VRS almost a 100% move in a few days. I'd not dissuade anyone from booking some profit on such a move but this is the sort of story which can just get bigger and bigger. Especially with potentially imminent newsflow from the McLaren F1 car launch on Friday 24th Feb

-

Contact the PP Team

Connect with us

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying shares?

- Thread starter DeadlyVenom

- Start date

Hedge Funds try to corner market in cobalt

https://www.ft.com/content/4f88cb60-f8f7-11e6-bd4e-68d53499ed71

https://www.ft.com/content/4f88cb60-f8f7-11e6-bd4e-68d53499ed71

GUN Management need to pull their fingers out. Stock trading as discount to assets doesn't say much for Management. Hoping due to Lenigas links they will come up with hot Cobalt/Lithium RTO opp soon. He is all over the subject on Twitter. Having huge success with likes of EMH, PREM, Artemis, Macarthur etc

Graphite Investors Beware - Prices Are About To Collapse

http://seekingalpha.com/article/4047957-graphite-investors-beware-prices-collapse

Quite a strong view

http://seekingalpha.com/article/4047957-graphite-investors-beware-prices-collapse

Quite a strong view

Watch out for RLH, the shellmeister Chris Akers is involved now with 29% and he has a bit of a following

http://www.investegate.co.uk/red-le...nges-and-nomad-appointed/201702280700089795X/

Akers has paid 0.1p ; would not be surprised to see people chasing it at 0.2p

http://www.investegate.co.uk/red-le...nges-and-nomad-appointed/201702280700089795X/

Akers has paid 0.1p ; would not be surprised to see people chasing it at 0.2p

VAL peer reviewed articles are big validation

http://www.investegate.co.uk/valirx...iewed-articles-on-val401/201702280700239778X/

http://www.investegate.co.uk/valirx...iewed-articles-on-val401/201702280700239778X/

SML mention magic word cobalt but grades look a bit low to me

http://www.investegate.co.uk/strate...ralisation-at-hanns-camp/201702280700210232Y/

http://www.investegate.co.uk/strate...ralisation-at-hanns-camp/201702280700210232Y/

Watch out for RLH, the shellmeister Chris Akers is involved now with 29% and he has a bit of a following

http://www.investegate.co.uk/red-le...nges-and-nomad-appointed/201702280700089795X/

Akers has paid 0.1p ; would not be surprised to see people chasing it at 0.2p

That was a quick move, missed it :-(

RRR poised to move higher, dividend from Jupiter Mines should be received in next two weeks. Jupiter will also then probably announce next strategic steps which could include listing or takeover. Either way more liquidity and value exhibiting coming on this one

http://www.valuethemarkets.com/index.php/2017/02/28/red-rock-resources/

http://www.valuethemarkets.com/index.php/2017/02/28/red-rock-resources/

VAL really disappointing that they spoofed the market with a good news RNS and then did a hugely discounted placing. This is a proper placing though rather than interminable Darwin/Yorkville tap so hopefully will clear overhang quicker. Market cap is simply wrong for a potential cancer treatment.

GUN

Outlook

The Company has and continues to look at a number of investments that fit within our investment strategy and we are confident that we will be able to successfully conclude one or more investments in the near future that should hopefully generate further significant returns for shareholders. It is pleasing that Gunsynd is clearly in a much better position than it was six months prior and with the resources sector looking more buoyant we feel confident in the future.

http://www.investegate.co.uk/gunsynd-plc--gun-/rns/half-year-report/201703021256563727Y/

Outlook

The Company has and continues to look at a number of investments that fit within our investment strategy and we are confident that we will be able to successfully conclude one or more investments in the near future that should hopefully generate further significant returns for shareholders. It is pleasing that Gunsynd is clearly in a much better position than it was six months prior and with the resources sector looking more buoyant we feel confident in the future.

http://www.investegate.co.uk/gunsynd-plc--gun-/rns/half-year-report/201703021256563727Y/

RRR after big initial move 0.40 to 0.80 consolidating now at around 0.60. Still a bit more sideways working needed but then expect a wave 2 and wave 3 move higher.

Expect move here within 2 weeks now. If it can break 1p can see 2p v.quickly

VRS - starting to move

Graphene is going to be a huge growth sector and this Company which looks to have a lot of validation for it's positioning is only valued at c.£10m, claims to have made transformational acquisition and is due to hold an Investor Day in a few weeks. Looks like it's gearing up for a move.

