-independent-vehicles-2016-2026-000446.asp

Hoping/expecting 2017 will be a great year for CPX, TRK, VRS

TRK - surprised at reaction to news of delay to licensing off-highway KERS, think main story is V-Charge and passenger cars

http://www.investegate.co.uk/torotrak-plc--trk-/rns/trading-update/201612160700090222S/

http://www.investegate.co.uk/torotrak-plc--trk-/rns/trading-update/201612160700090222S/

TRK mullered today. They've accumulated losses of c.£30m developing their tech over the years according to their balance sheet. Partnerships with likes of JCB and Caterpillar in off-highway suggest the tech is validated and has commercial potential. A Market Cap of only £14m (with c.£6m (though rapidly depleting cash) seems an over-reaction.

Another VRS RNS and it seems on face of it to be with an inconsequential small firm with turnover in single digit millions. I think there is real game changing strategy in place and I'm thinking this has the makings of an immense story. Once people wake up this could be explosive.

VRS - starting to move

Graphene is going to be a huge growth sector and this Company which looks to have a lot of validation for it's positioning is only valued at c.£10m, claims to have made transformational acquisition and is due to hold an Investor Day in a few weeks. Looks like it's gearing up for a move.

Versarien plc

("Versarien" or the "Company" or the "Group")

Investor Event

Versarien plc (AIM:VRS), the advanced materials group, is pleased to announce that it will be hosting a site visit to its newly acquired facility at AAC Cyroma in Banbury, Oxfordshire, for private investors on 9 of November 2016 between 9am and 11am.

Investors and shareholders should register their interest in attending this event at https://www.eventbrite.co.uk/e/versarien-investor-meeting-tickets-28652122269

ASA had results today. Again historic so pretty meaningless in and of themselves. However it shows the trend towards profitability is accelerating. Longer term my main bull case for it was the gold side and that has to be tempered with current low price of gold which has totally blown my expectations given the likely uncertainty with a Trump presidency on the way. Longer term I still think Gold and ASA as a leveraged way to play it is one of the best trades around but after a 600% move in a few months some sideways consolidation likely. Nickel could become a legitimate story for ASA if China and US reflations work but I have low conviction in these as of yet.

Muhammad10

T20I Debutant

- Joined

- Jul 7, 2013

- Runs

- 6,284

Sorry, but we cannot allow any links to other forums.

VAL fyi

new valirx company flyer leaftlet just released

https://drive.google.com/file/d/0B-Tn0fowHgy8b3E5Skt0NWJLNDYyMzBDVjBxakpvV0swV2ZJ/view

new valirx company flyer leaftlet just released

https://drive.google.com/file/d/0B-Tn0fowHgy8b3E5Skt0NWJLNDYyMzBDVjBxakpvV0swV2ZJ/view

RRR not a fan of management but chart shaping nicely and March 2017 dividend due of £0.5m should allow them to fund themselves without recourse to shareholders or death spiral financiers

Andrew Bell piece starts 15:47 in

<iframe width="560" height="315" src="https://www.youtube.com/embed/Ip0BD3Fp_fM" frameborder="0" allowfullscreen></iframe>

Andrew Bell piece starts 15:47 in

<iframe width="560" height="315" src="https://www.youtube.com/embed/Ip0BD3Fp_fM" frameborder="0" allowfullscreen></iframe>

ALO - looks like it could be a good acquisition £6m in cash and shares for a project which is meant to be close to restart, has been mined recently and supposedly has an NPV of $250m at $2.50/lb copper

I'd ask questions as to why the vendors would sell out a $250m NPV project for 'only £6m' but then most of the consideration is in shares so they retain some upside via the equity component

My other issue would be it muddies the strategy waters a little bit from being a Gold play to a Gold and Industrial metals play and I'm not to keen on exposure to the economically cyclical metals like Copper.

Given Trump and China reflation hopes for 2017 it may play well for a while but needs to be monitored now for any slippages.

I'd ask questions as to why the vendors would sell out a $250m NPV project for 'only £6m' but then most of the consideration is in shares so they retain some upside via the equity component

My other issue would be it muddies the strategy waters a little bit from being a Gold play to a Gold and Industrial metals play and I'm not to keen on exposure to the economically cyclical metals like Copper.

Given Trump and China reflation hopes for 2017 it may play well for a while but needs to be monitored now for any slippages.

