-

Contact the PP Team

Connect with us

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Buying shares?

- Thread starter DeadlyVenom

- Start date

classic

Local Club Captain

- Joined

- Feb 14, 2007

- Runs

- 2,567

CPX Good rise again and at year high 14p gone through . Looking very strong indeed. Could see profit takers at this level maybe.

You've probably been asked this a million times already on this thread but since it's gigantic am sure you can understand why I am asking you this.re VRS

The Company's Annual General Meeting will be held at 11 am on Wednesday 13 September 2017 at the offices of Gloucester Rugby at Kingsholm Stadium, Kingsholm Road, Kingsholm, Gloucester GL1 3AX.

But I am new to this entire game...Forex, Shares, Cryptocurrency. I have an expendable £1k and I need some advice on what to invest this in. The only shares experience is my dad but he's was a long term investment as a opposed to quick money. Any advice (sorry in advance lol).

I'm afraid what you are describing seems to be more akin to trading and I consider myself more of an investor.

I'm clueless on forex and cryptocurrency (my theoretical economics knowledge tells me it's nigh on impossible to call correctly and my personal experience of City Currency Strategists backs that up)

I'd suggest if you do want to be a fast money trader you read something like 'Reminiscences of a Stock Operator' an Investment Classic. That guy made and lost several fortunes during his life... https://www.amazon.com/Reminiscences-Stock-Operator-Investment-Classics/dp/0470580844

I'm clueless on forex and cryptocurrency (my theoretical economics knowledge tells me it's nigh on impossible to call correctly and my personal experience of City Currency Strategists backs that up)

I'd suggest if you do want to be a fast money trader you read something like 'Reminiscences of a Stock Operator' an Investment Classic. That guy made and lost several fortunes during his life... https://www.amazon.com/Reminiscences-Stock-Operator-Investment-Classics/dp/0470580844

classic

Local Club Captain

- Joined

- Feb 14, 2007

- Runs

- 2,567

Cpx RNS Out today looks like an increased holdings at the current price by HH. They must be feeling confident or know something I'm guessing . Looking strong again today 15.5p offer as I write...

RRR chart setting up nicely for a good September I reckon

Laptop15 23 Aug '17 - 09:00 - 49 of 50 0 0

Mini tick up!! I can smell the news coming, some expected in August I've been told plus a lot in september! Tshipi news being so quiet makes me think a sale or ipo could be about to be announced most likely a sale at a decent price!!

most likely a sale at a decent price!!

TheKLF 21 Aug '17 - 23:27 - 12206 of 12206 4 0

Looks like RRR have really lucked out on this Steelmin investment.

On 23rd June they said :

"Steelmin's plant consists of two electric arc furnaces with a combined annual capacity of 48,720 tonnes ferrosilicon (FeSi 75) and 9,700 tonnes of microsilica and expected initial capacity from Furnace V of 29,000t of ferrosilicon p.a. and 5,800t of microsilica

o Steelmin's targets annual revenues on initial production levels of €36m and EBITDA of €7m"

The price of ferro-silicon has since rocketed to c.$1500/tonne which should imply revenues of over €40m and one assumes EBITDA of €10m+

Laptop15 23 Aug '17 - 09:00 - 49 of 50 0 0

Mini tick up!! I can smell the news coming, some expected in August I've been told plus a lot in september! Tshipi news being so quiet makes me think a sale or ipo could be about to be announced

most likely a sale at a decent price!!

most likely a sale at a decent price!!TheKLF 21 Aug '17 - 23:27 - 12206 of 12206 4 0

Looks like RRR have really lucked out on this Steelmin investment.

On 23rd June they said :

"Steelmin's plant consists of two electric arc furnaces with a combined annual capacity of 48,720 tonnes ferrosilicon (FeSi 75) and 9,700 tonnes of microsilica and expected initial capacity from Furnace V of 29,000t of ferrosilicon p.a. and 5,800t of microsilica

o Steelmin's targets annual revenues on initial production levels of €36m and EBITDA of €7m"

The price of ferro-silicon has since rocketed to c.$1500/tonne which should imply revenues of over €40m and one assumes EBITDA of €10m+

lol haha I got a bit excited at the purpose of this thread. While I'm more akin'd to making quick money, I do also want a semi longer term investment like a year or so. What would be the best stock company to invest 1k for a gradual increase?I'm afraid what you are describing seems to be more akin to trading and I consider myself more of an investor.

I'm clueless on forex and cryptocurrency (my theoretical economics knowledge tells me it's nigh on impossible to call correctly and my personal experience of City Currency Strategists backs that up)

I'd suggest if you do want to be a fast money trader you read something like 'Reminiscences of a Stock Operator' an Investment Classic. That guy made and lost several fortunes during his life... https://www.amazon.com/Reminiscences-Stock-Operator-Investment-Classics/dp/0470580844

Most of the online trading houses have apps. e.g. I use https://www.tddirectinvesting.co.uk/mobile-trading-apps

Nobody can promise you or give you any comfort on what is the best stock for you to invest in as we don't know you or your risk-reward parameters etc

Part of the reason for suggesting reading Investment Classics like the one cited above is that you might recognise what sort of investment or trading style might suit you

Most people on here stick to talking about stocks they themselves like or are buying/selling and trying to learn from the experience

When I first started I stuck to something I thought I might be able to understand e.g. in my case football clubs. Back in the day (1990s) you could buy the likes of Manchester United or Arsenal or Liverpool shares when the companies were valued in the single digit millions... now they are worth billions and individual players get sold for more than whole football clubs were valued at !

IF you have an interest in cars I'd advise looking at car related stocks e.g. Tesla or stocks of companies who might provide tech for new cars in future e.g. CPX, SCE, SEE, TRK, ITM, VRS etc

There are no short cuts. Be prepared to lose all your money but gain a lot of knowledge in the process. Some of my most valuable lessons came from losing money on stocks.