Versarien plc

("Versarien" or the "Company" or the "Group")

Investor Event

Versarien plc (AIM:VRS), the advanced materials group, is pleased to announce that it will be hosting a site visit to its newly acquired facility at AAC Cyroma in Banbury, Oxfordshire, for private investors on 9 of November 2016 between 9am and 11am.

Investors and shareholders should register their interest in attending this event at https://www.eventbrite.co.uk/e/versarien-investor-meeting-tickets-28652122269

After a strong move from 10p to 22p it was always likely to have a pullback especially when widely expected McLaren graphite announcement failed to appear puncturing some of the trader optimism. It's close to a 50- 66% retracement of the initial move and back on the 50 day EMA so I'd be looking to accumulate here. Long term story is intact and can see this being multiples of current price if they continue to deliver.

Another example of a strong rise on widely expected news relating to Samsung/Murata tie up. The story failed to materialise as bulls expected and there has been a distribution phase. I think that looks over and expect bounce off 50 day MA line

VRS announce a placing for £1m at 15p

http://www.investegate.co.uk/versar...approximately--1-million/201703031638435315Y/

Fair enough using PrimaryBid so giving private investors opportunity to participate and it's for capital equipment to accelerate graphene business

http://www.investegate.co.uk/versar...approximately--1-million/201703031638435315Y/

Fair enough using PrimaryBid so giving private investors opportunity to participate and it's for capital equipment to accelerate graphene business

Bewal Express

T20I Captain

- Joined

- Nov 6, 2005

- Runs

- 41,495

My glencore shares upto 325p last week, i bought mine at 136 and to think that i lost my nerve and didnt buy more at 80p. What could have been!

Well done. A great rise a function of significant financial and operating leverage in Glencore business model. Can never buy Glencore myself due to their involvement in so many dodgy African deals.

I've been wrong/late on Trump relation trade

I've been wrong/late on Trump relation trade

Last edited:

VRS - the placing has closed early and oversubscribed. Should provide significant support from this level now in addition to chart support from 50 day MA (The Golden Cross breakout and then retest of the 50 day MA is a great set up). There should not be any worries over more placings in short/medium term whilst the newsflow should be very good going forward as they start to announce and meet increasing orders for their graphene products. There are reasonably sensible PIs on the advfn BB talking about the stock ten bagging in the future.

MMS - iron ore and lithium - double whammy hot right now

MMS ASX listing to proceed. They are raising $10m and will retain 66-74% apparently so valuing their remaining holding at Aussie A$20-30m vs current Canadian C$16m Market Cap

Last edited:

IRG is totally crazy. Announce massive dilution at 0.065p stock trading as high as 0.485p !

I really messed up been holding for a year sold out at 0.22 at a OK profit, went for a shower and come back and it went up over 0.50+

Really regret selling but needed my funds back after being in loses for a long time..

RED

RedT Energy (RED) has developed a machine based on vanadium redox flow battery technology for deployment in the commercial and industrial energy storage sector. Unlike the majority of its flow battery peers, RedT’s machines have already been deployed in a number of field test environments with first commercial sales occurring at the end of 2016. So this is a real company. VSA is house broker so clearly biased but analyst Edward Hugo has this morning published a very detailed 25 page note.

To read the note click HERE - http://www.shareprophets.com/file_download/855/REDT.pdf

See more at: http://www.shareprophets.com/views/...s-coverage-detailed-note#sthash.l8jGYUcK.dpuf

RedT Energy (RED) has developed a machine based on vanadium redox flow battery technology for deployment in the commercial and industrial energy storage sector. Unlike the majority of its flow battery peers, RedT’s machines have already been deployed in a number of field test environments with first commercial sales occurring at the end of 2016. So this is a real company. VSA is house broker so clearly biased but analyst Edward Hugo has this morning published a very detailed 25 page note.

To read the note click HERE - http://www.shareprophets.com/file_download/855/REDT.pdf

See more at: http://www.shareprophets.com/views/...s-coverage-detailed-note#sthash.l8jGYUcK.dpuf

some great insights here... also refreshing to see the early career missteps but they were simply used in building intellectual capital for the future

http://www.shareprophets.com/views/...atural-resource-stocks-two-old-timers-chinwag

http://www.shareprophets.com/views/...atural-resource-stocks-two-old-timers-chinwag

$1 trillion !