RRR really interests me because it is not an easy one to get your head around.

RRR owns 1.2% of Jupiter Mines.

Jupiter Mines owns 49.9% of Tshipi Manganese mine.

Tshipi Mines has announced it will pay a dividend to it's shareholders because it's doing so well right now. They announced a distribution which will payout $55m to Jupiter and $650k to RRR.

RRR's total Mkt Cap is only £2.9m so for £2.9m you get to 'own' the dividend stream of £0.5m which seems like a Dividend Yield of about (£0.5m/£2.9m)x100= 17%

So given most stocks/indexes trade on dividend yields of 3-4% it might be seen as implying RRR is 4-5x undervalued right now ?

Thing is having looked into this it looks like the initial Dividend is just an interim dividend. there is likelihood of a further distribution this year. Furthermore the underlying economics seem to be getting even better. When the distribution was announced Manganese was trading at c.$7/DMTU (dry metric tonne unit) [Yes a unit that hardly anybody has a clue about for a commodity hardly anybody has a clue about]

Since then it looks like the Manganese price has gone up to $9/DMTU. Tshipi was supposedly profitable at $2/DMTU so at $9/DMTU it must be throwing off incredible amounts of cash.

I make it 2m tonnes annual production x $9/DMTU x 38% manganese = (2m x $9 x 38 = Revenue of c.$740m p.a.)

Assuming $2/DMTU breakeven that is profitability of c. 600m p.a.

Jupiters share of that ? c.$300m p.a.

RRR share of that ? c.$3.6m p.a.

Not entirely sure my numbers are correct, and it's a very opaque market and the current price spike may well not last so one shouldn't build castles in the sky. Furthermore Andrew Bell the CEO of RRR has a tendency to squander shareholder funds so significant reinvestment risk here and a deserved Management risk discount. However with chart and fundamentals marrying up right now it's definitely one to keep an eye on

RRR owns 1.2% of Jupiter Mines.

Jupiter Mines owns 49.9% of Tshipi Manganese mine.

Tshipi Mines has announced it will pay a dividend to it's shareholders because it's doing so well right now. They announced a distribution which will payout $55m to Jupiter and $650k to RRR.

RRR's total Mkt Cap is only £2.9m so for £2.9m you get to 'own' the dividend stream of £0.5m which seems like a Dividend Yield of about (£0.5m/£2.9m)x100= 17%

So given most stocks/indexes trade on dividend yields of 3-4% it might be seen as implying RRR is 4-5x undervalued right now ?

Thing is having looked into this it looks like the initial Dividend is just an interim dividend. there is likelihood of a further distribution this year. Furthermore the underlying economics seem to be getting even better. When the distribution was announced Manganese was trading at c.$7/DMTU (dry metric tonne unit) [Yes a unit that hardly anybody has a clue about for a commodity hardly anybody has a clue about]

Since then it looks like the Manganese price has gone up to $9/DMTU. Tshipi was supposedly profitable at $2/DMTU so at $9/DMTU it must be throwing off incredible amounts of cash.

I make it 2m tonnes annual production x $9/DMTU x 38% manganese = (2m x $9 x 38 = Revenue of c.$740m p.a.)

Assuming $2/DMTU breakeven that is profitability of c. 600m p.a.

Jupiters share of that ? c.$300m p.a.

RRR share of that ? c.$3.6m p.a.

Not entirely sure my numbers are correct, and it's a very opaque market and the current price spike may well not last so one shouldn't build castles in the sky. Furthermore Andrew Bell the CEO of RRR has a tendency to squander shareholder funds so significant reinvestment risk here and a deserved Management risk discount. However with chart and fundamentals marrying up right now it's definitely one to keep an eye on

Last edited by a moderator:

TJI - cash has been released for the second plot, but the SP does not seem to be affected

http://uk.advfn.com/stock-market/lo...d-Completion-of-disposal-of-Arjan-Pl/73355946

http://uk.advfn.com/stock-market/lo...d-Completion-of-disposal-of-Arjan-Pl/73355946

Sad. This guy (a former colleague) unlucky enough to get caught.

https://www.bloomberg.com/news/arti...anager-jailed-for-1-year-over-insider-trading

What's surprising is the piffling amounts. The guy would have been getting 7 figure bonuses at Blackrock.

https://www.bloomberg.com/news/arti...anager-jailed-for-1-year-over-insider-trading

What's surprising is the piffling amounts. The guy would have been getting 7 figure bonuses at Blackrock.