Nobody can promise you or give you any comfort on what is the best stock for you to invest in as we don't know you or your risk-reward parameters etc

Part of the reason for suggesting reading Investment Classics like the one cited above is that you might recognise what sort of investment or trading style might suit you

Most people on here stick to talking about stocks they themselves like or are buying/selling and trying to learn from the experience

When I first started I stuck to something I thought I might be able to understand e.g. in my case football clubs. Back in the day (1990s) you could buy the likes of Manchester United or Arsenal or Liverpool shares when the companies were valued in the single digit millions... now they are worth billions and individual players get sold for more than whole football clubs were valued at !

IF you have an interest in cars I'd advise looking at car related stocks e.g. Tesla or stocks of companies who might provide tech for new cars in future e.g. CPX, SCE, SEE, TRK, ITM, VRS etc

There are no short cuts. Be prepared to lose all your money but gain a lot of knowledge in the process. Some of my most valuable lessons came from losing money on stocks.

Rising on good volume and with a steady underlying bid

AVX seem to be launching new CPX based products on an almost weekly basis right now (With no fanfare/RNS from CPX so far)

http://datasheets.avx.com/AVX-SCM-16V.pdf

Date on this Datasheet is 082117 (i.e. 21st August 2017)

http://datasheets.avx.com/AVX-SCM-16V.pdf

Date on this Datasheet is 082117 (i.e. 21st August 2017)

CPX

What would really blow the doors off to CPX share price is a big high profile Auto OEM/tier one name adopting CPX tech and/or evidence of a Murata CPX battery tie up going into Samsung (we can't categorically connect the dots yet but we know CPX and Murata are long term partners ; Murata recently extended licence to include supercap tech in batteries ; Murata took over Sony Lithium battery division ; Murata/Sony batteries are going into latest Samsung 8 Phone )

What would really blow the doors off to CPX share price is a big high profile Auto OEM/tier one name adopting CPX tech and/or evidence of a Murata CPX battery tie up going into Samsung (we can't categorically connect the dots yet but we know CPX and Murata are long term partners ; Murata recently extended licence to include supercap tech in batteries ; Murata took over Sony Lithium battery division ; Murata/Sony batteries are going into latest Samsung 8 Phone )

GUN

old article on Oyster and GUN but it may be due to come to fruition soon

yawn1 25 Aug '17 - 11:07 - 567420 of 567424 0 1

GUN

Oyster Oil & Gas currently $C0.60 in Canada so should be easy enough to raise £3-4m on AIM when it comes in next week or two at around 50cents say or just over .30p here. If so, and drilling news follows soon then that looks good news for GUN share price imho. We shall see.

Interesting comment earlier this year on oyster from a respected broker on oil companies:

Top stockbroker Andrew Monk of VSA has today served up his third share tip of the year (following from his win with Sula HERE) and it is a real "hell or glory play". it is right now TSX.V listed but there is an AIM listed way to play it. Over to the Monkey...

So today I can give you my 3rd tip of 2017. This one is the really speculative one but if I am right then the return really will be huge. It also really is the PA one as it is currently listed on the TSX-v but I hope it will head to London soon as this is where it should be listed and it would do very well on AIM

Oyster Oil & Gas is the stock and it’s a little pearl (sorry couldn’t reist!!)

It Light oil in the north of Madagascar and I reckon it has Billions of barrels and also very shallow so very cheap to extract – this project would work in my view down to $25 and so if price is just where it s today – its worth a bloody fortune

So why is it different to Madagascar Oil &Gas which let’s be honest I got wrong as it delisted and you basically have had to write it off. Well the real problem with MOIL was firstly the shareholders who just were not suitable for a listed company and secondly it was of course heavy oil and so needed a much higher price to breakeven and I mean much higher

Madagascar has amazing geology and it is very under explored – also where you have heavy oil you nearly always find light oil although this is a different structure up on the North of the island and more akin to across the Mozambique channel ro Mozambique and Tanzania where we also know there are huge reserves of Oil & Gas

Now the asset was owned by Candax and then went to Afren who had 90% and Oyster had 10% but with Afren going bust , Oyster has secured 100% from the administrator for nothing – it just needs to finally fully sign off with OMNIS the local ministry

It also has assets covering most of Djibouti but I am focussed on Madagascar

I also believe very strongly that this will be an ideal asset for a major to farm in because of its potential size – this is a game changer – a monster – many Billions of Barrels ………….so don’t think it will need a constant funding , it wont , it will sit back and let a major do it ………..another difference between it and MOIL who wanted to fund 100% to full production

Mike Wood who runs Oyster is a serious player – found most of the oil for Heritage , so also worth backing. It ticks all my boxes

Clearly has risk as its exploration , but we know there is oil as it seeps out of the ground and it has cores which show it – yes there has bene some historic drilling. But this is probably the best lottery ticket you will ever buy

Now the reason I can tell you today is that Aim listed Gunsynd (GUN) announced on Friday that it had taken a small initial stake - I obviously knew that so had to be quiet – so you could buy through Gunsynd on Aim but then that comes with all sorts of other bits and pieces some of which are ok , some maybe not (who knows) but it’s not a pure play and it’s a small part of its portfolio – had it been bigger then I would be jumping up and down and saying buy Gunsynd.

old article on Oyster and GUN but it may be due to come to fruition soon

yawn1 25 Aug '17 - 11:07 - 567420 of 567424 0 1

GUN

Oyster Oil & Gas currently $C0.60 in Canada so should be easy enough to raise £3-4m on AIM when it comes in next week or two at around 50cents say or just over .30p here. If so, and drilling news follows soon then that looks good news for GUN share price imho. We shall see.

Interesting comment earlier this year on oyster from a respected broker on oil companies:

Top stockbroker Andrew Monk of VSA has today served up his third share tip of the year (following from his win with Sula HERE) and it is a real "hell or glory play". it is right now TSX.V listed but there is an AIM listed way to play it. Over to the Monkey...