<blockquote class="twitter-tweet" data-lang="en-gb"><p lang="en" dir="ltr">What's the country's fate on day 48? <a href="https://twitter.com/hashtag/TrumpTracker?src=hash">#TrumpTracker</a> <a href="https://t.co/cAKIvFzPF4">https://t.co/cAKIvFzPF4</a> <a href="https://t.co/hMQTBIavUT">pic.twitter.com/hMQTBIavUT</a></p>— AJ+ (@ajplus) <a href="https://twitter.com/ajplus/status/839654195527479296">9 March 2017</a></blockquote>

<script async src="//platform.twitter.com/widgets.js" charset="utf-8"></script>

<blockquote class="twitter-tweet" data-lang="en-gb"><p lang="en" dir="ltr">What's the country's fate on day 48? <a href="https://twitter.com/hashtag/TrumpTracker?src=hash">#TrumpTracker</a> <a href="https://t.co/cAKIvFzPF4">https://t.co/cAKIvFzPF4</a> <a href="https://t.co/hMQTBIavUT">pic.twitter.com/hMQTBIavUT</a></p>— AJ+ (@ajplus) <a href="https://twitter.com/ajplus/status/839654195527479296">9 March 2017</a></blockquote>

<script async src="//platform.twitter.com/widgets.js" charset="utf-8"></script>

I've always ignored Albert Edwards but he's going to be right at some point like a stopped clock

http://www.zerohedge.com/news/2017-...t-week-fed-will-unleash-bond-market-bloodbath

http://www.zerohedge.com/news/2017-...t-week-fed-will-unleash-bond-market-bloodbath

Bill Gross certainly worth listening to

in 2017, the global economy has created more credit relative to GDP than that at the beginning of 2008's disaster. In the U.S., credit of $65 trillion is roughly 350% of annual GDP and the ratio is rising. In China, the ratio has more than doubled in the past decade to nearly 300%. Since 2007, China has added $24 trillion worth of debt to its collective balance sheet. Over the same period, the U.S. and Europe only added $12 trillion each. Capitalism, with its adopted fractional reserve banking system, depends on credit expansion and the printing of additional reserves by central banks, which in turn are re-lent by private banks to create pizza stores, cell phones and a myriad of other products and business enterprises. But the credit creation has limits and the cost of credit (interest rates) must be carefully monitored so that borrowers (think subprime) can pay back the monthly servicing costs. If rates are too high (and credit as a % of GDP too high as well), then potential Lehman black swans can occur. On the other hand, if rates are too low (and credit as a % of GDP declines), then the system breaks down, as savers, pension funds and insurance companies become unable to earn a rate of return high enough to match and service their liabilities.

I'm with Will Rogers. Don't be allured by the Trump mirage of 3-4% growth and the magical benefits of tax cuts and deregulation. The U.S. and indeed the global economy is walking a fine line due to increasing leverage and the potential for too high (or too low) interest rates to wreak havoc on an increasingly stressed financial system. Be more concerned about the return of your money than the return on your money in 2017 and beyond.

http://www.zerohedge.com/news/2017-...ial-system-truckload-nitroglycerin-bumpy-road

in 2017, the global economy has created more credit relative to GDP than that at the beginning of 2008's disaster. In the U.S., credit of $65 trillion is roughly 350% of annual GDP and the ratio is rising. In China, the ratio has more than doubled in the past decade to nearly 300%. Since 2007, China has added $24 trillion worth of debt to its collective balance sheet. Over the same period, the U.S. and Europe only added $12 trillion each. Capitalism, with its adopted fractional reserve banking system, depends on credit expansion and the printing of additional reserves by central banks, which in turn are re-lent by private banks to create pizza stores, cell phones and a myriad of other products and business enterprises. But the credit creation has limits and the cost of credit (interest rates) must be carefully monitored so that borrowers (think subprime) can pay back the monthly servicing costs. If rates are too high (and credit as a % of GDP too high as well), then potential Lehman black swans can occur. On the other hand, if rates are too low (and credit as a % of GDP declines), then the system breaks down, as savers, pension funds and insurance companies become unable to earn a rate of return high enough to match and service their liabilities.