Sad. This guy (a former colleague) unlucky enough to get caught.

https://www.bloomberg.com/news/arti...anager-jailed-for-1-year-over-insider-trading

What's surprising is the piffling amounts. The guy would have been getting 7 figure bonuses at Blackrock.

sometimes greed just takes over... crazy

RRR - Andrew Bell talks about their Jupiter Mines stake being worth c.£10m (21 minutes in)

RRR Mkt Cap is c.£3m

<iframe width="560" height="315" src="https://www.youtube.com/embed/Ip0BD3Fp_fM" frameborder="0" allowfullscreen></iframe>

I did my own numbers in post #6209 above

If I'm right you could make a case for £20-30m!

RRR Mkt Cap is c.£3m

<iframe width="560" height="315" src="https://www.youtube.com/embed/Ip0BD3Fp_fM" frameborder="0" allowfullscreen></iframe>

I did my own numbers in post #6209 above

If I'm right you could make a case for £20-30m!

Last edited:

It's New Year share tipping time of year. I like to go off the beaten track on these and not go for stuff mentioned in papers as they tend to be heavily broked by self-interested parties.

A few ideas I've come across (and mentioned myself occassionally/often on here)..

CAP-XX (CPX)

5.2p mid at COB 23rd Dec

Good progress in monetisation of intellectual property and the sale of small and large super capacitors.

Completed the sale of a non-exclusive licence with AVX with upfront licence fees and guaranteed royalty payments spread over the first three years during fiscal year to June 2016

AVX product launched in September 2016 with first quarter royalty payment received.

The Company benefited from a sharp increase in royalties from Murata, up 117% following a 106% rise in the previous year.

Achieved first design win for the new Thinline product range for a small credit card for customer delivery in 2017. A thinner 400 micron product is under development.

Significant operational cash savings realised and the Company has identified further cost savings, which should incrementally improve gross margin and enhance future product competiveness. The Company now expects to see the truckStart module selling to truck OEMs and aftermarket chains for less than US$500, a significant reduction from the $1,000 price that was previously envisaged.

During FY16, the Company expanded its development efforts for automotive applications both in terms of new customers and product.

Cash reserves at the end of June were A$0.3 million. A$1.7 million was received from AVX following the year end. R&D tax rebate from the Australian Tax Office of A$1.5m received in October 2016

The Company was awarded the Society of Automotive Engineers - Australasia's (SAE-A) 2016 Platinum Award for overall engineering excellence, for its automotive powerModule and truckStart projects, having faced tough competition from Ford, GM, SC Innovation and others. CAP-XX also won the SAE-A's 2016 Gold Award in the Manufacturing/non-OE (non-Original Equipment) category.

A few ideas I've come across (and mentioned myself occassionally/often on here)..

CAP-XX (CPX)

5.2p mid at COB 23rd Dec

Good progress in monetisation of intellectual property and the sale of small and large super capacitors.

Completed the sale of a non-exclusive licence with AVX with upfront licence fees and guaranteed royalty payments spread over the first three years during fiscal year to June 2016

AVX product launched in September 2016 with first quarter royalty payment received.

The Company benefited from a sharp increase in royalties from Murata, up 117% following a 106% rise in the previous year.

Achieved first design win for the new Thinline product range for a small credit card for customer delivery in 2017. A thinner 400 micron product is under development.

Significant operational cash savings realised and the Company has identified further cost savings, which should incrementally improve gross margin and enhance future product competiveness. The Company now expects to see the truckStart module selling to truck OEMs and aftermarket chains for less than US$500, a significant reduction from the $1,000 price that was previously envisaged.

During FY16, the Company expanded its development efforts for automotive applications both in terms of new customers and product.

Cash reserves at the end of June were A$0.3 million. A$1.7 million was received from AVX following the year end. R&D tax rebate from the Australian Tax Office of A$1.5m received in October 2016

The Company was awarded the Society of Automotive Engineers - Australasia's (SAE-A) 2016 Platinum Award for overall engineering excellence, for its automotive powerModule and truckStart projects, having faced tough competition from Ford, GM, SC Innovation and others. CAP-XX also won the SAE-A's 2016 Gold Award in the Manufacturing/non-OE (non-Original Equipment) category.

