Adani bonds slide to year low as investors and lenders weigh bribery allegations

Adani dollar bond prices fell on Monday to almost one-year lows, as investors cut their exposure to the Indian conglomerate and some bankers considered pausing fresh lending in the wake of bribery and fraud accusations by U.S. authorities.

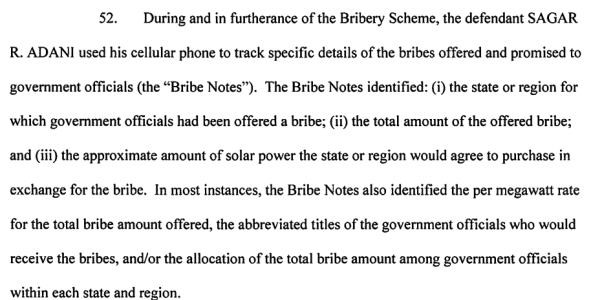

The group's billionaire chairman, Gautam Adani, and seven other people were last week charged with agreeing to pay around $265 million in bribes to Indian government officials.

The charges related to alleged payments to obtain contracts that could yield $2 billion of profit over 20 years as well as to develop India's largest solar power project.

The charges also included making misleading statements to the public despite being made aware of the U.S. investigation in 2023.

The Adani Group has said the accusations as well as those levelled by the U.S. Securities and Exchange Commission in a parallel civil case are baseless and that it will seek "all possible legal recourse".

Banks and regulators have been reviewing exposure to the ports-to-power conglomerate in the wake of the charges.

The Singapore banking sector's overall exposure to the Adani Group, is small, the Monetary Authority of Singapore said on Monday.

"Banks have in place measures to review and manage their exposures to borrowers and counterparties," an MAS spokesperson said in a statement.

DBS Group (DBSM.SI), Singapore's biggest bank by assets, had said in early 2023 that its exposure to the Adani Group was S$1.3 billion ($967 million). DBS declined comment in response to request from Reuters.

Some global banks are considering temporarily halting fresh credit to the company after the U.S. indictment but maintaining existing loans, according to several bankers spoken to by Reuters, raising questions about its access to future funding.

"In the near term, the U.S indictment is likely to constrain the group’s access to financing, particularly in the offshore market," a Lucror Analytics note published on Smartkarma said.

The cash balances of Adani portfolio companies stood at $6.33 billion as of the first half of the current fiscal year ending March 2025, the company announced. These cash balances exceed long-term debt repayments for the next 28 months, as detailed in a presentation on the credit and financial performance of its group companies, which is regularly shared after quarterly results.

This marks the second crisis in two years for the Adani Group, which was accused last year by short-seller Hindenburg Research of improperly using offshore tax havens. The company denied those claims.

In Asian trade on Monday, some of the most liquid debts issued by Adani Ports and Special Economic Zone fell between 1 cent and 2 cents, with similar selling in Adani Transmission debt. Ports bonds maturing in 2027 were down 1.6 cents to 88.98 cents on the dollar, having lost nearly 7 cents in face value since U.S. prosecutors issued charges last week. Longer-dated Ports bonds were also down on Monday, losing between 8 cents and 10 cents in face value following the news.

Adani Transmission debt maturing in May 2036 fell 1.8 cents on Monday, marking a loss of more than 7 cents since Wednesday.

The Adani Group's 10 listed stocks, led by Adani Enterprises, lost $27.9 billion in market value over two sessions last week after the U.S. charges. However, the stocks regained some lost ground on Monday. Adani Energy Solutions rose 6%, while Adani Green Energy climbed 4% in early trade.

.png)