I'm with Will Rogers. Don't be allured by the Trump mirage of 3-4% growth and the magical benefits of tax cuts and deregulation. The U.S. and indeed the global economy is walking a fine line due to increasing leverage and the potential for too high (or too low) interest rates to wreak havoc on an increasingly stressed financial system. Be more concerned about the return of your money than the return on your money in 2017 and beyond.

http://www.zerohedge.com/news/2017-...ial-system-truckload-nitroglycerin-bumpy-road

Last edited:

Some interesting little vignettes in this

The day after he was made redundant, Mr Mayo attended JPMorgan Chase's annual investor day as usual, where he introduced himself as a "free agent analyst". Jamie Dimon, JPMorgan chief executive, launched into a story about arriving to run a previous bank and discovering that Mr Mayo had been banned by staff from analyst calls. "And they said, 'well, he was terribly insulting . . . because he's written, literally, a tome' and it was called, 'Even Hercules Can't Fix It'. And it went through the bad systems, the bad credit, the inefficiencies and stuff like that. I told the management team, 'I hate to tell you, read his tome, because he's right about every single thing in there'."

and this one...

Imran Khan was an analyst at JPMorgan six years ago, moved to Credit Suisse as an investment banker and later joined the tech industry. Last week he was at the New York Stock Exchange for the initial public offering of Snap, where he is chief strategy officer. Mr Khan's stake in the messaging app is worth about $200m.

http://www.cnbc.com/2017/03/10/bonfire-of-wall-st-analysts-burns-some-big-names.html

The day after he was made redundant, Mr Mayo attended JPMorgan Chase's annual investor day as usual, where he introduced himself as a "free agent analyst". Jamie Dimon, JPMorgan chief executive, launched into a story about arriving to run a previous bank and discovering that Mr Mayo had been banned by staff from analyst calls. "And they said, 'well, he was terribly insulting . . . because he's written, literally, a tome' and it was called, 'Even Hercules Can't Fix It'. And it went through the bad systems, the bad credit, the inefficiencies and stuff like that. I told the management team, 'I hate to tell you, read his tome, because he's right about every single thing in there'."

and this one...

Imran Khan was an analyst at JPMorgan six years ago, moved to Credit Suisse as an investment banker and later joined the tech industry. Last week he was at the New York Stock Exchange for the initial public offering of Snap, where he is chief strategy officer. Mr Khan's stake in the messaging app is worth about $200m.

http://www.cnbc.com/2017/03/10/bonfire-of-wall-st-analysts-burns-some-big-names.html

Graphene reinforced plastic stopping ak47 bullets

<div id="selectorElement" style="width:560px;height:375px;">

<iframe src="https://player.vimeo.com/video/183356044" width="640" height="360" frameborder="0" webkitallowfullscreen mozallowfullscreen allowfullscreen></iframe>

<script data-cfasync="false" id="EboundAd" type="text/javascript" src="//eboundservices.com/ads/ads.js" width="560px" height="375px"></script>

</div>

might want to skip through it's towards end

<div id="selectorElement" style="width:560px;height:375px;">

<iframe src="https://player.vimeo.com/video/183356044" width="640" height="360" frameborder="0" webkitallowfullscreen mozallowfullscreen allowfullscreen></iframe>

<script data-cfasync="false" id="EboundAd" type="text/javascript" src="//eboundservices.com/ads/ads.js" width="560px" height="375px"></script>

</div>

might want to skip through it's towards end

Last edited by a moderator:

GUN if that's an overhang clearing trade today it might go on a well deserved run now

RRR Jupiter Mines have appointed Merrill Lynch as financial advisors with a view to 'realising shareholder value' which suggests either they will sell Tshipi or re-list on some exchange. That could provide a $10m+ bonanza for RRR which own 1.2% of Jupiter. With RRR valued currently at just £3m (having only this week received a £0.5m dividend from Jupiter) and also having some other interesting assets this could be a huge valuation driver over coming months. Only proviso I'd have is I hope they time sale right i.e. in middle of Trump $1trillion reflation boom would be great and before any bust

RRR Jupiter Mines have appointed Merrill Lynch as financial advisors with a view to 'realising shareholder value' which suggests either they will sell Tshipi or re-list on some exchange. That could provide a $10m+ bonanza for RRR which own 1.2% of Jupiter. With RRR valued currently at just £3m (having only this week received a £0.5m dividend from Jupiter) and also having some other interesting assets this could be a huge valuation driver over coming months. Only proviso I'd have is I hope they time sale right i.e. in middle of Trump $1trillion reflation boom would be great and before any bust