Erogenous Jones 27 Dec '16 - 11:10 - 24 of 45 0 0

VLS - gas to liquids. The company is at the point of commissioning plant in Oklahoma, which harnesses the gases from landfill and converts into diesel, jet fuel and waxes.

The company has sufficient funding for the current projects but the depressed share price has been the result of delay, low oil price and surplus oil.

Once commissioning is completed, revenue is likely to be gradual as production commences. However, what it will allow is revenue from consultancy in other continents, in particular Asia through strategic partnerships.

The bid price is IRO 37.75p. My target price is 150p. However, as this is a support business that might be construed as part of the oil industry, I have another equity tucked up my sleeve!

VLS - gas to liquids. The company is at the point of commissioning plant in Oklahoma, which harnesses the gases from landfill and converts into diesel, jet fuel and waxes.

The company has sufficient funding for the current projects but the depressed share price has been the result of delay, low oil price and surplus oil.

Once commissioning is completed, revenue is likely to be gradual as production commences. However, what it will allow is revenue from consultancy in other continents, in particular Asia through strategic partnerships.

The bid price is IRO 37.75p. My target price is 150p. However, as this is a support business that might be construed as part of the oil industry, I have another equity tucked up my sleeve!

Arthur_Lame_Stocks27 Dec '16 - 07:38 - 3 of 45 0 0

Transense Technologies (TRT)

The market cap is just £9m with over £3m in the bank. They have been developing their technology for years but finally seem to be coming to the point of commercial acceptance. They have recently launched a new product, I track 2 into the mining market and have recently licenced some tech to GE for up to $750k. They also have a tie up with one unnamed major OEM, possibly Siemens.

I believe the time has finally arrived for TRT and think this could be their year.

Arthur

Transense Technologies (TRT)

The market cap is just £9m with over £3m in the bank. They have been developing their technology for years but finally seem to be coming to the point of commercial acceptance. They have recently launched a new product, I track 2 into the mining market and have recently licenced some tech to GE for up to $750k. They also have a tie up with one unnamed major OEM, possibly Siemens.

I believe the time has finally arrived for TRT and think this could be their year.

Arthur

Alchemy 27 Dec '16 - 08:40 - 7 of 45 0 1

One of Bill Gates' focii is "big battery". He cites research into Vanadium batteries. RedT have them in early commercial production.

Rarely has such promise shown on recent commercial UK stock exchange Radar.

Read about in on the web-site and elsewhere. RedT in Google ; also see Vanadium for "under the bonnet" knowledge.

They have been at 16 prior to raising £12million in the past three weeks. Now at 9, I'd think 18 is a foregone conclusion once references are published.

Get on the train where it suits you as order book zooms.

You'll be in the sweet spot of practical green-ness.

One of Bill Gates' focii is "big battery". He cites research into Vanadium batteries. RedT have them in early commercial production.

Rarely has such promise shown on recent commercial UK stock exchange Radar.

Read about in on the web-site and elsewhere. RedT in Google ; also see Vanadium for "under the bonnet" knowledge.

They have been at 16 prior to raising £12million in the past three weeks. Now at 9, I'd think 18 is a foregone conclusion once references are published.

Get on the train where it suits you as order book zooms.

You'll be in the sweet spot of practical green-ness.

The Trump reflation trade has been a big win for UK listed US facing 'plant equipment/hire' type companies already. These companies can be very cyclical so should be v.v.sensitive to any Trump reflation of US economy. The guy is a builder and his chief strategist Bannan really wants to make a populist splash with big infrastructure spending. e.g. AHT LVD SOM AGK

One stock that hasn't mode much yet is TAN despite them saying pre-Trump election that things were already looking up and their NAV was 24p vs 12p share price

TAN own 49% of Snorkel https://www.snorkelusa.com/Home.aspx

One stock that hasn't mode much yet is TAN despite them saying pre-Trump election that things were already looking up and their NAV was 24p vs 12p share price

TAN own 49% of Snorkel https://www.snorkelusa.com/Home.aspx

Last edited:

jaspa888

Local Club Star

- Joined

- Aug 1, 2007

- Runs

- 2,022

CPX

Great RNS.