So today I can give you my 3rd tip of 2017. This one is the really speculative one but if I am right then the return really will be huge. It also really is the PA one as it is currently listed on the TSX-v but I hope it will head to London soon as this is where it should be listed and it would do very well on AIM

Oyster Oil & Gas is the stock and it’s a little pearl (sorry couldn’t reist!!)

It Light oil in the north of Madagascar and I reckon it has Billions of barrels and also very shallow so very cheap to extract – this project would work in my view down to $25 and so if price is just where it s today – its worth a bloody fortune

So why is it different to Madagascar Oil &Gas which let’s be honest I got wrong as it delisted and you basically have had to write it off. Well the real problem with MOIL was firstly the shareholders who just were not suitable for a listed company and secondly it was of course heavy oil and so needed a much higher price to breakeven and I mean much higher

Madagascar has amazing geology and it is very under explored – also where you have heavy oil you nearly always find light oil although this is a different structure up on the North of the island and more akin to across the Mozambique channel ro Mozambique and Tanzania where we also know there are huge reserves of Oil & Gas

Now the asset was owned by Candax and then went to Afren who had 90% and Oyster had 10% but with Afren going bust , Oyster has secured 100% from the administrator for nothing – it just needs to finally fully sign off with OMNIS the local ministry

It also has assets covering most of Djibouti but I am focussed on Madagascar

I also believe very strongly that this will be an ideal asset for a major to farm in because of its potential size – this is a game changer – a monster – many Billions of Barrels ………….so don’t think it will need a constant funding , it wont , it will sit back and let a major do it ………..another difference between it and MOIL who wanted to fund 100% to full production

Mike Wood who runs Oyster is a serious player – found most of the oil for Heritage , so also worth backing. It ticks all my boxes

Clearly has risk as its exploration , but we know there is oil as it seeps out of the ground and it has cores which show it – yes there has bene some historic drilling. But this is probably the best lottery ticket you will ever buy

Now the reason I can tell you today is that Aim listed Gunsynd (GUN) announced on Friday that it had taken a small initial stake - I obviously knew that so had to be quiet – so you could buy through Gunsynd on Aim but then that comes with all sorts of other bits and pieces some of which are ok , some maybe not (who knows) but it’s not a pure play and it’s a small part of its portfolio – had it been bigger then I would be jumping up and down and saying buy Gunsynd.

Greek Islander 1 Sep '17 - 12:26 - 5173 of 5177 3 0

I respectfully refer to an excellent email from another even better informed CPX investor to me this morning.

https://asia.nikkei.com/Business/Companies/Murata-to-pour-450m-into-Sony-battery-ops-after-purchase

the market is going crazy for this today.

Murata has finally completed the purchase of the Sony battery business , and will invest double what it paid into the business , taking it into every major smartphone and , most importantly , the burgeoning electric vehicle market .

What makes this so exciting for CAP-XX is that Murata is its oldest and original licencee , and last year Murata extended that licence to cover lithium-ion batteries before the Sony deal took place . Since then , Murata has launched , in a small way , a few products combining supercapacitor technology from CAP-XX with lithium-ion batteries , but , now , with Sony's battery business and far greater critical mass , Murata has a chance to raise their game to a much higher level across all industries .................. and with CAP-XX intellectual property .

Great chance now of a Murata bid for CAP-XX - thinking 30-40p

Really does look a no brainer at this price.

I respectfully refer to an excellent email from another even better informed CPX investor to me this morning.

https://asia.nikkei.com/Business/Companies/Murata-to-pour-450m-into-Sony-battery-ops-after-purchase

the market is going crazy for this today.

Murata has finally completed the purchase of the Sony battery business , and will invest double what it paid into the business , taking it into every major smartphone and , most importantly , the burgeoning electric vehicle market .

What makes this so exciting for CAP-XX is that Murata is its oldest and original licencee , and last year Murata extended that licence to cover lithium-ion batteries before the Sony deal took place . Since then , Murata has launched , in a small way , a few products combining supercapacitor technology from CAP-XX with lithium-ion batteries , but , now , with Sony's battery business and far greater critical mass , Murata has a chance to raise their game to a much higher level across all industries .................. and with CAP-XX intellectual property .

Great chance now of a Murata bid for CAP-XX - thinking 30-40p

Really does look a no brainer at this price.

CPX Notice the propensity for the stock to gap up (and down) in the 15 to 30p range (i.e. no resistance or support)

If the news speculated about emerges I would certainly expect that sort of move... as a start

clear breakout now, expect 20-30p in short order

Chinese PMI sets tone for now for wider markets

https://www.metalbulletin.com/Artic...ta-provides-support-but-watch-the-dollar.html

https://www.metalbulletin.com/Artic...ta-provides-support-but-watch-the-dollar.html

Greek Islander 4 Sep '17 - 09:17 - 5222 of 5222 0 0

Encouraging start to the day. A friend of mine has just spent 300k and intends more. £1m-plus investments are nothing to him. Really not sure how big this one can go. It has real momentum at the moment, just hope it can continue though I quite fancy a bit of a slowdown so that I can get in again at a bargain price. When you think this momentum is happening without any positive contract news or takeover rumours one suspects it will continue apace for some time yet. Heady days

Encouraging start to the day. A friend of mine has just spent 300k and intends more. £1m-plus investments are nothing to him. Really not sure how big this one can go. It has real momentum at the moment, just hope it can continue though I quite fancy a bit of a slowdown so that I can get in again at a bargain price. When you think this momentum is happening without any positive contract news or takeover rumours one suspects it will continue apace for some time yet. Heady days

Greek Islander 4 Sep '17 - 09:17 - 5222 of 5222 0 0

Encouraging start to the day. A friend of mine has just spent 300k and intends more. £1m-plus investments are nothing to him. Really not sure how big this one can go. It has real momentum at the moment, just hope it can continue though I quite fancy a bit of a slowdown so that I can get in again at a bargain price. When you think this momentum is happening without any positive contract news or takeover rumours one suspects it will continue apace for some time yet. Heady days

Which share name is this...