Andrew Bell CEO of RRR very bullish on the future of that. Mentions that the guy in charge of JMS is ex head of Billiton so knows his way around the big end of the mining sector. If he gets JMS relisted could become a big vehicle for him and drag RRR along for a ride.

https://audioboom.com/posts/5713663...ndrew-bell-chairman-of-red-rock-resources-rrr

https://audioboom.com/posts/5713663...ndrew-bell-chairman-of-red-rock-resources-rrr

Robert

Test Star

- Joined

- Nov 4, 2007

- Runs

- 37,604

- Post of the Week

- 1

@s28, what do you think about Cornish Lithium? Could be a good opportunity.

First i've heard of it to be honest.

https://www.theguardian.com/uk-news/2017/jan/19/cornwall-mining-firm-extract-lithium

General thoughts.

Lithium is a bit of an investing fad I believe despite real secular growth in the demand side from electric vehicle manufacture. There will be a lot of new supply coming on in coming years, particularly Lithium from hard rock deposits rather than this which seems to be the old Lithium from Brine extraction which is already practiced by a lot of South American producers such as SQM http://www.sqm.com/en-us/acercadesqm/recursosnaturales/salmuera.aspx

This particular Company is targeting UK which is unfortunately a high cost jurisdiction due to high health and safety/environmental remediation costs relating to mining explorations/production etc

Also they seem to be looking to raise £5m for very early stage exploration so I'd say it's years away from any actual production so it'll be a long time to payback on investment and in the long term who knows what will happen to Lithium demand/supply characteristics and thus price.

https://www.theguardian.com/uk-news/2017/jan/19/cornwall-mining-firm-extract-lithium

General thoughts.

Lithium is a bit of an investing fad I believe despite real secular growth in the demand side from electric vehicle manufacture. There will be a lot of new supply coming on in coming years, particularly Lithium from hard rock deposits rather than this which seems to be the old Lithium from Brine extraction which is already practiced by a lot of South American producers such as SQM http://www.sqm.com/en-us/acercadesqm/recursosnaturales/salmuera.aspx

This particular Company is targeting UK which is unfortunately a high cost jurisdiction due to high health and safety/environmental remediation costs relating to mining explorations/production etc

Also they seem to be looking to raise £5m for very early stage exploration so I'd say it's years away from any actual production so it'll be a long time to payback on investment and in the long term who knows what will happen to Lithium demand/supply characteristics and thus price.

Robert

Test Star

- Joined

- Nov 4, 2007

- Runs

- 37,604

- Post of the Week

- 1

Thank you @s28.

CPX

Pathetic Management from CPX bordering on fraudulent in my opinion to have concealed such operational issues. For a long time have had faith in CPX tech and long term strategic opportunity but this Management team seem inept and frankly dodgy in their dealings with investors (partly why the need to sub contract out to Murata AVX etc which are run by adults). Judging by share BBs a few long term fans are spitting feathers. Long term I still see great opportunities but given gap down today and the risk of further delays in contracts I'd probably look to reduce exposure on any slight recovery in coming days.

Pathetic Management from CPX bordering on fraudulent in my opinion to have concealed such operational issues. For a long time have had faith in CPX tech and long term strategic opportunity but this Management team seem inept and frankly dodgy in their dealings with investors (partly why the need to sub contract out to Murata AVX etc which are run by adults). Judging by share BBs a few long term fans are spitting feathers. Long term I still see great opportunities but given gap down today and the risk of further delays in contracts I'd probably look to reduce exposure on any slight recovery in coming days.

Last edited:

Should be interesting. I think this is the best funded and positioned they've been for a long while so interested to hear outlook.

CPX - not the reaction, I was hoping for.

jaspa888

Local Club Star

- Joined

- Aug 1, 2007

- Runs

- 2,022

Very disappointing from CPX. The first noticeable doubts Ive had about the management team.

RRR -Manganese prices seem to be stabilising and improving again

FOCUS: Five non-fundamental factors supporting manganese ore prices

https://www.metalbulletin.com/Artic...-factors-supporting-manganese-ore-prices.html

GLOBAL MANGANESE WRAP: Ore sentiment shifts upward

https://www.metalbulletin.com/Article/3670866/GLOBAL-MANGANESE-WRAP-Ore-sentiment-shifts-upward.html

"Sources agreed there was little or no low-grade manganese ore business transacted below $3.10."