CAP-XX is pleased to announce that its licensee, Murata, has introduced the DMH Series, the world's lowest profile 0.4mm supercapacitor. The product, which uses Cap-XX's supercapacitor technology, is for peak power assist, as required in wearables applications and various other devices.

Murata will present the product today at the Consumer Electronics Show, (CES) which will be held in Las Vegas from January 5th to 8th, 2017. Production is scheduled to start in February 2016. Details of the device can be seen at:

http://www.murata.com/en-us/about/newsroom/news/product/capacitor/2017/0105

Great RNS.

CAP-XX is pleased to announce that its licensee, Murata, has introduced the DMH Series, the world's lowest profile 0.4mm supercapacitor. The product, which uses Cap-XX's supercapacitor technology, is for peak power assist, as required in wearables applications and various other devices.

Murata will present the product today at the Consumer Electronics Show, (CES) which will be held in Las Vegas from January 5th to 8th, 2017. Production is scheduled to start in February 2016. Details of the device can be seen at:

http://www.murata.com/en-us/about/newsroom/news/product/capacitor/2017/0105

CPX things looking v good

CAP-XX licensee Introduces 0.4mm supercapacitor

CAP-XX is pleased to announce that its licensee, Murata, has introduced the DMH Series, the world's lowest profile 0.4mm supercapacitor. The product, which uses Cap-XX's supercapacitor technology, is for peak power assist, as required in wearables applications and various other devices.

Murata will present the product today at the Consumer Electronics Show, (CES) which will be held in Las Vegas from January 5th to 8th, 2017. Production is scheduled to start in February 2016. Details of the device can be seen at:

http://www.murata.com/en-us/about/newsroom/news/product/capacitor/2017/0105

http://www.investegate.co.uk/cap-xx-limited--cpx-/rns/murata-product-launch/201701051140044552T/

Murata wearables makes me think Apple. Massive if right.

CAP-XX licensee Introduces 0.4mm supercapacitor

CAP-XX is pleased to announce that its licensee, Murata, has introduced the DMH Series, the world's lowest profile 0.4mm supercapacitor. The product, which uses Cap-XX's supercapacitor technology, is for peak power assist, as required in wearables applications and various other devices.

Murata will present the product today at the Consumer Electronics Show, (CES) which will be held in Las Vegas from January 5th to 8th, 2017. Production is scheduled to start in February 2016. Details of the device can be seen at:

http://www.murata.com/en-us/about/newsroom/news/product/capacitor/2017/0105

http://www.investegate.co.uk/cap-xx-limited--cpx-/rns/murata-product-launch/201701051140044552T/

Murata wearables makes me think Apple. Massive if right.

CPX Fundamentals have long justified a major up move, now Technicals may be aligning as well

. I think CPX should be valued at £50-100m given the investment to date and the future potential of existing royalties/licensing agreements. Even before other contracts and Auto market.

7p and 9p looks like the last resistance areas before a move to 20/30/40p I hope

. I think CPX should be valued at £50-100m given the investment to date and the future potential of existing royalties/licensing agreements. Even before other contracts and Auto market.

7p and 9p looks like the last resistance areas before a move to 20/30/40p I hope

CPX

Great RNS.

CAP-XX is pleased to announce that its licensee, Murata, has introduced the DMH Series, the world's lowest profile 0.4mm supercapacitor. The product, which uses Cap-XX's supercapacitor technology, is for peak power assist, as required in wearables applications and various other devices.

Murata will present the product today at the Consumer Electronics Show, (CES) which will be held in Las Vegas from January 5th to 8th, 2017. Production is scheduled to start in February 2016. Details of the device can be seen at:

http://www.murata.com/en-us/about/newsroom/news/product/capacitor/2017/0105

The move looks like there was some leakiness beforehand. Will be interesting to see if Murata announce/show off design wins during CES.

jaspa888

Local Club Star

- Joined

- Aug 1, 2007

- Runs

- 2,022

The move looks like there was some leakiness beforehand. Will be interesting to see if Murata announce/show off design wins during CES.

There was talk of an impending RNS yesterday morning on ADVFN, so definitely a leaky stock.