VRS - starting to move

Graphene is going to be a huge growth sector and this Company which looks to have a lot of validation for it's positioning is only valued at c.£10m, claims to have made transformational acquisition and is due to hold an Investor Day in a few weeks. Looks like it's gearing up for a move.

Versarien plc

("Versarien" or the "Company" or the "Group")

Investor Event

Versarien plc (AIM:VRS), the advanced materials group, is pleased to announce that it will be hosting a site visit to its newly acquired facility at AAC Cyroma in Banbury, Oxfordshire, for private investors on 9 of November 2016 between 9am and 11am.

Investors and shareholders should register their interest in attending this event at https://www.eventbrite.co.uk/e/versarien-investor-meeting-tickets-28652122269

maybe on verge of another sustained move ?

think there has been an overhang recently

AGM due soon so could be uplift in newsflow

jaspa888

Local Club Star

- Joined

- Aug 1, 2007

- Runs

- 2,022

And still no news.

Surely the directors have a regulatory responsibility to comment on the price increase, one way or the other?

Surely the directors have a regulatory responsibility to comment on the price increase, one way or the other?

CPX

Although the move looks very dramatic and vertical there has not been any one day 20%+ move. They have been open that they expect more significant licensing activity and so unless they have a specific contract to announce they can't really be expected to provide a running commentary on 'white noise' market moves.

I've given up trying to guess where the next big news could come from they seem to involved on so many different fronts now. If this all works then I expect a market cap of several hundred millions so 1p+

Recent IQE move shows how quickly these things can go if they hit a sweet spot

Although the move looks very dramatic and vertical there has not been any one day 20%+ move. They have been open that they expect more significant licensing activity and so unless they have a specific contract to announce they can't really be expected to provide a running commentary on 'white noise' market moves.

I've given up trying to guess where the next big news could come from they seem to involved on so many different fronts now. If this all works then I expect a market cap of several hundred millions so 1p+

Recent IQE move shows how quickly these things can go if they hit a sweet spot

Last edited:

AOR looks like the old CEO who retired from Board last year is buying up stock...

https://www.investegate.co.uk/aortech-inter-plc--aor-/rns/holding-s--in-company/201709081548352780Q/

I like the positive recent comments from current Management and the long term chart set up

https://www.investegate.co.uk/aortech-inter-plc--aor-/rns/holding-s--in-company/201709081548352780Q/

I like the positive recent comments from current Management and the long term chart set up

CPX

Although the move looks very dramatic and vertical there has not been any one day 20%+ move. They have been open that they expect more significant licensing activity and so unless they have a specific contract to announce they can't really be expected to provide a running commentary on 'white noise' market moves.

I've given up trying to guess where the next big news could come from they seem to involved on so many different fronts now. If this all works then I expect a market cap of several hundred millions so 1p+

Recent IQE move shows how quickly these things can go if they hit a sweet spot

So true, too much is happening behind the scene, hard to identity which one will come first.

Personally think with mutala gaining contract for Sony batteries, an take over looks a more possibility

It's very hard to takeover small companies which have numerous patents but also know-how in several overlapping areas. The key people can walk out of the door and you've paid millions for some 'ideas' which can be re-created elsewhere. I doubt anybody will takeover CPX unless they offer extreme amounts which almost makes it not worth acquiring anyway.

VRS CPX AOR going well

RRR don't seem to have announced the upcoming JMS dividends they expect

and theirs, GUN that does not want to shift

A lot of GUN reliant on Oyster IPO. Maybe JOG Jersey today not best day to be talking up wildcat explorers although Oyster does look interesting given they got 100% of one of their licenses due to Afren collapse so might be interesting serendipity story

CPX

The amount of investment Murata is pouring into it's new Sony Battery division is immense. They are now major suppliers to Apple and Samsung. CPX supplying IP into Murata is a potential goldmine. Just waiting on final connection of dots/confirmation of CPX tech in Murata batteries and actual Samsung/Apple products now.

The amount of investment Murata is pouring into it's new Sony Battery division is immense. They are now major suppliers to Apple and Samsung. CPX supplying IP into Murata is a potential goldmine. Just waiting on final connection of dots/confirmation of CPX tech in Murata batteries and actual Samsung/Apple products now.

AGL this sounds good, they do need to raise money though

https://www.investegate.co.uk/angle...on-over-megakaryocyte-ip/201709130700055663Q/

ANGLE Founder and Chief Executive, Andrew Newland, commented:

"This deal further strengthens ANGLE's intellectual property position in the fast-emerging liquid biopsy market. Use of the Parsortix system is driving new discoveries by key opinion leaders and customers and ANGLE is the obvious partner to drive their commercialisation so we expect to see other similar developments over time continually strengthening the Company's position in the market."

Michele Hill-Perkins, Head of Technology Transfer Biopharma at QMUL Barts Queen Mary Innovation Ltd, commented:

"We believe the patents on the role of megakaryocytes in patient blood as a favourable prognostic biomarker has the potential to open up new avenues of research in the fight against cancer. We are delighted to have signed this deal with ANGLE to progress their commercialisation for the benefit of patients."

Dr Yong-Jie Lu, Reader in Medical Oncology at Barts Cancer Institute, and the Principal Investigator for the megakaryocytes discovery commented:

"We believe megakaryocytes in patient blood may play a key role in the body's immune response to all solid cancer types not just prostate cancer and we are currently investigating this in several other cancer types."

https://www.investegate.co.uk/angle...on-over-megakaryocyte-ip/201709130700055663Q/

ANGLE Founder and Chief Executive, Andrew Newland, commented:

"This deal further strengthens ANGLE's intellectual property position in the fast-emerging liquid biopsy market. Use of the Parsortix system is driving new discoveries by key opinion leaders and customers and ANGLE is the obvious partner to drive their commercialisation so we expect to see other similar developments over time continually strengthening the Company's position in the market."