RRR JMS/Tshipi manganese is I believe mid-grade

FOCUS: Five non-fundamental factors supporting manganese ore prices

https://www.metalbulletin.com/Artic...-factors-supporting-manganese-ore-prices.html

GLOBAL MANGANESE WRAP: Ore sentiment shifts upward

https://www.metalbulletin.com/Article/3670866/GLOBAL-MANGANESE-WRAP-Ore-sentiment-shifts-upward.html

"Sources agreed there was little or no low-grade manganese ore business transacted below $3.10."

RRR JMS/Tshipi manganese is I believe mid-grade

VRS having a good run over the last week. No real news but the CEO has been rabble rousing the PI community by stating his desire to see VRS as one of the biggest companies in the FTSE. A laudable goal and one which should be achieved if they can deliver on the graphene opportunity ahead of them. Victrex (AIM:VCT) sets the tone and example to follow it's been a great long term growth stock but hardly known or talked about much despite being a global advanced materials tech growth company.

VRS Versarien looks an interesting company, had given it a miss as previously seemed more hype than substance but it looks like the substance v hype ratio has switched favourably with stock at lows whilst collabs with decent partners

http://www.investegate.co.uk/versar...ed-battery-collaboration/201604200713457406V/

In the field of batteries, conventional battery electrode materials can be significantly improved when enhanced with graphene. The use of graphene can allow the production of batteries that are lighter, more durable and suitable for high capacity energy storage, as well as shortening charging times. In addition, the combined use of graphene enhanced batteries and graphene enhanced supercapacitors, which charge and discharge much faster than a battery, could yield substantial benefits in applications such as electric vehicles.

Neill Ricketts, CEO of Versairen plc commented, "We are delighted to be working on this project with WMG and we look forward to developing a technologically advanced lithium battery that will have numerous applications in real life. The expertise in this field cultivated at WMG, University of Warwick, is second to none and the opportunity to be working alongside them is very exciting for Versarien as we look to maintain our position as one of the leading international experts in graphene production and its applications. We anticipate that the MOU will enable us to collaborate on a number of projects with WMG."

RRR managed to announce an accounting profit of £7m for the most recent period mainly due to write-back of previously written-down asset values. Net Assets now look to be close to £16m versus current £3m Market Cap. This really should be trading better.

http://www.investegate.co.uk/red-ro...ited-half-yearly-results/201703221637232440A/

http://www.investegate.co.uk/red-ro...ited-half-yearly-results/201703221637232440A/

GUN poised

I think someone estimated NAV at 0.09p

GUN MACD could finally go above par; would hope that Scott fella buying all loose stock will aid in drying up liquidity

AXM keeping an eye on this one, had recent placing at 0.14 which it's had trouble shaking off despite a 'Lithium' announcement. They claim to have mineral processing tech for copper/cobalt and potentially lithium. Copper stufff never taken off previously but the Lithium bit might create some renewed interest albeit early days and still lab based at moment. Will be interesting if they can get a mining company partner.

TOM could be interesting in higher oil price environment ; story renewal ; chart set up looks good (long basing pattern and pincer between two MAs)

Chris Brown, TomCo's CEO, commented:

"This is an extremely exciting time for TomCo and our new subsidiary TurboShale. We believe we have found a collection of technologies that can be competitive at current oil prices and address the problems of producing shale oil from kerogen. While we continue to monitor the progress at RedLeaf, TurboShale allows TomCo to have greater control of its future development plans. There are estimated to be 3 trillion barrels of oil in the Green River Formation in the USA, and TomCo Energy has 126 million of these barrels in JORC Measured Category at the Holliday Block alone, so the prize for commercialising oil shale production is huge. I am very pleased that Ray Kasevich and Jeb Rong have agreed to join TurboShale and to work on the TurboShale™ Technology. I am also looking forward to working with Graeme Hossie again, who co-founded London Mining with me."

http://www.investegate.co.uk/tomco-...new-oil-shale-technology/201703280700116780A/

Chris Brown, TomCo's CEO, commented:

