- Joined

- Oct 2, 2004

- Runs

- 218,133

A non-bailable arrest warrant issued against Waqar Zaka in an alleged Rs 86 million cryptocurrency scam. The ex host and social media influencer is currently on the run

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Another great opportunity is on the horizon.

Like what

Sell and wait for it drop. Use the profits to invest. Nothing to loseBitcoin Rose above 37k$. It was for a short while, but the trend of higher highs has started. I guess patience us the key for some of us who jumped in when it was sub 21k

Yeah did that for half the bag.Sell and wait for it drop. Use the profits to invest. Nothing to lose

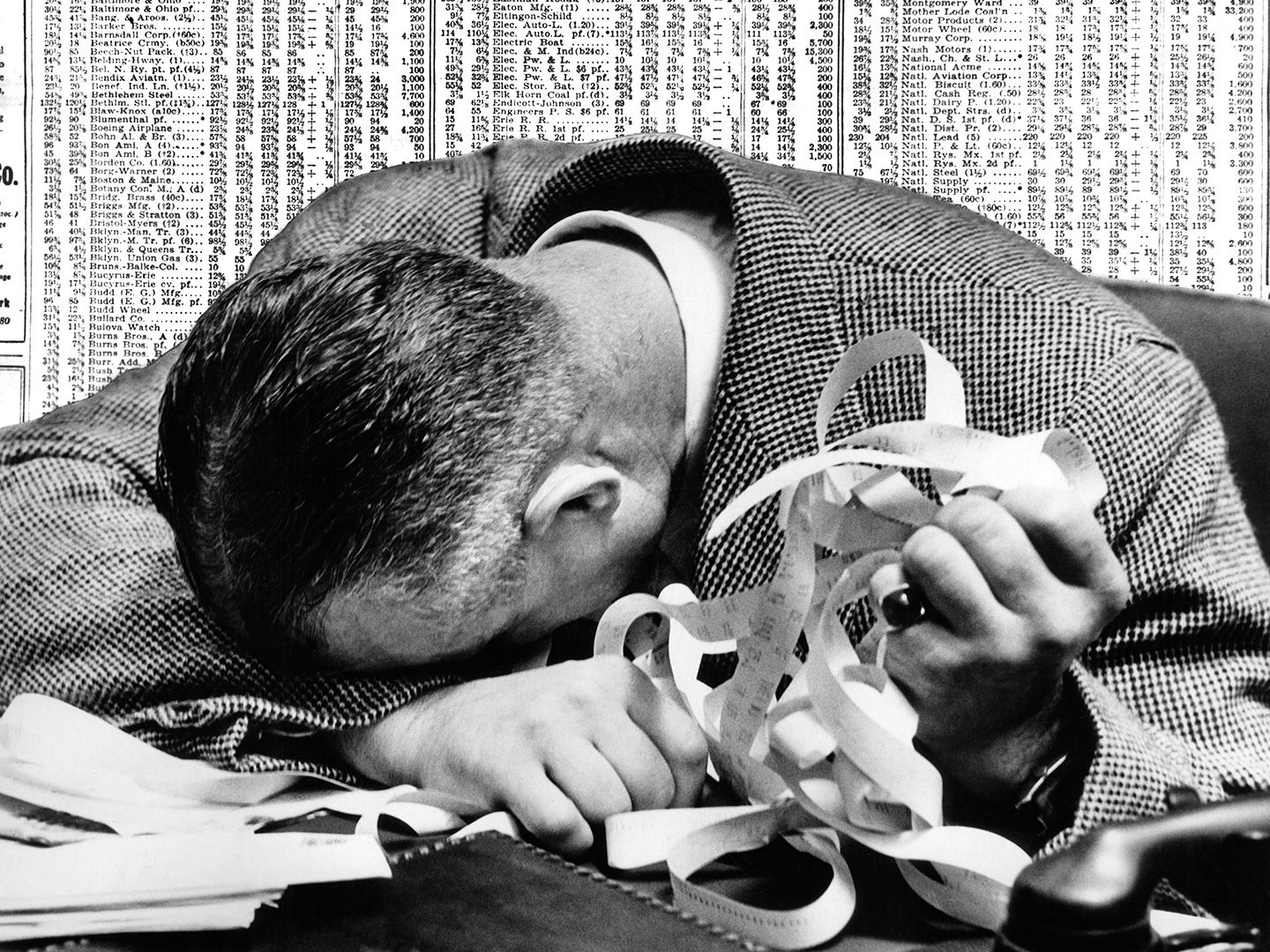

Glad you are. I lost over £9k. My worst investment decision ever.Yeah did that for half the bag.