Michele Hill-Perkins, Head of Technology Transfer Biopharma at QMUL Barts Queen Mary Innovation Ltd, commented:

"We believe the patents on the role of megakaryocytes in patient blood as a favourable prognostic biomarker has the potential to open up new avenues of research in the fight against cancer. We are delighted to have signed this deal with ANGLE to progress their commercialisation for the benefit of patients."

Dr Yong-Jie Lu, Reader in Medical Oncology at Barts Cancer Institute, and the Principal Investigator for the megakaryocytes discovery commented:

"We believe megakaryocytes in patient blood may play a key role in the body's immune response to all solid cancer types not just prostate cancer and we are currently investigating this in several other cancer types."

VRS - one of the buy who went to the AGM mentioned this :-

California

NR off to west coast tomorrow. Through work with Manchester, NGI, Innovate & Cambridge received considerable unsolicited approaches leading to NR spending 10 days in California meeting the likes of Tesla, Microsoft Apple Google all at chief officer level

Wouldn't get too excited would expect it to be a long sales cycle for such new bleeding edge tech

California

NR off to west coast tomorrow. Through work with Manchester, NGI, Innovate & Cambridge received considerable unsolicited approaches leading to NR spending 10 days in California meeting the likes of Tesla, Microsoft Apple Google all at chief officer level

Wouldn't get too excited would expect it to be a long sales cycle for such new bleeding edge tech

RED

possibly game changing news for REDT. Competitor out of business and they've poached two senior employees including head of sales.

https://www.investegate.co.uk/redt-...signs-partner-agreements/201709180700059632Q/

possibly game changing news for REDT. Competitor out of business and they've poached two senior employees including head of sales.

https://www.investegate.co.uk/redt-...signs-partner-agreements/201709180700059632Q/

VRS - overhang should clear soon and newsflow will accelerate. Going to be a big double whammy I reckon

https://www.investegate.co.uk/versarien-plc--vrs-/rns/significant-tender-win/201709190700050915R/

https://www.investegate.co.uk/versarien-plc--vrs-/rns/significant-tender-win/201709190700050915R/

Eagle_Eye

ODI Debutant

- Joined

- Jan 11, 2010

- Runs

- 9,954

What you holding these days s28?

RRR was a perpetual dog last I looked few years ago... what's changed?

Haven't invested in oiler for few years, might take a punt with Char

RRR was a perpetual dog last I looked few years ago... what's changed?

Haven't invested in oiler for few years, might take a punt with Char

biggest conviction positions right now

CPX - looks like their supercapacitors gaining traction; Murata licenced the tech for batteries then announced they were buying Sony Battery division and then became supplier to Samsung. Hopeful at some point Murata will take CPX IP into Apple and Samsung

VRS - 'THE' play on graphene as far as i'm concerned. Went to their Investor Day at University of Cambridge Nanotech centre. Amazing for such a small company (£20m) to be co-located in c.£400m worth of Government funded labs giving access to all the best academics and equipment. One piece of equipment alone was worth £1m!

RRR - This has been a disaster for many years but Andrew Bell looks like he has lucked out because their 1.2% position in Jupiter Mines (ASX:JMS) (which in turn owns 50% of the Tshipi Manganese mine) is probably worth c.£10m versus RRR Mkt Cap only £3m. RRR also have a few other strings to their bow. Tshipi is throwing off so much money at the moment they've paid out almost £1m in dividends to RRR in the last year. Normal dividend yield for a established dividend payer is c.3% implying a 'PE' ratio of c.33x

So if you expected RRR to be a regular divi payer (paying the money it gets from Jupiter/Tshipi) straight thru to it's investors you might value RRR at 33x £1m i.e. £33m. The Tshipi mine life is supposed to be about 60-100 years so might be a decent view to take. Unfortunately RRR not paying out cash so then you have to take into account 'reinvestment risk' of that money being invested properly vs going into Management pockets. The Market obviously taking a v pessimistic view of that risk so far.

Punts in some other stuff like AOR (biocompatible heart stents?) ; AXM (Lithium/Cobalt processing tech) ; GUN (stakes in Horse Hill and upcoming Oyster Oil IPO) ; PFP (might get their licence back - total punt)

Not big fan of Oil right now too economically sensitive with risks of Brexit/Nuclear war etc

Would like to have more gold exposure given those exact risks. Tough finding decent plays though. Keeping eye on MNC, XTR etc

CPX - looks like their supercapacitors gaining traction; Murata licenced the tech for batteries then announced they were buying Sony Battery division and then became supplier to Samsung. Hopeful at some point Murata will take CPX IP into Apple and Samsung

VRS - 'THE' play on graphene as far as i'm concerned. Went to their Investor Day at University of Cambridge Nanotech centre. Amazing for such a small company (£20m) to be co-located in c.£400m worth of Government funded labs giving access to all the best academics and equipment. One piece of equipment alone was worth £1m!

RRR - This has been a disaster for many years but Andrew Bell looks like he has lucked out because their 1.2% position in Jupiter Mines (ASX:JMS) (which in turn owns 50% of the Tshipi Manganese mine) is probably worth c.£10m versus RRR Mkt Cap only £3m. RRR also have a few other strings to their bow. Tshipi is throwing off so much money at the moment they've paid out almost £1m in dividends to RRR in the last year. Normal dividend yield for a established dividend payer is c.3% implying a 'PE' ratio of c.33x

So if you expected RRR to be a regular divi payer (paying the money it gets from Jupiter/Tshipi) straight thru to it's investors you might value RRR at 33x £1m i.e. £33m. The Tshipi mine life is supposed to be about 60-100 years so might be a decent view to take. Unfortunately RRR not paying out cash so then you have to take into account 'reinvestment risk' of that money being invested properly vs going into Management pockets. The Market obviously taking a v pessimistic view of that risk so far.