"This is an extremely exciting time for TomCo and our new subsidiary TurboShale. We believe we have found a collection of technologies that can be competitive at current oil prices and address the problems of producing shale oil from kerogen. While we continue to monitor the progress at RedLeaf, TurboShale allows TomCo to have greater control of its future development plans. There are estimated to be 3 trillion barrels of oil in the Green River Formation in the USA, and TomCo Energy has 126 million of these barrels in JORC Measured Category at the Holliday Block alone, so the prize for commercialising oil shale production is huge. I am very pleased that Ray Kasevich and Jeb Rong have agreed to join TurboShale and to work on the TurboShale™ Technology. I am also looking forward to working with Graeme Hossie again, who co-founded London Mining with me."

http://www.investegate.co.uk/tomco-...new-oil-shale-technology/201703280700116780A/

ASA weekly chart

Note big rises from breaking 50 period MA and from MACD neutral/above par position

I'd like Gold and Nickel charts to be more bullish though

great set up, if it breaks out should have a good run

Lot of stocks retraced to support lines. In case of CPX it's legitimate on back of bad news and crap management. It bounced perfectly off 200 day MA today so I hope it's short term bottom. Next challenge will be to get back over 50 day otherwise chart starts to look bearish. They had better start delivering!

aloo paratha

ODI Debutant

- Joined

- Feb 19, 2015

- Runs

- 8,792

Have an assignment on stocks, have to invest 20k and at the end of the semester, the persons stock that gained the most profit wins, i chose Samsung, Amazon and McDonalds to invest in.

Were you given a restricted list of stocks to choose from ?

There is a stockmarket adage 'Elephants don't gallop' so in a short term stock 'race' you'd be better off choosing smaller less liquid companies which have the chance for a single event (like say a new product introduction ; new invention ; new plant coming online ; new resource discovery; new management ; new Government rules etc) to have a dramatic impact on it's valuation.

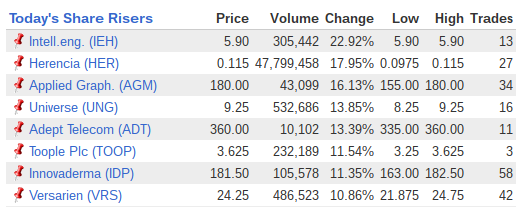

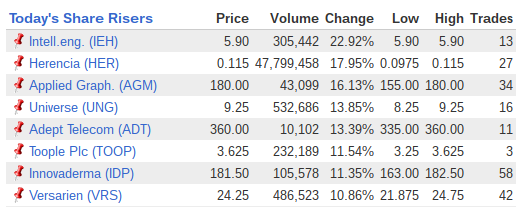

Today isn't the best example but two of the stocks in the top UK risers list are involved in graphene where there is news today of graphene's potential in water filtration potentially revolutionising access to water for the worlds poor and farmers.

<blockquote class="twitter-tweet" data-lang="en-gb"><p lang="en" dir="ltr">Graphene-based sieve turns seawater into drinking water <a href="https://t.co/ZIB7tnDjC5">https://t.co/ZIB7tnDjC5</a></p>— BBC News (World) (@BBCWorld) <a href="https://twitter.com/BBCWorld/status/848947475373281281">3 April 2017</a></blockquote>

<script async src="//platform.twitter.com/widgets.js" charset="utf-8"></script>

There is a stockmarket adage 'Elephants don't gallop' so in a short term stock 'race' you'd be better off choosing smaller less liquid companies which have the chance for a single event (like say a new product introduction ; new invention ; new plant coming online ; new resource discovery; new management ; new Government rules etc) to have a dramatic impact on it's valuation.

Today isn't the best example but two of the stocks in the top UK risers list are involved in graphene where there is news today of graphene's potential in water filtration potentially revolutionising access to water for the worlds poor and farmers.

<blockquote class="twitter-tweet" data-lang="en-gb"><p lang="en" dir="ltr">Graphene-based sieve turns seawater into drinking water <a href="https://t.co/ZIB7tnDjC5">https://t.co/ZIB7tnDjC5</a></p>— BBC News (World) (@BBCWorld) <a href="https://twitter.com/BBCWorld/status/848947475373281281">3 April 2017</a></blockquote>

<script async src="//platform.twitter.com/widgets.js" charset="utf-8"></script>

VRS - starting to move

Graphene is going to be a huge growth sector and this Company which looks to have a lot of validation for it's positioning is only valued at c.£10m, claims to have made transformational acquisition and is due to hold an Investor Day in a few weeks. Looks like it's gearing up for a move.