I am doing well with BTc and ETH, it’s the Altcoins that not working for me, almost 50% negative for alts. Waiting for fair price

you mean you are negative £9kGlad you are. I lost over £9k. My worst investment decision ever.

Yes. But my hopes have disappeared and I don't think ICP will ever recover. I got scammed because I was greedy.you mean you are negative £9k

can’t lose if you didn’t sell them yet. Time to sell is wen in profit

Feel you brother, I lost so much in Luna scam, MOVR and ENJYes. But my hopes have disappeared and I don't think ICP will ever recover. I got scammed because I was greedy.

It's life. You win some, you lose some. I am more fearful of what would have happened if they went up and then crashed.Feel you brother, I lost so much in Luna scam, MOVR and ENJ

Yes. But my hopes have disappeared and I don't think ICP will ever recover. I got scammed because I was greedy.

I hope you are right. Even if I get 1/2 my losses back, I would be over the moonIn crypto you've got to take the rough with the smooth.

in the months ahead we are heading in to a Bull run, there's a strong possibility you could recover your loses.

Cryptocurrency is real? how does it work? How can one invest and make a profit?I hope you are right. Even if I get 1/2 my losses back, I would be over the moon

It's a scam. I fell for it and quite rightly got punished. It's a ponzi scheme and as long as there are greedy people like me, it will continue. I am only bitter because I lost a lot of money. Otherwise I, too would be singing its praisesCryptocurrency is real? how does it work? How can one invest and make a profit?

It's a scam. I fell for it and quite rightly got punished. It's a ponzi scheme and as long as there are greedy people like me, it will continue. I am only bitter because I lost a lot of money. Otherwise I, too would be singing its praises

I wish ICP also spikes so I can get my money back. Break even is close to $100. Thinking about it, I might as well bet on horse with no legs winning the grand nationalBitcoin spiked above $50,000 on Tuesday for the first time in more than two years as investors grow optimistic that US approval of broader trading in the unit will ramp up demand.

People still having interest in this thing?

--------------------------

Bitcoin bursts above $68,000, record high comes into view

Bitcoin rallied to a two-year high on Monday, breaking above $68,000 as a wave of money carried it within striking distance of record levels.

The price hit a session high of $68,580 and was last at $68,161. Bitcoin hit a record $68,999.99 in November 2021.

The largest cryptocurrency by market value has gained 50% this year and most of the rise has come in the last few weeks when inflows into U.S.-listed bitcoin funds have surged.

Spot bitcoin exchange-traded funds were approved in the United States earlier this year. Their launch opened the way for new large investors and has re-ignited enthusiasm and momentum reminiscent of the run up to record levels in 2021.

"The flows are not drying up as investors feel more confident the higher price appears to go," said Markus Thielen, head of research at crypto analytics house 10x Research in Singapore.

Net flows into the 10 largest U.S. spot bitcoin funds reached $2.17 billion in the week to March 1, with more than half of that going into BlackRock's iShares Bitcoin Trust (IBIT.O), opens new tab, according to LSEG data.

Smaller rival ether has hitched a ride on speculation that it too may soon have exchange-traded funds driving inflows. It's up 50% year-to-date and by Monday was trading at two-year highs, up 2.6% on the day at $3,518.

The rally has come in tandem with records tumbling on stock indexes from Japan's Nikkei (.N225), opens new tab to the S&P 500 (.SPX), opens new tab and tech-heavy Nasdaq (.IXIC), opens new tab and with volatility gauges in equities (.VIX), opens new tab and foreign exchange (.DBCVIX), opens new tab turning lower.

"In a world where Nasdaq is making new all-time highs, crypto is going to perform well as bitcoin remains a high-volatility tech proxy and liquidity thermometer," said Brent Donnelly, trader and president at analysis firm Spectra Markets.

"We are back to a 2021-style market where everything goes up and everyone is having fun."

SOURCE: REUTERS

Good for people who kept faith in Bitcoin. from a great decline to around 18-19k to 66k. People got rich.Who wouldn’t? Anyone who is in crypto knew bull run will start in 2024 when halving nears.