Punts in some other stuff like AOR (biocompatible heart stents?) ; AXM (Lithium/Cobalt processing tech) ; GUN (stakes in Horse Hill and upcoming Oyster Oil IPO) ; PFP (might get their licence back - total punt)

Not big fan of Oil right now too economically sensitive with risks of Brexit/Nuclear war etc

Would like to have more gold exposure given those exact risks. Tough finding decent plays though. Keeping eye on MNC, XTR etc

Noirua 22 Sep '17 - 12:18 - 190 of 192 0 0

Peter Gyllenhammar holds a 14.85% interest ( 70,671,427 - 14.85% )

in Red Rock Resources after purchasing shares from Metal Tiger Limited.

Http://pg-ab.se/en/

Peter Gyllenhammar holds a 14.85% interest ( 70,671,427 - 14.85% )

in Red Rock Resources after purchasing shares from Metal Tiger Limited.

Http://pg-ab.se/en/

Iron ore price has been in free fall recently but manganese has bounced and is reasonably strong which could mean another dividend on the way for RRR from it's holding in Jupiter Mines

RRR remains one of the few stocks which looks cheap on fundamentals with decent supportive chart and potential catalyst imminent

Big news for RRR today.

Gyllenhammer is a well known value investor. By buying 15% he's soaked up supply and anyone who wants to be more activist and drive value at RRR can go thru him to put pressure on Board. Much needed.

I'm going to sell a few punt positions to buy more RRR this afternoon.

Chart looking nicely poised as well with share price in pincer movement between 50 and 200 day MA. Any move could be explosive.

Last edited:

SALV engaged in some very exciting high potential projects. The optionality seems mispriced.

https://www.investegate.co.uk/salva...f-saugatuck-therapeutics/201709250800016781R/

https://www.investegate.co.uk/salva...f-saugatuck-therapeutics/201709250800016781R/

CPX

Dyson to spend £2bn ! £2000m to develop an Electric Car.

Cap-XX Market Cap is £50m

Illustrates the optionality in CPX if they can execute on the auto opportunity alone.

<blockquote class="twitter-tweet" data-lang="en-gb"><p lang="en" dir="ltr">Dyson has announced plans to make an electric car. <a href="https://t.co/cgaQBIsAj2">https://t.co/cgaQBIsAj2</a></p>— Twitter Moments (@TwitterMoments) <a href="https://twitter.com/TwitterMoments/status/912741338990485506">26 September 2017</a></blockquote>

<script async src="//platform.twitter.com/widgets.js" charset="utf-8"></script>

Dyson to spend £2bn ! £2000m to develop an Electric Car.

Cap-XX Market Cap is £50m

Illustrates the optionality in CPX if they can execute on the auto opportunity alone.

<blockquote class="twitter-tweet" data-lang="en-gb"><p lang="en" dir="ltr">Dyson has announced plans to make an electric car. <a href="https://t.co/cgaQBIsAj2">https://t.co/cgaQBIsAj2</a></p>— Twitter Moments (@TwitterMoments) <a href="https://twitter.com/TwitterMoments/status/912741338990485506">26 September 2017</a></blockquote>

<script async src="//platform.twitter.com/widgets.js" charset="utf-8"></script>

CPX results look fine, decent cash level, outlook promising

I don't expect fireworks on the back of these results but outlook is very confident especially on auto developments

Anthony Kongats, CEO of CAP-XX said:

"This has been an exciting year in the development of CAP-XX. We are seeing tangible traction in our target markets, as evidenced by the level of enquiries and size of initial orders. The strong performance of our licences is a further affirmation of this trend, reflected in the sharp growth in royalty receipts. We continue to invest in product development, adding to our portfolio of IP and are receiving an unprecedented level of enquiries from potential licensees. This traction together with our own operating performance gives us great confidence that CAP-XX will be at the forefront of the rising trend for the adoption of supercapacitors as a mainstream source of portable energy storage."

https://www.investegate.co.uk/cap-x...-year-ended-30-june-2017/201710090700039990S/

· Three large automotive opportunities are under development, including applications for passenger vehicles and heavy vehicles

· Three new custom designed automotive systems delivered to customers for evaluation

· In negotiations with potential manufacturing partners to secure the necessary production capacity to fulfill these automotive opportunities

I don't expect fireworks on the back of these results but outlook is very confident especially on auto developments

Anthony Kongats, CEO of CAP-XX said:

"This has been an exciting year in the development of CAP-XX. We are seeing tangible traction in our target markets, as evidenced by the level of enquiries and size of initial orders. The strong performance of our licences is a further affirmation of this trend, reflected in the sharp growth in royalty receipts. We continue to invest in product development, adding to our portfolio of IP and are receiving an unprecedented level of enquiries from potential licensees. This traction together with our own operating performance gives us great confidence that CAP-XX will be at the forefront of the rising trend for the adoption of supercapacitors as a mainstream source of portable energy storage."

https://www.investegate.co.uk/cap-x...-year-ended-30-june-2017/201710090700039990S/

· Three large automotive opportunities are under development, including applications for passenger vehicles and heavy vehicles

· Three new custom designed automotive systems delivered to customers for evaluation

· In negotiations with potential manufacturing partners to secure the necessary production capacity to fulfill these automotive opportunities

Automotive applications such as truckStart, Stop-Start systems, regenerative energy capture or KERS (Kinetic Energy Recovery Systems), distributed power, hybrid electric vehicles and electric vehicles also present very attractive opportunities for supercapacitors. A number of CAP-XX's competitors are active in these markets, but the Board believes that we have significant advantages over the competition in certain applications upon which CAP-XX has focused its efforts. During the year, numerous automotive OEMs and automotive Tier-1/Tier-2 suppliers have purchased CAP-XX's products for evaluation; however because of the significant resources that each project requires, we have taken the decision to focus our resources on just a small number of key automotive projects. Progress during the year with these projects has been very pleasing. Three new automotive products were designed to the customer's specifications, manufactured, tested and evaluation units were delivered to customers including all the necessary electronic circuitry. These products include a 48V system to work with lithium ion batteries in hybrid vehicles; a 12v system for stop-start; vehicle acceleration and regenerative braking; and a 12V system for stop-start and support for the vehicle electronics. However, as previously highlighted, automotive markets have historically been slow to adopt new technology and this still remains a risk today. The Company has also recently commenced two projects involving the development of large supercapacitors for automotive defence applications.

