Iron ore price surges past $US90, continues to surprise analysts

By Graeme Powell

Updated about an hour ago

[IMG]

The price of iron ore continues to defy market expectations, surging past $US90 a tonne for the first time in more than two years.

The iron ore spot price jumped $US5.61 overnight and is now trading at $US92.23 a tonne.

It is the first time the price has climbed beyond the $US90 mark since August 2014.

The Federal Government had forecast iron ore prices to average $US55 a tonne in 2016-2017.

The current high prices are expected to add billions of dollars in tax receipts for the federal and state governments.

In another development, the price of iron ore contracts traded on the Dalian exchange hit $US101.76 a tonne.

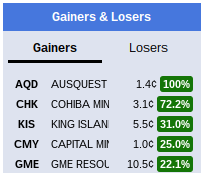

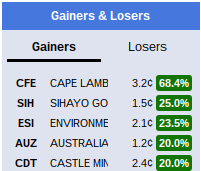

The higher prices have seen the share prices of iron ore companies in Western Australia jump sharply in recent months.

Shares in the Perth-based Fortescue Metals Group rose more than 6 per cent or 40 cents on Monday, to trade at $6.88.

Perth-based mining analyst Peter Strachan said a number of low-quality iron ore mines in China had closed, but that still did not explain the continuing surge in prices.

"There's around 130 to 140 million tonnes of capacity in China that has been closed down and they are preferring to buy the higher grade iron ore from Australia because they are lower polluting and cheaper to put through their steel mills," he said.

"But despite that, when you tumble the numbers there's about 70 million tonnes a year net surplus of iron ore in the market, so it appears the Chinese are building some sort of stock pile that's perhaps for their own national security reasons."

Mr Strachan said everyone, including the Federal Government, had been surprised by the surge in iron ore prices and he had now given up trying to forecast the price of the commodity.

"If you just look at supply and demand you'd expect that the iron ore price would be back below $70 a tonne," he said.

"But here we are knocking on the door of $100 a tonne."

http://www.abc.net.au/news/2017-02-14/iron-ore-price-continues-to-defy-expectations/8268066

59 - 10408 of 10648

59 - 10408 of 10648

at the moment indulge in completely risk free endeavours when I get a bit of time off

at the moment indulge in completely risk free endeavours when I get a bit of time off