All savvy investors accumulated when price was between 20-30k and now are 2-3x up on their investment.

Sone alt coins might do 10-20x but those are more risky/gamble plays.

Damn! i should i have invested in it last year.The price of the world's largest cryptocurrency, Bitcoin, briefly hit a new all-time high of more than $69,000.

It surpassed the previous record set in November 2021 - though by 2022 Bitcoin's value had sunk to $16,500.

The new surge in price has been spurred by US finance giants pouring billions into buying bitcoins.

The cryptocurrency rose to around $69,200 shortly after 15:00 GMT on Tuesday, before falling back. It was trading around $62,185 by 21:00 GMT.

Bitcoin's value has spiked by more than 50% over the last month, according to cryptocurrency market data platform CoinMarketCap.

BBC

Damn! i should i have invested in it last yearC

I am glad i stuck in there. FYI fetct.ai. ( i was an early investor) which at the moment is exploding is developed by a pakistani Humuyan Sheikh.Damn! i should i have invested in it last year.

yes , I also feel bad now. Even one bitcoin would have given me a big gain today.Damn! i should i have invested in it last year.

Because money is more valued than lives by every "establishment" throughout the world and this is the sad reality that we all live in.Why is it that financial criminals get tried and convicted, but not war criminals?

Hunt for Bitcoin's elusive creator Satoshi Nakamoto hits another dead-end

Bitcoin underpins a two trillion-dollar cryptocurrency industry, is now traded by the world's biggest investment houses and is even an official currency in one country.

But despite its meteoric rise, a deep mystery remains at its heart: what is the true identity of its founder, the elusive Satoshi Nakamoto?

Many have tried to answer that question, but so far all have failed. In October, a high-profile HBO documentary suggested that a Canadian bitcoin expert called Peter Todd was he. The only problem: he said he was not, and the crypto world largely shrugged it off.

So, inevitably, ears *****ed up across our newsroom - and the crypto world at large - when on Thursday a call went out that the mysterious creator of Bitcoin was to, finally, unmask himself at a press conference.

There is deep interest in who Satoshi Nakamoto is in part because they are considered a revolutionary programmer who helped spawn the crypto industry.

Their voice, opinions and world view would be extremely influential on an industry with such a devoted and zealous fanbase.

But the fascination also stems from the fact that, as the holder of more than one million bitcoins, Satoshi would be a multi-billionaire, not least because the price of the coins is currently close to an all-time high.

Given that vast wealth, it was somewhat unusual to be asked by the organiser of Thursday’s press conference to pay for my seat at his grand unveiling.

A front row seat would be £100. It was another £50 if I wanted unlimited questions. Organiser Charles Anderson even encouraged me to spend £500 in exchange for the privilege of interviewing "Satoshi" on stage.

I declined.

Mr Anderson said I could come along any way but cautioned there might not be a seat for me, such was the level of anticipation.

As it happened, seating wasn’t a problem.

Only around a dozen reporters turned up to the prestigious Frontline Club - which interrupted proceedings at one point to stress it only provided a room, and not any official endorsement.

Very soon it became clear that all attendees were extremely sceptical.

After some digging it emerged both the organiser and the purported Satoshi were currently embroiled in a complex legal fight over fraud allegations - linked to claims to be Satoshi.

It was an unpromising start, and things only got worse from there.

Mr Anderson invited "Satoshi" to come on stage.

A man called Stephen Mollah, who had been sat silently on the side the whole time walked up and resolutely declared: “I am here to make a statement that yes: I am Satoshi Nakamoto and I created the Bitcoin on Blockchain technology.”

Over the following hour, reporters went from amused to irritated as he failed to provide any of the promised evidence for his claims.

Mr Mollah promised that he would make the Hail-Mary move of unlocking and interacting with the first-ever Bitcoins to be created - something that only Satoshi could do.

But he didn't.

I departed, along with other bemused reporters, taking with us any lingering doubts that this would prove to be yet another dead-end in the quest to unmask Satoshi.

Not another one

The list of those identified - unsuccessfully - as Satoshi Nakamoto is long.

In 2014, a high-profile article in Newsweek said it was Dorian Nakamoto, a Japanese-American man living in California.