Gold

Think this means Goldman Sachs are short Gold and looking to buy

http://www.kitco.com/news/2017-10-09/Gold-Price-To-Suffer-a-Tremendous-Drop-Says-Goldman-Sachs.html

Think this means Goldman Sachs are short Gold and looking to buy

http://www.kitco.com/news/2017-10-09/Gold-Price-To-Suffer-a-Tremendous-Drop-Says-Goldman-Sachs.html

CPX Allenby research note following results

http://allenbycapital.com/research/research-cpx_20_1474277532.pdf

http://allenbycapital.com/research/research-cpx_20_1474277532.pdf

I'm on a Twitter DM group with a bunch of CPX traders/investors. They're not very sophisticated so easy to shake them out I suspect. They were getting far too excited about CPX/Murata/Samsung when in fact there has been no official confirmation at all.

After recent one day mega rise of JOG (400%) a few other small caps starting to react

MNC, XTR, GUN on the leader boards today

GUN results announced look good. I think they need to concentrate on a single narrative to build faith in story, it seems a bit scattergun and unfocused at the moment.

Knowing 12 Oct '17 - 15:22 - 812 of 814 0 0

£492K Profit

The Company made a profit for the year of £492,000 (2016: loss of £564,000) after taxation. This profit originated from realised gains on disposals of its listed investments of £408,000 along with market value revaluation gains of £417,000 (2016: losses £54,000). The Company had net assets of £3,266,000 (2016: £1,307,000) including cash balances of £372,000 (2016: £358,000) at 31 July 2017

Outlook

Whilst unfortunately not yet reflected in the share price Gunsynd is in a far better shape than it was this time last year. This, however, is merely the start. We intend to be very active in the next twelve months.

The Board would like to take this opportunity to thank our shareholders for their continued support and I look forward to reporting further progress over the next period and beyond

MNC, XTR, GUN on the leader boards today

GUN results announced look good. I think they need to concentrate on a single narrative to build faith in story, it seems a bit scattergun and unfocused at the moment.

Knowing 12 Oct '17 - 15:22 - 812 of 814 0 0

£492K Profit

The Company made a profit for the year of £492,000 (2016: loss of £564,000) after taxation. This profit originated from realised gains on disposals of its listed investments of £408,000 along with market value revaluation gains of £417,000 (2016: losses £54,000). The Company had net assets of £3,266,000 (2016: £1,307,000) including cash balances of £372,000 (2016: £358,000) at 31 July 2017

Outlook

Whilst unfortunately not yet reflected in the share price Gunsynd is in a far better shape than it was this time last year. This, however, is merely the start. We intend to be very active in the next twelve months.

The Board would like to take this opportunity to thank our shareholders for their continued support and I look forward to reporting further progress over the next period and beyond

RRR

<iframe width="560" height="315" src="https://www.youtube.com/embed/rIjXzRaQ_yo" frameborder="0" allowfullscreen></iframe>

Good presentation, lots of potential drivers. I think people have stopped listening to Bell because he has failed so much but with Peter Gyllenhammer now a big investor I expect Bell's feet to be held to the fire. Will take any 'bad news' dip on the chin if its based on Tshipi not listing/no liquidity event in short term on Jupiter Mines. If they are going to pay out dividends at rate of £0.5-1m a year it's an asset worth holding onto not dumping like it's toxic.

GCM

some news, any is welcome !

looking potentially close to breakout territory

I'm sceptical about a lot of these cryptocurrency fads like Bitcoin etc

In Economics one of the least well understood 'variables'/'instruments of policy' is Exchange Rates because they are impacted by so many different factors. So trying to 'value' a Currency as an 'investment proposition' is a hopeless task. Currencies should 'merely' be mediums of exchange, unit of account, store of value etc not an investment vehicle in and of itself.

Having said all that there are some gold-backed crypto-currency contenders emerging and it might be an area worth following to see how it develops. One such company announced they plan to launch their 'Goldbloc' currency in coming months. It's a UK listed company which has gold exploration assets in India called Lionsgold (formerly Kolar Gold). It's a micro-cap so highly risky and they aren't the only ones trying to develop gold backed crypto currencies e.g. OneGram ? BulletCoin ? but it seems the only 'listed' vehicle that might provide insight into this particular niche.

Here is Lionsgold's press release from today

https://www.investegate.co.uk/lions...h-gold-update---goldbloc/201710181430019813T/

Highlights

· Goldbloc aims to provide the convenience and utility of a fiat currency bank account, but representing direct ownership of physical gold by the Goldbloc holder.

· Each Goldbloc unit will represent 1/1,000 of a gram of physical gold (approximately £0.03 based on the current gold spot price) and shall be divisible to two decimal places.

· Goldbloc is the evolution of TRAC's offering of an online physical gold holding and trading account to become a gold-backed digital currency and banking platform.

· To achieve this TRAC has partnered with Railsbank Limited (www.railsbank.com) to integrate its exchange platform and accounts ledger with Railsbank's banking and compliance platform that is designed to connect a global network of partner banks through its proprietary application programming interface ("API").

· Market research on Goldbloc is being conducted during November around the upcoming product(s), services and pricing models, with the initial Goldbloc product scheduled for release by the end of this year.

Cameron Parry, Lionsgold CEO, commented: "We are delighted to be able to announce Goldbloc which we have been developing within Lionsgold's fintech subsidiary. Goldbloc is designed to be used as a gold-backed digital currency and banking platform, to enable individuals to hold their wealth securely in gold and spend their gold with the convenience of everyday banking.

In Economics one of the least well understood 'variables'/'instruments of policy' is Exchange Rates because they are impacted by so many different factors. So trying to 'value' a Currency as an 'investment proposition' is a hopeless task. Currencies should 'merely' be mediums of exchange, unit of account, store of value etc not an investment vehicle in and of itself.