CPX credit where credit is due in this case it was good research from the LSE forum boys

Murata had a press release on December 20th saying they would launch a new supercapacitor at CES on January 5th. The LSE boys were onto it a few days ago.

http://www.murata.com/en-us/about/newsroom/news/event/americas/2016/1220

It's a nice feeling when a multi-billion dollar Apple component suppliers headlines their CES show with 'our' products. Really looks like Murata have our backs now.

With Murata taking over Sony's Battery division the potential going forward looks immense.

I suspect Murata have already bid for CPX lock stock and barrel but the CPX Management who IPO'd it at 100p will want a full price not a cheap Chinese takeaway. Think CEO Kongats has 10m shares? You'd think given this is his life work he'd expect 10m+ as an adequate reward for his perseverance.

Murata had a press release on December 20th saying they would launch a new supercapacitor at CES on January 5th. The LSE boys were onto it a few days ago.

http://www.murata.com/en-us/about/newsroom/news/event/americas/2016/1220

It's a nice feeling when a multi-billion dollar Apple component suppliers headlines their CES show with 'our' products. Really looks like Murata have our backs now.

With Murata taking over Sony's Battery division the potential going forward looks immense.

I suspect Murata have already bid for CPX lock stock and barrel but the CPX Management who IPO'd it at 100p will want a full price not a cheap Chinese takeaway. Think CEO Kongats has 10m shares? You'd think given this is his life work he'd expect 10m+ as an adequate reward for his perseverance.

jaspa888

Local Club Star

- Joined

- Aug 1, 2007

- Runs

- 2,022

The CPX guys have a done a great job in getting this to license stage so quickly.

Ive been involved in many stocks where the company had huge potential, but any distinctive competence was dissipated due to delays - usually external, but sometimes through naivety.

Ive been involved in many stocks where the company had huge potential, but any distinctive competence was dissipated due to delays - usually external, but sometimes through naivety.

CPX -

http://www.murata.com/en-global/about/newsroom/news/event/japan/2017/0110

looks like things could be heating up

http://www.murata.com/en-global/about/newsroom/news/event/japan/2017/0110

looks like things could be heating up

Interesting

Power Train

We will introduce a variety of power supply modules helping to make drive devices more compact and efficient.

- Lithium-ion battery for engine starting

The booth will introduce thin, compact lithium-ion batteries with laminating technology first developed for ceramic capacitors. Thanks to Murata's unique electrode structure, these products offer industry-leading output in a small and thin form.

Power Train

We will introduce a variety of power supply modules helping to make drive devices more compact and efficient.

- Lithium-ion battery for engine starting

The booth will introduce thin, compact lithium-ion batteries with laminating technology first developed for ceramic capacitors. Thanks to Murata's unique electrode structure, these products offer industry-leading output in a small and thin form.

jaspa888

Local Club Star

- Joined

- Aug 1, 2007

- Runs

- 2,022

What are your current thoughts on oil stocks s28?

I don't like oil stocks because I'm bearish on growth and thus economically cyclical commodities such as oil/coal/copper/iron ore etc However I am prepared to believe the Trump reflation trade may work as a fad so fast money traders might find opportunities in coming months in these sectors on specific stocks

jaspa888

Local Club Star

- Joined

- Aug 1, 2007

- Runs

- 2,022

I particularly excited about HURR at the moment. Great prospects, great management team, money in the bank, rising POO. But high risk, as you already know.

CPX Fundamentals have long justified a major up move, now Technicals may be aligning as well

. I think CPX should be valued at £50-100m given the investment to date and the future potential of existing royalties/licensing agreements. Even before other contracts and Auto market.

7p and 9p looks like the last resistance areas before a move to 20/30/40p I hope

holding well on 7p, hopefully 9p can be tested soon

CPX Fundamentals have long justified a major up move, now Technicals may be aligning as well

. I think CPX should be valued at £50-100m given the investment to date and the future potential of existing royalties/licensing agreements. Even before other contracts and Auto market.

7p and 9p looks like the last resistance areas before a move to 20/30/40p I hope

Consolidating nicely on weekly chart prior to what looks like a good period of newsflow. Normally I would be a bit cautious with the stock price on the daily chart showing divergence from support in form of MA lines. However just maybe this time it's different.

Similar threads

- Replies

- 23

- Views

- 1K

- Replies

- 98

- Views

- 3K

- Replies

- 1

- Views

- 186

- Replies

- 2

- Views

- 181

- Replies

- 33

- Views

- 471