But he denied it and the claim has largely been debunked.

A year later, Australian computer scientist Craig Wright was outed as Satoshi by reporters.

He denied it, before saying it was true - but then failed over many years to produce any evidence.

In the spring the High Court in London ruled that Mr Wright was not the inventor.

Tech billionaire and crypto enthusiast Elon Musk also denied he was behind the cryptocurrency after a former employee at one of his firms, SpaceX, suggested it.

Which brings us to the question: does it really matter?

The crypto market's current valuation means it is worth more than Google. And it seems inconceivable that the tech giant would play such a big role in our lives without people knowing who founded it, and owned a sizeable chunk of the firm.

Perhaps there’s good reason for the real Satoshi to keep schtum though. That bitcoin stash would make them worth an estimated $69bn and their life and character would no doubt be heavily scrutinised if they were found.

Peter Todd, who was named by the HBO documentary as being Satoshi, said the unwelcome attention he's received has made him fearful for his safety.

Many in the crypto world enjoy the fact that the mystery remains unsolved.

"No-one knows who Satoshi is and that's a good thing," Adam Back, one of its core developers (and another potential Satoshi candidate) posted on X recently.

Natalie Brunell, a Bitcoin podcaster, thinks Satoshi's anonymity is not only deliberate but essential.

"By concealing his true identity, Satoshi ensured that Bitcoin wouldn’t have a leader or central figure, whose personal agenda could influence the protocol," she told me.

"This allows people to trust Bitcoin as a system, rather than placing their trust in an individual or company."

Carol Alexander, professor of finance at Sussex University - who lectures on the history of Bitcoin - is less sure.

In her view, the circus around who Satoshi Nakamoto is distracts from people looking into - and getting to grips with - the more serious question of how cryptocurrencies might upend the way the economy works.

As I left the Frontline Club it was hard to compute the bizarre press event, beyond one obvious fact.

For now - and perhaps forever - the search for Satoshi continues.

BBC

Donald Trump is Satoshi Nakamoto.Satoshi Nakamoto has more than 1-million Bitcoins. Wow!

That's worth billions of Dollars.

Wouldn't be surprised if Satoshi are a group of people and not one person.

US hacker sentenced over Bitcoin heist worth billions

A hacker has been sentenced to five years in a US prison for laundering the proceeds of one of the biggest ever cryptocurrency thefts.

Ilya Lichtenstein pleaded guilty last year in the case involving the Bitfinex cryptocurrency exchange being hacked in 2016 and the theft of almost 120,000 bitcoin.

He laundered the stolen cryptocurrency with the help of his wife Heather Morgan, who used the alias Razzlekhan to promote her hip hop music.

At the time of the theft, the bitcoin was worth around $70m (£55.3m), but had risen in value to more than $4.5bn by the time they were arrested. At today's prices they would be worth more than double that.

The $3.6bn worth of assets recovered in the case was the biggest financial seizure in the Department of Justice's history, Deputy Attorney General Lisa Monaco said at the time.

“It’s important to send a message that you can’t commit these crimes with impunity, that there are consequences to them,” district judge Colleen Kollar-Kotelly said.

Lichtenstein, who has been in prison since his arrest in February 2022, expressed remorse for his actions.

He also said that he hopes to apply his skills to fight cybercrime after serving his sentence.

Morgan also pleaded guilty last year to one count of conspiracy to commit money laundering. She is due to be sentenced on 18 November.

According court documents, Lichtenstein used advanced hacking tools and techniques to hack into Bitfinex.

Following the hack, he enlisted Morgan's help to launder the stolen funds.

They "employed numerous sophisticated laundering techniques", the Department of Justice said in a statement.

The methods included using fictitious identities, switching the funds into different cryptocurrencies and buying gold coins.

Lichtenstein, who was born in Russia but grew up in the US, would then meet couriers while on family trips and move the laundered money back home, prosecutors said.

Morgan's Razzlekhan persona went viral on social media when the case emerged.

Even as the couple attempted to cover up the hack, she published dozens of expletive-filled music videos and rap songs filmed in locations around New York.

In her lyrics she called herself a "bad-ass money maker" and "the crocodile of Wall Street".

In articles published in Forbes magazine, Morgan also claimed to be a successful technology businesswoman, calling herself an "economist, serial entrepreneur, software investor and rapper".

BBC