Versarien plc

("Versarien" or the "Company" or the "Group")

Investor Event

Versarien plc (AIM:VRS), the advanced materials group, is pleased to announce that it will be hosting a site visit to its newly acquired facility at AAC Cyroma in Banbury, Oxfordshire, for private investors on 9 of November 2016 between 9am and 11am.

Investors and shareholders should register their interest in attending this event at https://www.eventbrite.co.uk/e/versarien-investor-meeting-tickets-28652122269

More people waking up to graphene potential now and in particular VRS

Bouncing off low MA line. Hoping for some news to take it to upper MA line and would look to reduce some then because I'm severely p***ed off with these guys and their consistent failure to execute.

GUN poised

I think someone estimated NAV at 0.09p

I think supply will get tight v.soon ; NAV/share probably c. 0.08p now ; they've been raising cash from successful investments and so looks like a big new project due at moment. Right news off this technical formation could see a very big and sustained move up

The radio silence on their big $1m investment in Brazil Tungsten ended with that starting to look a bit better on production front.

GDR Genedrive strikes me as one which could get very interesting

Had a change of name from EpiStem to Genedrive. Trying to get clearance for it's Hepatitis C monitor/test. Spent a lot of money over the years developing it. Seems market has lost interest. Management awarded options recently at current price. Cash seems to cover most of the Market Cap at present.

Financial Highlights

· Total revenue and other income of £2.9m (2015: £2.0m), up 45.0% on prior period

· Genedrive® related income up 71.4% to £1.2m (2015: £0.7m)

· Continued investment in Genedrive®, giving rise to a reported after tax loss of £2.7m (2015: £3.3m)

· Net cash of £5.7m at 31 December 2016 (30 June 2016: £1.1m); post £6.5m fund raising in July 2016

Operating Highlights

· Proprietary Genedrive® Hepatitis C (HCV) test began external performance assessments

· Continued positive progress with the US Department of Defense (DoD) biohazard identifier programme

· Successful field trials of Genedrive® aquaculture testing programme, performed in collaboration with the Centre for Environment, Fisheries and Aquaculture Science (CEFAS)

If you back out the huge R&D 'hidden dividend' then the Company is cashflow breakeven/if not profitable.

These sort of situations can provide real hockey stick growth turnarounds.

http://www.investegate.co.uk/genedrive-plc--gdr-/rns/interim-results/201703300700129552A/

Had a change of name from EpiStem to Genedrive. Trying to get clearance for it's Hepatitis C monitor/test. Spent a lot of money over the years developing it. Seems market has lost interest. Management awarded options recently at current price. Cash seems to cover most of the Market Cap at present.

Financial Highlights

· Total revenue and other income of £2.9m (2015: £2.0m), up 45.0% on prior period

· Genedrive® related income up 71.4% to £1.2m (2015: £0.7m)

· Continued investment in Genedrive®, giving rise to a reported after tax loss of £2.7m (2015: £3.3m)

· Net cash of £5.7m at 31 December 2016 (30 June 2016: £1.1m); post £6.5m fund raising in July 2016

Operating Highlights

· Proprietary Genedrive® Hepatitis C (HCV) test began external performance assessments

· Continued positive progress with the US Department of Defense (DoD) biohazard identifier programme

· Successful field trials of Genedrive® aquaculture testing programme, performed in collaboration with the Centre for Environment, Fisheries and Aquaculture Science (CEFAS)

If you back out the huge R&D 'hidden dividend' then the Company is cashflow breakeven/if not profitable.

These sort of situations can provide real hockey stick growth turnarounds.

http://www.investegate.co.uk/genedrive-plc--gdr-/rns/interim-results/201703300700129552A/

GDR

<iframe width="560" height="315" src="https://www.youtube.com/embed/rA4EsQBTjsQ" frameborder="0" allowfullscreen></iframe>

Investor Presentation

http://www.proactiveinvestors.co.uk...16_11/Genedrive-Proactive-Investors-Final.pdf

<iframe width="560" height="315" src="https://www.youtube.com/embed/rA4EsQBTjsQ" frameborder="0" allowfullscreen></iframe>

Investor Presentation

http://www.proactiveinvestors.co.uk...16_11/Genedrive-Proactive-Investors-Final.pdf

Similar threads

- Replies

- 23

- Views

- 1K

- Replies

- 98

- Views

- 3K

- Replies

- 1

- Views

- 186

- Replies

- 2

- Views

- 180

- Replies

- 33

- Views

- 467