Having said all that there are some gold-backed crypto-currency contenders emerging and it might be an area worth following to see how it develops. One such company announced they plan to launch their 'Goldbloc' currency in coming months. It's a UK listed company which has gold exploration assets in India called Lionsgold (formerly Kolar Gold). It's a micro-cap so highly risky and they aren't the only ones trying to develop gold backed crypto currencies e.g. OneGram ? BulletCoin ? but it seems the only 'listed' vehicle that might provide insight into this particular niche.

Here is Lionsgold's press release from today

https://www.investegate.co.uk/lions...h-gold-update---goldbloc/201710181430019813T/

Highlights

· Goldbloc aims to provide the convenience and utility of a fiat currency bank account, but representing direct ownership of physical gold by the Goldbloc holder.

· Each Goldbloc unit will represent 1/1,000 of a gram of physical gold (approximately £0.03 based on the current gold spot price) and shall be divisible to two decimal places.

· Goldbloc is the evolution of TRAC's offering of an online physical gold holding and trading account to become a gold-backed digital currency and banking platform.

· To achieve this TRAC has partnered with Railsbank Limited (www.railsbank.com) to integrate its exchange platform and accounts ledger with Railsbank's banking and compliance platform that is designed to connect a global network of partner banks through its proprietary application programming interface ("API").

· Market research on Goldbloc is being conducted during November around the upcoming product(s), services and pricing models, with the initial Goldbloc product scheduled for release by the end of this year.

Cameron Parry, Lionsgold CEO, commented: "We are delighted to be able to announce Goldbloc which we have been developing within Lionsgold's fintech subsidiary. Goldbloc is designed to be used as a gold-backed digital currency and banking platform, to enable individuals to hold their wealth securely in gold and spend their gold with the convenience of everyday banking.

Some stocks I would keep on watch. Potentially interesting blue sky stories but have queered their pitch in short term with poor financing choices. Once overhangs clear could have capacity to move strongly higher.

PREM - Could spin out Zulu Lithium got Lenigas acting as 'consultant'

VAST - Could re--open nicely named 'Giant' Zimbabwean gold mine

KEFI - could start mining of gold in Ethiopia w

I like VAST chart set up best but PREM has the coolest story as Lithium fad is hot with investors right now

huge rise on huge volume, that would usually point to continuation move

well done

I'm sceptical about a lot of these cryptocurrency fads like Bitcoin etc

In Economics one of the least well understood 'variables'/'instruments of policy' is Exchange Rates because they are impacted by so many different factors. So trying to 'value' a Currency as an 'investment proposition' is a hopeless task. Currencies should 'merely' be mediums of exchange, unit of account, store of value etc not an investment vehicle in and of itself.

Having said all that there are some gold-backed crypto-currency contenders emerging and it might be an area worth following to see how it develops. One such company announced they plan to launch their 'Goldbloc' currency in coming months. It's a UK listed company which has gold exploration assets in India called Lionsgold (formerly Kolar Gold). It's a micro-cap so highly risky and they aren't the only ones trying to develop gold backed crypto currencies e.g. OneGram ? BulletCoin ? but it seems the only 'listed' vehicle that might provide insight into this particular niche.

Here is Lionsgold's press release from today

https://www.investegate.co.uk/lions...h-gold-update---goldbloc/201710181430019813T/

Highlights

· Goldbloc aims to provide the convenience and utility of a fiat currency bank account, but representing direct ownership of physical gold by the Goldbloc holder.

· Each Goldbloc unit will represent 1/1,000 of a gram of physical gold (approximately £0.03 based on the current gold spot price) and shall be divisible to two decimal places.

· Goldbloc is the evolution of TRAC's offering of an online physical gold holding and trading account to become a gold-backed digital currency and banking platform.

· To achieve this TRAC has partnered with Railsbank Limited (www.railsbank.com) to integrate its exchange platform and accounts ledger with Railsbank's banking and compliance platform that is designed to connect a global network of partner banks through its proprietary application programming interface ("API").

· Market research on Goldbloc is being conducted during November around the upcoming product(s), services and pricing models, with the initial Goldbloc product scheduled for release by the end of this year.

Cameron Parry, Lionsgold CEO, commented: "We are delighted to be able to announce Goldbloc which we have been developing within Lionsgold's fintech subsidiary. Goldbloc is designed to be used as a gold-backed digital currency and banking platform, to enable individuals to hold their wealth securely in gold and spend their gold with the convenience of everyday banking.

https://youtu.be/mSWAPbxGjN0

it started off less that $ in value now its over $4k ... predicted to go upto $100k in next few yearz....

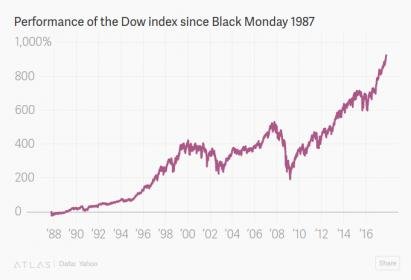

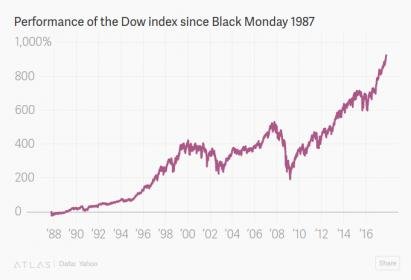

Today is 30th anniversary of Black Monday the stock market crash of 1987

https://qz.com/1106440/black-monday...h-that-was-so-bad-hospital-admissions-spiked/

https://qz.com/1106440/black-monday...h-that-was-so-bad-hospital-admissions-spiked/

Looks like this one may be building for a run. Chart setting up nicely.

Similar threads

- Replies

- 23

- Views

- 1K

- Replies

- 98

- Views

- 3K

- Replies

- 1

- Views

- 186

- Replies

- 2

- Views

- 181

- Replies

- 33

- Views

- 482