As of 2024, the top 5 countries with the largest foreign exchange (forex) reserves :

1. China – The country consistently holds the highest forex reserves, with over $3 trillion in reserves, largely due to its vast trade surplus and foreign investments.

2. Japan – Japan holds the second-largest reserves, generally exceeding $1.2 trillion, thanks to its export-oriented economy and foreign investments.

3. Switzerland – Known for its banking sector and financial services, Switzerland typically ranks third, with reserves around $900 billion.

4. India – India’s forex reserves have grown significantly, crossing the $600 billion mark, placing it among the top holders due to foreign investments and remittances.

5. Russia – Despite sanctions and economic challenges, Russia maintains a strong forex reserve position, with over $550 billion, as part of its economic stability policy.

6. Taiwan – Taiwan’s reserves are around $550 billion, supported by its strong electronics export sector and trade surplus.

7. Saudi Arabia – With over $450 billion in reserves, Saudi Arabia maintains large forex reserves due to its oil exports, which play a significant role in its economy.

8. Hong Kong – Hong Kong, a major financial hub, holds reserves around $430 billion, benefiting from its global financial integration and trade.

9. South Korea – South Korea’s forex reserves are typically over $400 billion, bolstered by its strong export-driven economy, particularly in electronics and automobiles.

10. Brazil – Brazil has around $350 billion in reserves, driven by its exports of commodities such as soybeans, iron ore, and oil.

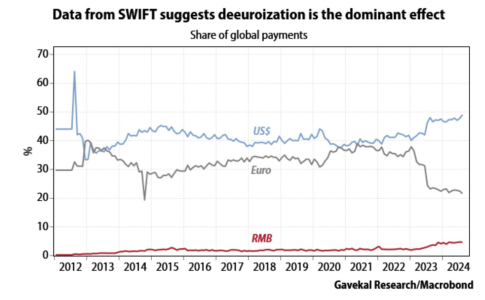

The United States, despite having the world’s largest economy, does not rank among the top countries in terms of foreign exchange reserves. Its reserves typically hover around $200 billion, placing it well outside the top 10. This relatively lower reserve level is because the U.S. dollar is the world’s primary reserve currency, meaning other countries hold U.S. dollars as part of their forex reserves, reducing the need for the U.S. to hold large amounts of foreign currency.

Additionally, the U.S. economy relies on different mechanisms, such as the strength of its financial markets, global demand for its currency, and its ability to borrow cheaply, rather than building large forex reserves.